DSCC has released its Q3 2020 update of its Advanced TV Display Cost Report, with updates to OLED and LCD cost outlines. This quarter’s edition includes new costs models for LCDs with MiniLED backlights, which will compete with OLEDs for the premium TV space.

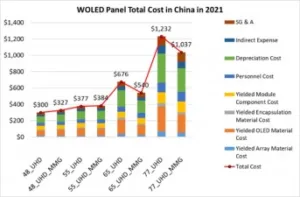

LGD is continuing to improve production at its Gen 8.5 White OLED (WOLED) fab in Guangzhou, China. While our cost report shows that total panel costs from China production in 2020 are higher than the costs for comparable panels made in Korea, by next year the advantages for China production will allow lower costs. China has lower costs for depreciation, personnel, indirect, and SG&A, leading to lower total costs even though yields in Korea will remain higher than China. We estimate that 55” total costs in 2021 in China will be ~14% lower than Korea production, with a similar advantage for 65”.

Source: DSCC Advanced TV Cost Report

Source: DSCC Advanced TV Cost Report

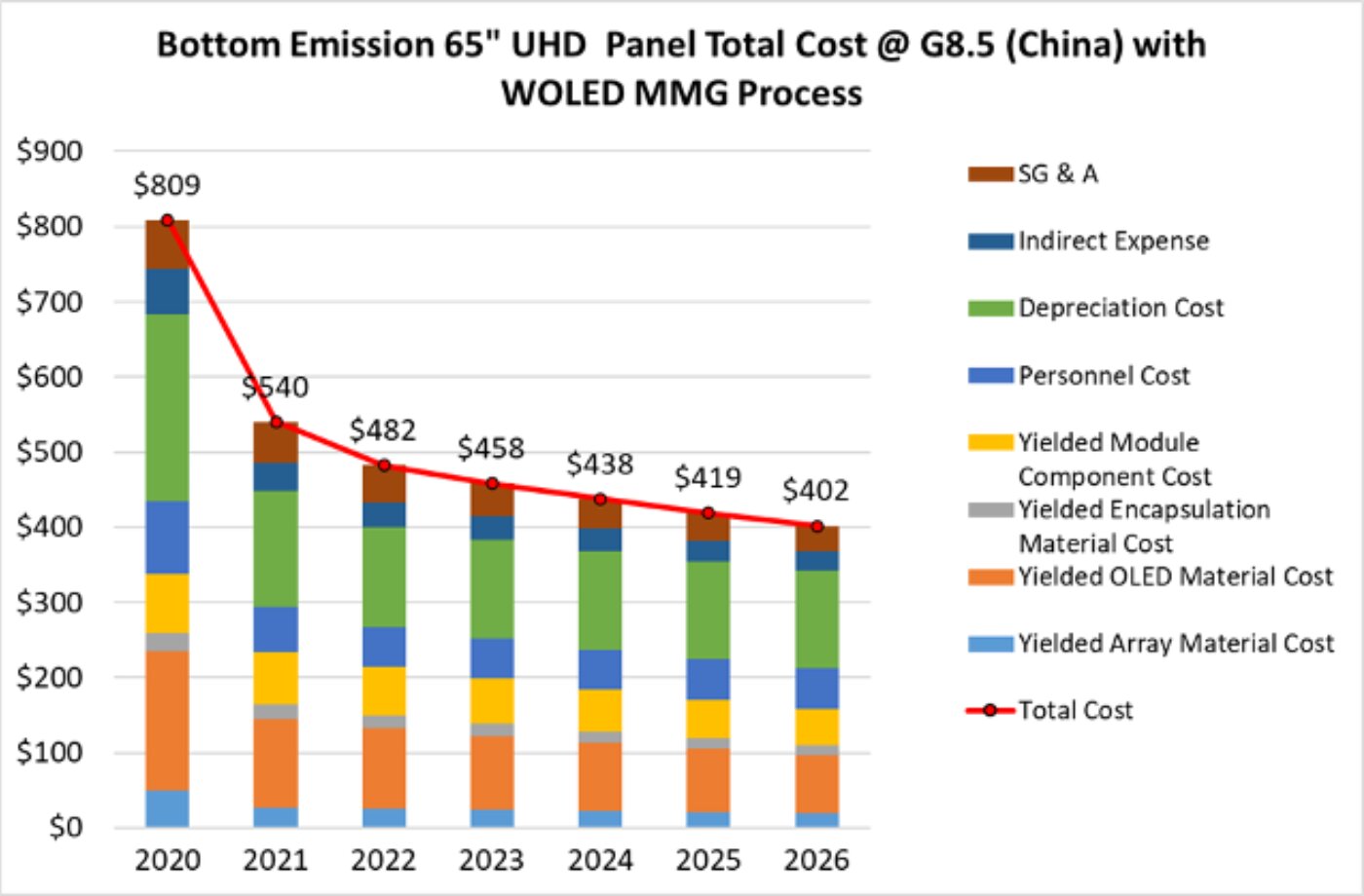

LGD can reach substantially lower cost with Multi-Cut Mother Glass (MMG) for production of 65” and 77” TV panels. MMG allows 3-up 65” and 2-up 55” on a single substrate, or 2-up 77” and 2-up 48” on a single substrate. This provides a cost reduction of 20% for China production.

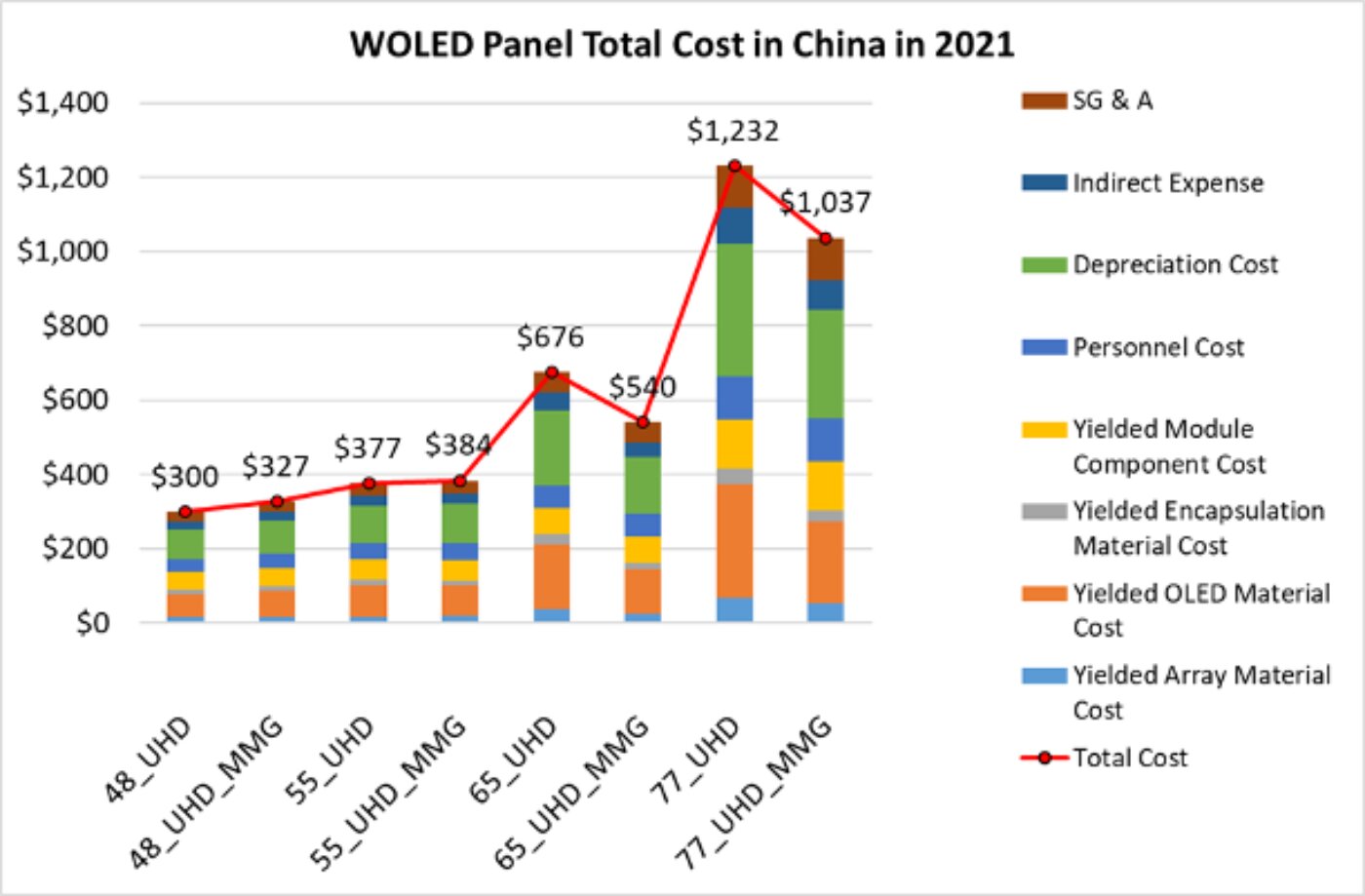

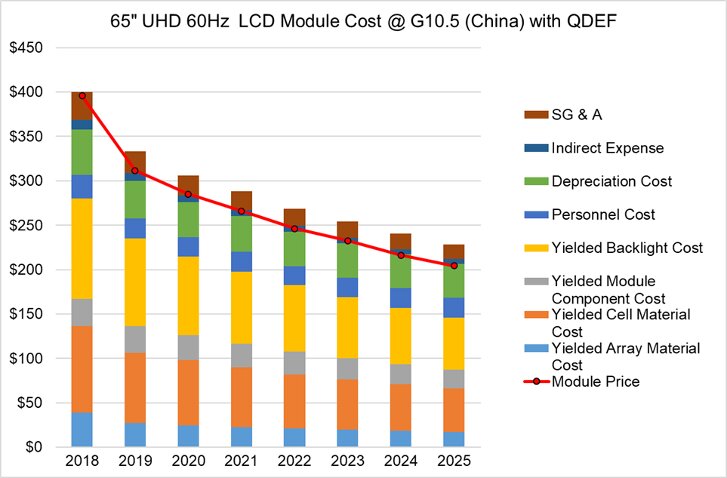

The new cost profiles for LCDs with MiniLED backlights allow for comparison between MiniLED and conventional LCD types, with LCD and QDEF and with OLED TV panels. The next two charts here show the cost profiles for 65” panels made in the most cost-effective fabs (China Gen 10.5), comparing QDEF with MiniLED. MiniLED products also use quantum dot enhancement films, but the higher backlight costs make these panels nearly twice as costly as QDEF.

Source: DSCC Advanced TV Cost Report

Source: DSCC Advanced TV Cost Report

Source: DSCC Advanced TV Cost Report

Source: DSCC Advanced TV Cost Report

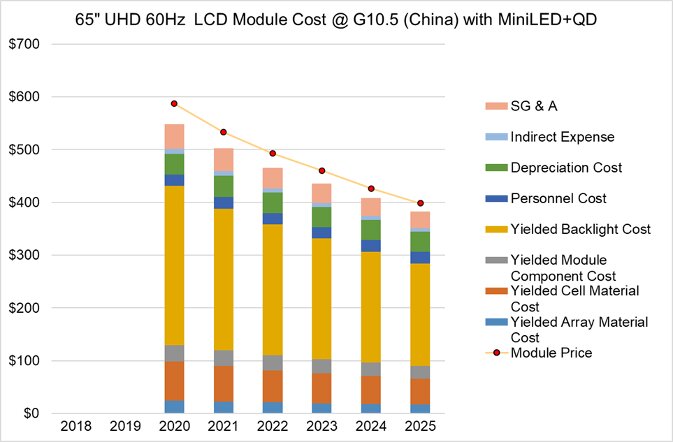

The last chart here shows the 65” OLED cost for comparison. Again, the lowest cost option for OLED is shown, in this case the Gen 8.5 production with MMG in China. MiniLED and OLED will compete in the marketplace, and the cost profile in the two technologies shows they are quite close. MiniLED total costs are lower than WOLED, but the gap is less than 10%. This suggests that MiniLED products will compete at retail price points similar to WOLED.

Source: DSCC Advanced TV Cost Report

Source: DSCC Advanced TV Cost Report

The cost comparison between MiniLED and OLED in 55” is similar, with MiniLED costs slightly lower than OLED, but when scaling up to larger sizes OLED cannot compete. For 75” LCD panels made on Gen 10.5 lines, MiniLED backlit TV panels are 20-25% lower cost than comparable WOLED panels. (BoB)

The author of this article was Bob O’Brien of DSCC

This article was originally published on the Display Supply Chain Consultants’ blog and is republished with permission.

The cost report provides detailed cost profiles of 96 distinct LCD products, including combinations of screen size, refresh frequency (60Hz/120Hz), backlight (conventional / QDEF/MiniLED), gen size and manufacturing location (Korea / China) and including open cell models. The report covers 48 distinct OLED products, ranging in size from 48” to 88”, with resolutions from FHD to 8K, and manufactured on Gen 8.5 and Gen 10.5 in China and Korea.

Contact [email protected].