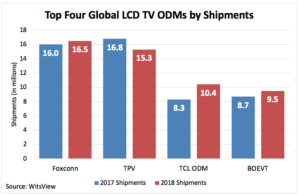

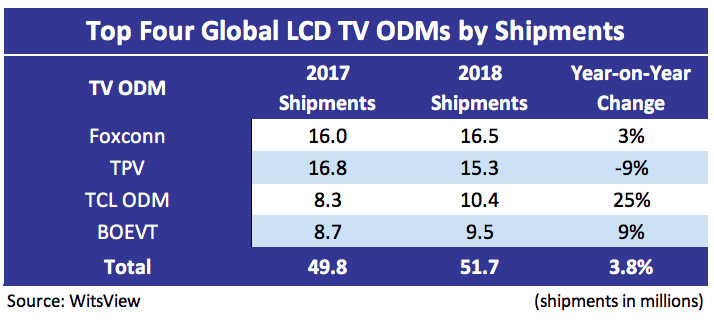

WitsView, a division of TrendForce of Taiwan, reports that Foxconn is expected to take first place in the global shipment ranking of LCD TV ODMs in 2018, with the brand benefiting from the strong business of Sharp, one of its subsidiaries, as well as stable orders from Sony and Vizio. TPV will drop into second place, with TCL and BOEVT rounding out the top four. Research manager Jeff Yang commented:

“All fo

ur major TV ODMs have their in-house panel supply networks, enabling them to offer more flexible prices to clients and secure orders amid tight panel supply”.

The companies have also made adjustments to their business models, due to a slowdown in the global TV market, allocating more capacity to own-brand TVs to boost shipments. After a significant shipment increase in 2017, Sharp-branded TVs from Foxconn are expected to see only marginal growth this year. This is because falling panel prices in the first half of 2018 offset the company’s advantage of in-house panel supply.

At the same time, Xiaomi is emerging as a key competitor, with surging demand for its Mi TV. Together with stable orders from Sony and Vizio, Foxconn’s global TV shipments for 2018 may total as many as 16.5 million units, outperforming TPV, the previous market leader.

TPV topped the TV ODM ranking in terms of shipments in 2017 but has been affected by the financial issues of some internet TV brands in China, plus Vizio transferring orders to other ODMs this year. Although TPV has been expanding shipments of its own-brand Philips and AOC TVs, the increased sales may not offset the decline in its annual global shipments of TV sets. Therefore, WitsView anticipates that TPV will slide to second, with estimated TV shipments of 15.3 million units.

TCL’s TV shipments for 2018 are expected to total 10.4 million units, ranking third, as the company has benefited from surging demand for Mi TV in China and Southeast Asia.

BOEVT, whose profits were significantly influenced by the drop in panel prices during the first half of this year, will record shipments of 9.5 million units, taking fourth place. On the client side, BOEVT has to give up some of its low-priced TV ODM orders and focus on developing major clients like Samsung and LG.

WitsView expects intensified competition in the TV ODM market, as panel makers like HKC and Innolux have been actively integrating downstream TV ODM services, while Chinese companies like KTC and AMTC continue to highlight their cost advantages.

Generally speaking, the integration of own-branded products into original ODM business models appears to be a double-edged sword for TV ODMs. With own-branded TVs, companies are able to keep a certain level of availability during fluctuations in the number of orders. However, the business of own-branded TVs may be unfavourable for ODMs when competing for orders with international brands like Samsung and LG, who may worry about the capacity allocation of the ODMs and consider own-branded TVs as potential competitors.

WitsView notes that the two business models will continue to co-exist in the market, each with their own pros and cons. TV ODMs’ ultimate strategy will be avoiding market competition between their own-branded TVs and those of their clients, seeking more reliable panel supply and increasing cost advantages to secure orders and meet client demand.