As this is my last Display Daily of the year, I thought I’d take the opportunity to set out where I think the industry will be going in the next year.

Strong growth for flexible AMOLED display in 2018

Flexible AMOLED display enables thinner, lighter, bezel-less smart phones with innovative design. Samsung has achieved great success with the flexible display in its Galaxy phone products. Apple hopes to achieve tremendous success with its new iPhone X, which has already received rave reviews for its flexible OLED display. Samsung and Apple’s adoption of this display will drive growth in 2018.

Apple’s iPhone X Uses a Flexible OLED

Apple’s iPhone X Uses a Flexible OLED

However, there are still challenges due to manufacturing complexity. So far, Samsung is the only maker with high volume manufacturing capabilities for flexible smartphone displays. LG Display has a very small presence. Even though many other suppliers, especially from China such as BOE, Tianma, and others, are planning to bring higher capacity in 2018 and beyond, it will take time. High costs will limit flexible OLED usage to high end products only, mostly from Samsung and Apple.

Volume productions of foldable display may not be ready in 2018

Foldable display is considered to be the second-generation product for flexible display technology. It can provide thin, light unbreakable bendable larger displays in a smaller form factor (smartphone/tablet). AMOLED display technology built on plastic substrates is in the lead in the quest for foldable display. Samsung is expected to introduce its first foldable smartphones in the market in the near future.

Even though the potential is very promising, there are many challenges including process technology, materials, manufacturing issues, high capex, higher costs, high price for consumer device, durability of the products, design acceptance by consumers, and consumer willingness to pay higher prices for the new designs. Foldable display technology needs more time to mature and high volume production may not be ready until 2019.

OLED supply pain will help LTPS LCD survival

OLED’s high cost and supply issues especially for flexible display will mean an opportunity for LTPS LCD in the near term. LCD is still dominating the smartphone market. Within LCD technology, the market is shifting towards LTPS (low temperature poly-silicon) away from amorphous-silicon (a-Si). LTPS LCD production capacity is increasing, product performance is improving, and costs are reducing. There are multiple suppliers from different regions including Samsung Display, LG Display AUO, Innolux, JDI and BOE. With new 18:9, all screen displays, LTPS LCD can bring new designs to marjet at a lower cost than OLED and bring higher volume to the smartphone market.

18:9 format “all screen display” will be a game changer. This new format display has several advantages that may help smartphone market growth.

- Provides larger display area for the same screen width compared to 16:9.

- Offers better design options and flexibility to smartphone suppliers with long slim design and a slim or “no bezel” shape

- Enables thinner, lighter, slimmer, taller form factor with higher resolutions and higher performance display

- Can offer differentiated products with unique aspect ratio to spur demand

- Supported by wide range of display technologies (AMOLED flexible and rigid display, LTPS and a-Si TFT LCD display) enabling both high-end and mid-range products.

- The new format display is already in production at Samsung Display, LG Display and JDI.

- LCD suppliers from Taiwan (Innolux, AUO, CPT, and Hannstar) and China (BOE and Tianma) are ramping up production.

- Smartphone suppliers (LG Electronics and Samsung) have already adopted this format in their flagship products. Apple, Sony, Google, and top Chinese brands (Huawei, Oppo, Vivo, Xiaomi and others) are joining in.

With increased supply and new model introductions at different price levels, displays with 18:9 aspect ratio can drive demand, opening up new opportunities for the display and smartphone industry.

JDI has an 18:9 LTPS smartphone LCD display

TVs will shift to higher resolution, WCG, HDR and larger screen size

TV manufacturers are shifting to higher resolutions (4K, 8K) to offer better picture quality. But adoption of WCG and HDR with 4K resolutions has really helped consumers to see the visual quality differences and experience the value of better performance. There has been a shift to larger screen sizes are large size sets are steadily increasing with higher capacity and lower costs. Now major 10.5 Gen fab capacity is expected to come from China (BOE, China Star, Foxconn and others). BOE is planning to start production in 2018. The 10.5 Gen capacity fab growth will help shift the market to above 60″ size TVs.

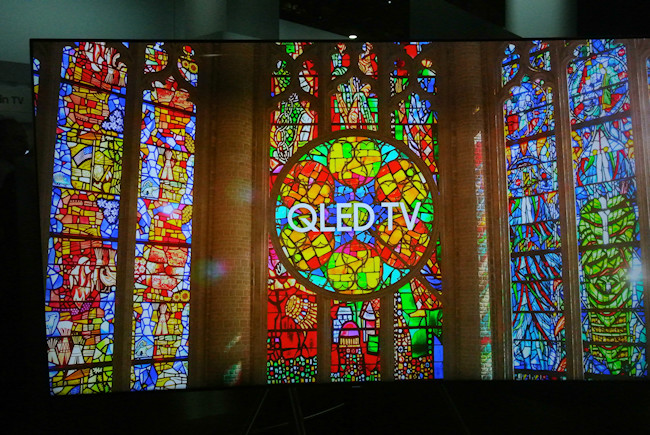

Quantum dot technology will enable LCD reinvention

Quantum dot-enhanced LCD TVx with 4K, HDR, WCG and better picture quality have the potential to drive TV replacement demand with lower price in next few years. But it still has many challenges such as higher prices, environmental concerns about cadmium-based products and performance level of some non-cadmium products. There are many suppliers working on this technology. The supply chain is developing. Nanosys (3M, Hitachi Cchemical, Licensing to Samsung), Nanoco (Wah Hong, Merck, Dow chemical), Quantum materials (GTG) and many others are working on Quantum dot technology development for display. Samsung has been leading the way with quantum dot enhanced LED TV (QLED). Hisense, TCL and many others have joined in. LCD panel supplier, AUO, has also introduced QD-based TV panels.

The first generation of quantum dot products are based on (photo-luminescent) enhanced LCD backlights. Next generation quantum dot photo emissive products can replace the color filter in the LCD with a layer of active Quantum dot emitters increasing efficiency even further with much wider viewing angles, and I expect them to be available by 2019. The next phase will be emissive electroluminescent quantum dot display with a similar structure to OLED. Quantum dot emissive display products are still many years away.

OLED TV will continue to have a small presence

OLED, the next generation display technology for TV, had a very small presence in 2017 due to higher costs and lower production volume, in spite of superior visual performance. OLED display panel production volume is steadily increasing, courtesy of LG Display which is currently the only supplier. Top TV brands including LG Electronics, Sony and many other Chinese TV brands have adopted OLED technology for their products in recent years. Sales are increasing. LG has been bringing differentiated design with 65″ slimmer, thinner, lighter wallpaper OLED TVs. LG expects OLED TV to have a strong presence in the higher end market. But production volume and high cost will continue to limit market presence in 2018. – Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com