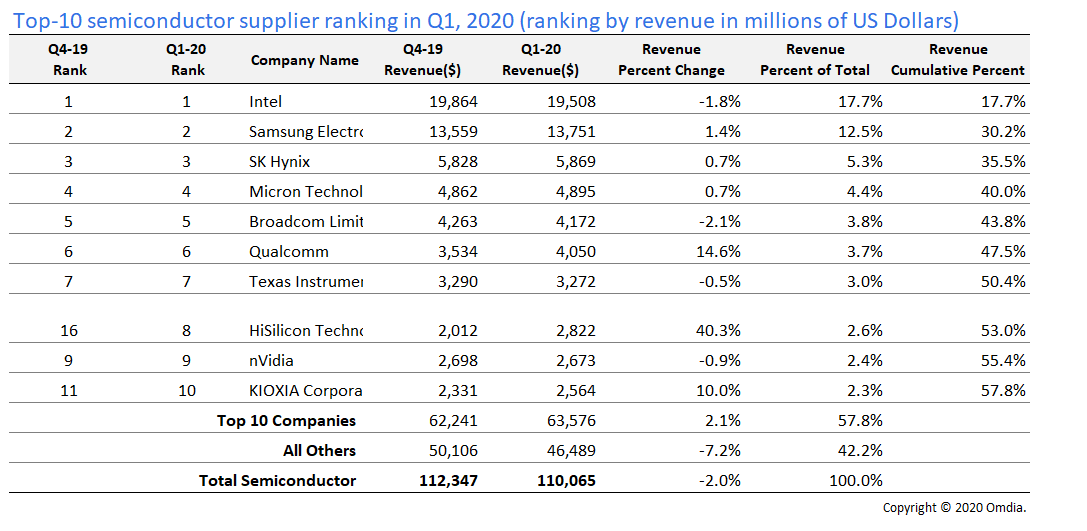

Defying a decline in market revenue, the world’s top-10 semiconductor suppliers managed to generate revenue growth of 2.1 percent in the first quarter, as the companies benefitted from a COVID-19-driven increase in PC and server sales. The top-10 chipmakers collectively generated revenue of $63.6 billion in the first quarter, up from $62.2 billion in the fourth quarter of 2019, according to the Omdia Competitive Landscaping Tool (CLT) service.

This contrasts with a 2 percent sequential decline in the overall global chip market in the first quarter, with revenue falling to $110.1 billion, down from $112.3 billion in the fourth quarter of 2019.

While Omdia typically employs a year-over-year comparison for market-share growth figures, the unprecedented downturn for the semiconductor market in 2019 and the pandemic in 2020 have made annual comparisons less meaningful, prompting a focus on the sequential aspect on the semiconductor market.

“Many of the leading semiconductor suppliers benefitted from strong demand for client PCs, enterprise PCs and servers in the first quarter,” said Ron Ellwanger, senior analyst, semiconductor manufacturing, at Omdia. “COVID-19-driven stay-at-home orders spurred rising demand for PCs as locked-down consumers tried to remain connected with friends, family, clients and business associates. In turn, this phenomenon has stimulated demand for corporate PCs and servers, with organizations striving to accommodate increasing consumer demand for cloud services. All this demand translated into increased demand for the kinds of chips offered by the world’s top semiconductor suppliers.”

As a result of the increasing demand for computer platforms, the data-processing category was the only application market for semiconductors to attain growth during the first quarter. Data processing posted a 0.9 percent increase in revenue compared to the fourth quarter of 2019.

Top-10 semiconductor supplier growth fueled by memory

Memory-oriented semiconductor suppliers drove much of the growth among the top-10 suppliers, with the three leading companies in this area— Samsung, SK Hynix, and Micron—collectively expanding their revenue by 1.1 percent during the first quarter. These companies benefitted from the growth in the data-processing market, which is generating increasing demand for NAND flash used in enterprise solid-state drives (SSDs). Sales of NAND flash memory grew 6.9 percent sequentially in the first quarter, representing the highest growth rate of any device in the semiconductor market during the time period.

Qualcomm and HiSilicon lead in growth among top-10

While the memory area was the leading growth driver for the top-10, the best individual performances were posted by U.S. wireless semiconductor supplier Qualcomm and Chinese fabless system-on-chip (SoC) firm HiSilicon. Sixth-ranked Qualcomm attained robust 14.6 percent sequential growth in the first quarter, while HiSilicon surged by a staggering 40.3 percent—the highest rate of expansion of any top-10 supplier.

“Qualcomm is benefitting from the Chinese government’s move to kickstart the economy by emphasizing the deployment of 5G infrastructure,” Ellwanger said. “The company is taking advantage of China’s subsidized 5G handset market, along with moves to accelerate the building of 5G infrastructure in the country.”

HiSilicon is the chip division of China’s Huawei. Despite the restrictions placed on Huawei by the US government, the company has managed to protect itself from the effects of the US/China trade war. The company is doing this by building up sufficient inventory to ride out the impact of the revised US trade restrictions, which are planned to go into effect in September.

Top-10 winners and losers

Although demand increased for PC-oriented chips in the first quarter, microprocessor chip leader Intel suffered a 1.8 percent drop in revenue during the period. The surge in computer demand in the first quarter was focused on lower-end systems, increasing demand for lower cost Intel microprocessors and chip sets, thus trimming its revenue.

KIOXIA, formerly known as Toshiba Memory, rose one rank to take the no.-10 spot, supplanting Sony Semiconductor. The company’s semiconductor revenue increased by an impressive 10 percent.