15 years ago, no one in entertainment had ever heard the term “over the top,” or knew what the acronyms SVOD and AVOD meant. Today, they are an integral part of every conversation about media consumption, and are even influencing the designs of tomorrow’s televisions.

A recent survey, conducted by Morning Consult in September, revealed that 44% of U.S. adults say there are too many ads on their streaming services; 69% say those ads are repetitive, and 79% of respondents are bothered by ads. (Everything old is new again, as the same could be said for broadcast television 30 years ago!)

“What’s that, again?” you ask. “My streaming service doesn’t have any ads.” Well, that’s because you’re paying $9.95 or $11.95 or $14.95 a month to get that content, more accurately called streaming video on demand (SVOD). But many of the streaming services offer a lower-cost or even free monthly subscription option, provided you’re willing to sit through a bunch of advertisements. That’s known as advertising-supported video on demand (AVOD).

I ran into this option recently after watching the 1998 film Gods and Monsters about director James Whale, who was best known for helming Frankenstein and Bride of Frankenstein. Having never seen the latter, we did a search through our TiVo Bolt DVR (broadcast and some OTT services) and found it was available for free on NBC Universal’s Peacock streaming service.

Free, that is, if were willing to sit through some ads. Which we did, and there were about ten during the movie’s 1:15 running time; none of which we could skip through (only the movie). The ads were clustered in three spots and popped up rather unexpectedly during mid-scenes. I was surprised to see Peacock offer a free AVOD option – Hulu’s AVOD option is $65 per month! I presume this was due to Peacock’s relatively low SVOD subscriber base (Comcast TV package customers get it for free).

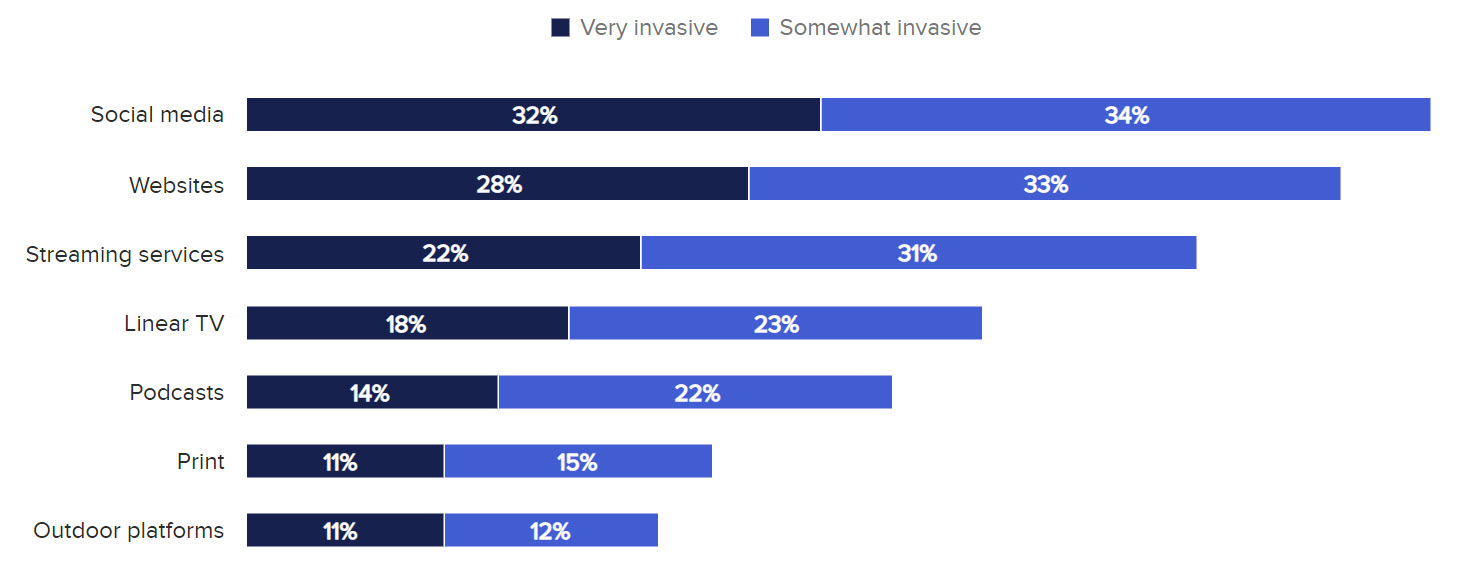

Getting back to the Morning Consult story: 53% of respondents said they found streaming ads to be somewhat (34%) or very (32%) invasive. Given my experience with Tubi and the Roku Channel (and TiVo’s own “free” channel), a lot of that has to do with when the ads pop up. More often than not, their placement isn’t at natural breaks in the story, but appear to be totally random, based on how many minutes have elapsed in the program.

Of course, it’s easy to deliver targeted ads over an AVOD service, but they aren’t always received warmly. 64% of those polled found targeted ads in general to be invasive, with 52% of respondents saying targeted ads were “creepy.” As for the preferred advertising format, 16% of those surveyed opted for “binge” ads, which are a large cluster of ads that run before two or more episodes of a program. 12% said they would rather see home screen ads; 11% favored “pause” ads, 11% liked shoppable ads, and just 9% indicated an interest in interactive ads.

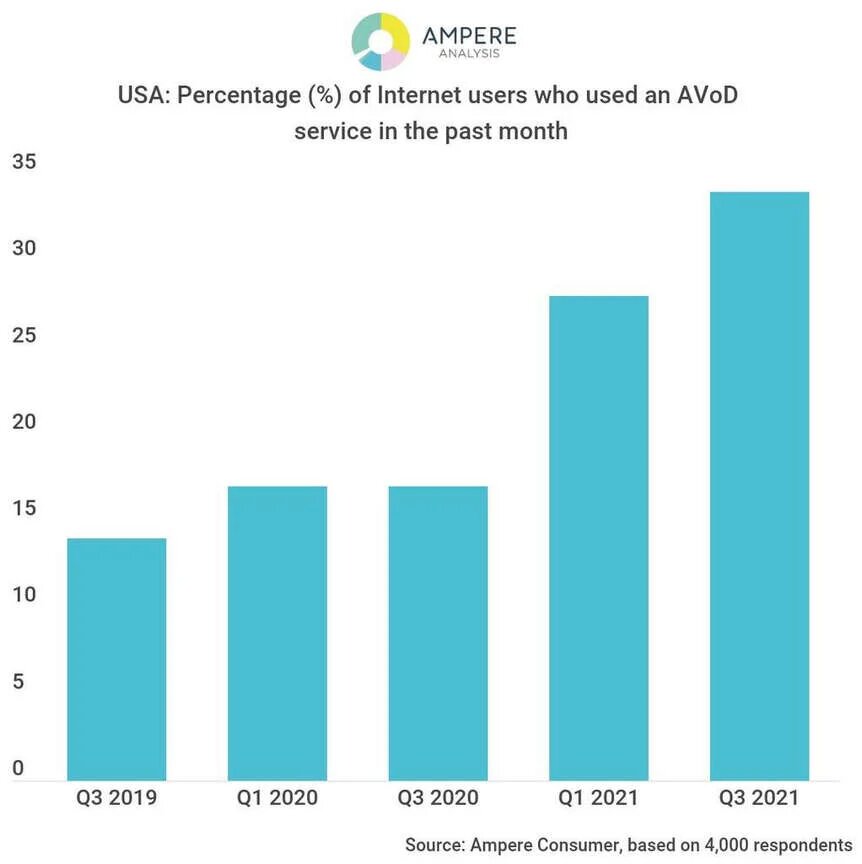

And who’s watching AVOD? According to another study conducted by Ampere; as of Q3 2021, more than a third (34%) of U.S. internet users reported having watched an AVOD service during the past month, up from 17% in Q3 Y-Y. The Ampere study found that 30% of 18-to-24-year-olds reported having watched an AVOD service in the past month, up from 9% in 2020.

So, what impact is streaming video having on television designs? For starters, it has been reported that Comcast is working with Hisense to develop a line of televisions that run on the X1/Flex OS software that also powers Comcast’s STBs. Xfinity works as a cloud DVR: There is no actual memory for program storage on-board. Instead, shows you “save” or “record” with Xfinity stream from a cloud server, much the same way as Hulu and HBO Max work.

The Comcast-owned Sky streaming service launched its own line of televisions, known as Glass, in early October. (When is a TV not a TV?) In addition to Sky programming, these sets will also provide access to Netflix, Disney+, Comcast-owned Peacock, and Paramount+ SVOD platforms. As smart TVs, these represent a new level of functionality by eliminating the need for a sidecar box.

But they also are a broadside against Samsung, LG, TCL, and Sony smart TVs, not to mention Vizio (which has an in-house ad agency delivering to its smart TV models). And Amazon is also getting into the game with its Alexa-operated Fire Omni and 4-Series smart TVs. Intriguingly, it appears that the ultimate target of these companies’ actions is Roku, which has millions of its streaming boxes running around the world….and whose launch of its own AVOD channel forced a carriage stand-off with HBO Max earlier this year.

What to make of all of this? It’s clear that some consumers don’t mind watching targeted ads in return for discounted monthly subscriptions. It’s also clear that both set makers and content providers increasingly want to control your TV and the program selection it provides. (Plus advertising, which is a significant and growing source of additional revenue). Could this spell more trouble for traditional broadcast television stations and networks? Will AVOD subscriptions overtake no-ad SVOD subs? What happens to proprietary TV operating systems like WebOS and Tizen?

Stay tuned! (But first, here’s a barrage of “binge” ads for you to endure! Don’t worry, they’ll only take up seven minutes!) (PP)