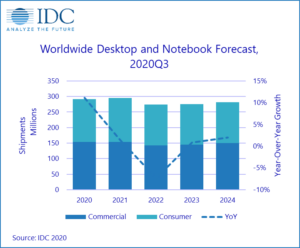

The ongoing surge in PC demand is expected to continue as work from home and remote education needs mix with the holiday spending season. According to a new International Data Corporation (IDC) forecast, shipments of desktop and notebook PCs will grow 18.2% year over year in the fourth quarter of 2020 (4Q20), followed by 1.4% growth in 2021.

The popularity of mobile devices is apparent with notebook PCs expected to grow 26.4% year over year in 4Q20 and 3.2% in 2021 while desktop PCs will decline in both periods. Looking beyond 2021, IDC expects PC shipments will eventually slow and experience some declines, but it seems that the pandemic has infused the market with new energy.

“The momentum in the PC market has been impressive to say the least,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “Earlier this year it seemed like this would be a six-month bump to the industry, but as we look at the supply chain pipeline into 2021, it’s clear that the surge has more legs. The education backlog remains extensive and many school districts around the world are doing everything they can to secure inventory. At the same time consumers seem to be buying all ranges of notebook PCs from low-end entry level systems to high-end gaming machines. It is important to note that all of this is happening at a time when other device categories like smartphones, PC monitors, TVs, and gaming consoles are also growing. A clear shift in consumer spend has happened.”

“Not only do we expect more PCs to ship this year and next, but the fundamental shift in everyone’s workflow is also expected to have a lasting impact on the PC market in 2022 and beyond,” said Jitesh Ubrani, research manager for IDC’s Worldwide Mobile Device Trackers. “Longer term forecasts for PC shipments and average selling prices have increased as households inch towards one PC per person while buying PCs further up the stack.”

The tablet market has also experienced growth resulting from the COVID-19 lockdowns and IDC expects total tablet shipments to grow 10% year over year in 2020. Most of the demand has been for detachable tablets led convincingly by Apple’s iPad lineup. In many emerging markets the education backlog for devices includes tablets, specifically Android products given their very low average selling prices compared to PCs or other tablet platforms.

|

Personal Computing Device Forecast by Product Category, 2020-2024 (shipments in millions) |

|||||

|

Product |

2020 Shipments* |

2020 Year-Over-Year Growth* |

2024 Shipments* |

2024 Year-Over-Year Growth* |

2020-2024 CAGR* |

|

Desktop |

75.5 |

-17.3% |

68.5 |

-1.1% |

-5.6% |

|

Notebook |

215.8 |

26.4% |

213.0 |

3.1% |

4.5% |

|

Total PC (DT+NB) |

291.3 |

11.2% |

281.5 |

2.0% |

1.4% |

|

Detachable Tablet |

63.2 |

63.1% |

62.2 |

1.6% |

9.9% |

|

Slate Tablet |

95.8 |

-9.4% |

67.6 |

-4.7% |

-8.5% |

|

Total Tablet |

158.9 |

10.0% |

129.8 |

-1.7% |

-2.1% |

|

Source: IDC Worldwide Quarterly Personal Computing Device Tracker, December 1, 2020 |

|||||

* Note: Forecast estimates.

IDC’s Worldwide Quarterly Personal Computing Device Tracker gathers data in more than 90 countries and provides detailed, timely, and accurate information on the global personal computing device market. This includes data and insight into global trends around desktops, notebooks, detachable tablets, slate tablets, and workstations. In addition to insightful analysis, the program delivers quarterly market share data and a five-year forecast by country. The research includes historical and forecast trend analysis.