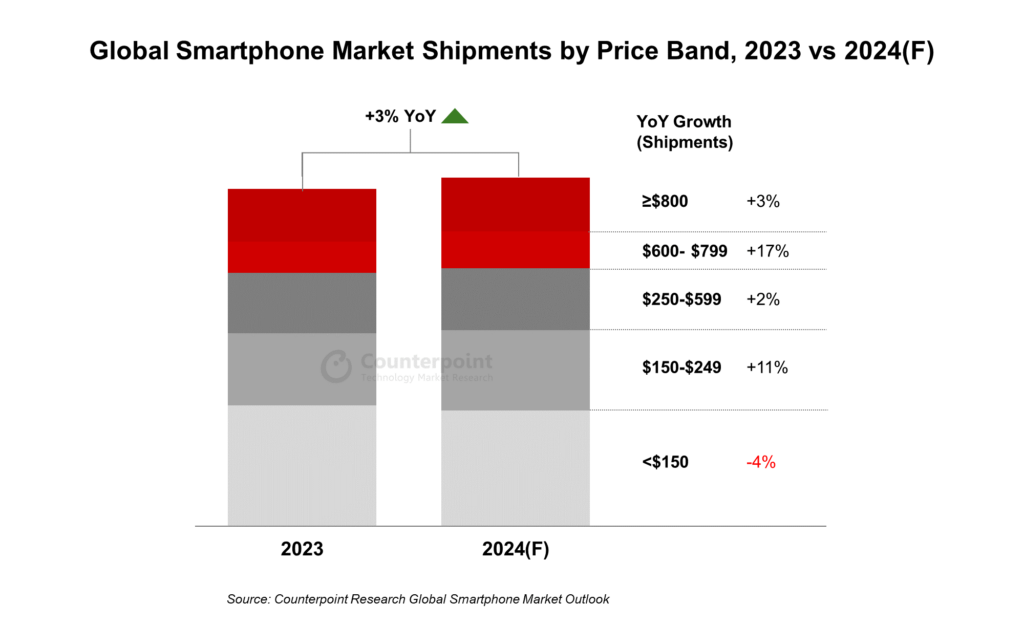

According to a forecast by Counterpoint Research, the worldwide shipments of smartphones are set to see a slight increase of 3% in 2024, amounting to 1.2 billion units. This growth is mainly attributed to the resurgence of the budget-economy smartphones, priced between $150 and $249, and the premium segment, with prices ranging from $600 to $799.

The budget segment, which saw a decrease in shipments last year due to economic challenges in emerging markets, is poised for an 11% year-over-year growth in 2024. This rebound is largely driven by markets in India, the Middle East and Africa (MEA), and the Caribbean and Latin American (CALA) regions. Factors such as eased inflationary pressures in Africa and stabilized currencies in several countries are enhancing consumer purchasing power in these regions.

Chinese manufacturers such as Oppo, vivo, Xiaomi, and the Transsion Group are ramping up their investments in the MEA and CALA regions, leading to heightened competition and, consequently, increased demand for budget smartphones.

The premium segment is forecasted to grow by 17% year over year in 2024. This segment’s growth is expected to be fueled by the popularity of older flagship models and flip smartphones. Moreover, advancements in GenAI smartphones and the foldable phone market are anticipated to boost the ultra-premium segment, particularly in the second half of the year. Apple and Huawei are projected to dominate the growth in this higher-end market, with India and the MEA regions contributing significantly to iPhone sales, and China remaining a critical market for both brands.