A couple of friends, well versed in the technology and graphics industries recently expressed surprise when I mentioned the withdrawal of Samsung from the LCD business. We had an email exchange and so I thought I’d turn that into a Display Daily. If you watch the industry all the time, there’s not much new here, but I hope the summary is useful.

The LCD business for a couple of decades has been a business that has really been about capital. Of course, there is technology and R&D, but fundamentally, anybody could get into the business if they were prepared to spend enough on the factories. China learned a lesson from the iPhone, where very little value of the value of the handset was left in China. Most of the money went on Japanese displays and touch systems, US, Korean or Taiwanese semiconductors and to Apple in the US. Only the assembly cost remained in China, at least initially.

Now, China has the biggest TV market in the world in terms of volume and if I remember correctly, flat panels for TVs were one of the top half dozen imports to China on a value basis, with panels being bought from Korea, Taiwan and Japan. To change this, the Chinese government decided that it wanted to ‘capture the value’ of the panels. It did this by making sure that very close to free capital was available to build fabs. It was almost impossible for companies that had to raise capital to compete. This was apparent more than a decade ago.

The Leaders Change Tack

The Koreans had become the leaders of the LCD world (with more than half of it), but they knew that, in a phrase that I heard from Samsung at the time, they needed to put ‘clear blue water’ between themselves and the Chinese. They decided to go for OLEDs and I remember hearing a keynote at SID when Samsung said that it would build RGB TV OLEDs based on LTPS. It caused an audible gasp in the audience. As I was writing it up, I remember thinking “Why would they do something so extremely difficult?”. Doh! They tried to do it precisely because it was so difficult.

At SID in 2012, David Barnes gave a great talk about the ‘OLED Island’. He said that Samsung’s quest to build OLEDs for smartphones and (abortively) for TVs might work if only they developed the technology – i.e. they had an ‘island’, but that if the others, especially the Chinese, found the island, there would be no profit. That is an analogy that I have used many times over the years!

David Barnes gave me the idea of OLED Islands in 2012 at the SID Business Conference.

David Barnes gave me the idea of OLED Islands in 2012 at the SID Business Conference.

In the end, Samsung’s plan to build RGB OLEDs for TVs didn’t work – it was too difficult. However, it has built a huge business in small RGB flexible and rigid OLEDs mainly for smartphones and, increasingly, IT applications (where it is the dominant supplier). LG, on the other hand, bought the ip to make OLEDs from a white OLED layer and using filters for the colour and has built a TV OLED panel business. It also makes smaller OLEDs for smartphones and automotive, in particular, but not on the scale that Samsung had.

On the other hand, Samsung has been the biggest supplier of TVs in the world for many years. The TV market is completely dominated by LCD technology, partly because of the cost, but partly because of the supply chain. At one time, it was my understanding that Samsung’s TV business was obliged by corporate policy to buy 50% of its panels, or so, from its own panel business. Samsung Display (SDC) wanted to get out of the LCD business because of the threat from China. Samsung’s TV division (SVD) bought panels from other vendors and that share increased as SDC started to wind down its LCD business.

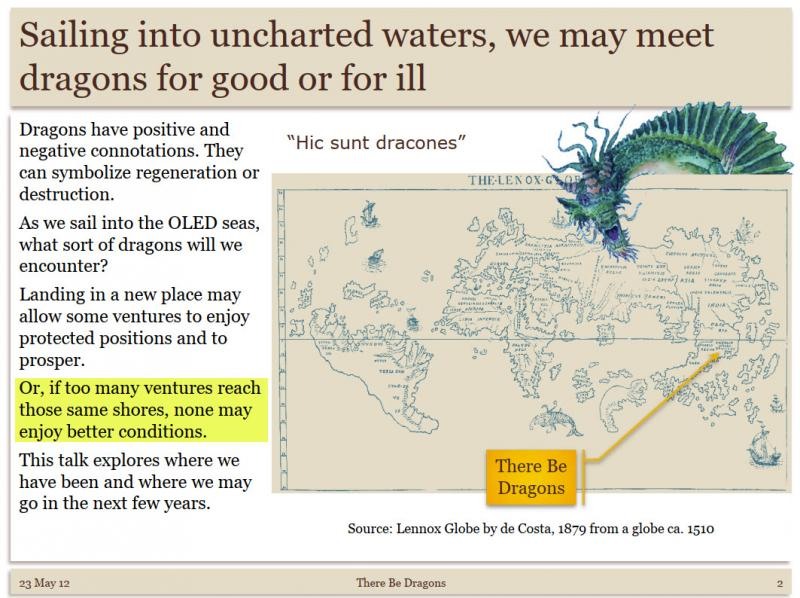

At the SID Business Conference last year, Nakane-san of Mizhuo, always a speaker I am happy to hear, revealed this table that showed which panel suppliers (across the top) are selling to which TV brands (down the left hand side). As you can see, by last year, it was expected that out of a total of 57.6 million panels that SVD was expected to buy in 2021, only 6 million were expected to come from SDC.

This data was presented by Nakane-san of Mizhuo at last year’s SID/DSCC Business Conference and shows which panel makers were expected to supply which TV brands in 2021.

This data was presented by Nakane-san of Mizhuo at last year’s SID/DSCC Business Conference and shows which panel makers were expected to supply which TV brands in 2021.

SDC had wanted to shut down its LCD business earlier and it wanted to move to its ‘second generation’ OLED TV technology, the QD-OLED. On the other hand, SVD was said to feel that it didn’t want another technology to promote as it was committed to LCDs, miniLED LCDs (which it calls QLED) and microLED (The Wall). It also was said to want to buy more of the best quality LCDs, which SDC certainly made. The story was that a deal was done for SDC to keep making LCDs for longer in return for SVD adopting QD-OLED. That was made an easier decision by the high prices that LCDs hit last year which made large LCDs profitable – at least for a while. (Panel Pricing, Crystal Cycles and Cuckoo Clocks)

However, as I wrote earlier this week, prices have plummeted again this year in the LCD panel business, so SDC will finally give up making LCDs for TVs this summer. It gave up notebooks a couple of years ago. So that is the end of LCD making for SDC. It’s slightly strange, after all these years, to look on the SDC website and see no reference to LCDs. As well as David’s OLED Island story, I talked at industry conferences for years about ‘The LCD Monster’. I had a graphic of an octopus with tentacles in every application from wearables to digital signage. SDC, for many years, was the epitome of the LCD Monster.

The LCD Monster six or seven years ago. These days, OLED has started to make significant inroads, especially in smartphones. Image:Meko

The LCD Monster six or seven years ago. These days, OLED has started to make significant inroads, especially in smartphones. Image:Meko

So, going forward, SVD is expected to have LCDs, QLEDs, QD-OLEDs and microLEDs in its TV range. However, reports suggest that SDC is struggling to get good yield in its QD-OLED factory which, in any case, has only limited capacity. Even if it could make the 1.5 million or so panels per year that the factory is designed for, that wouldn’t be a big enough supply to justify marketing and technical efforts by SVD in a new category as Sony is also signed up as a customer by SDC. So SVD has been looking to add more OLED TV panels to make its offer bigger, but the only supplier for those is LG Display.

Industry gossips, fuelled by leaks in Korea, have watched for months the discussions between SVD and LG Display over the purchase of OLEDs, with “It’s on” and “It’s off” stories for months. At the moment, Korean sources say “It’s (probably) on”, but our friends at DSCC are sceptical that the deal will happen. Only SVD and LGD really know – and even that is only a probability! There is an speculation though, that Samsung may buy as many as 5 million LCDs from LG Display. I expect to hear more about that next month at the DSCC/SID Business Conference.

This article is long enough, but an on-going topic will be the positioning of the QD-OLEDs in Samsung’s TV line-up. I wrote about that before and now that Samsung has revealed its US pricing, it may be time again. (QD-OLED vs miniLED – The Challenge of Positioning) (BR)