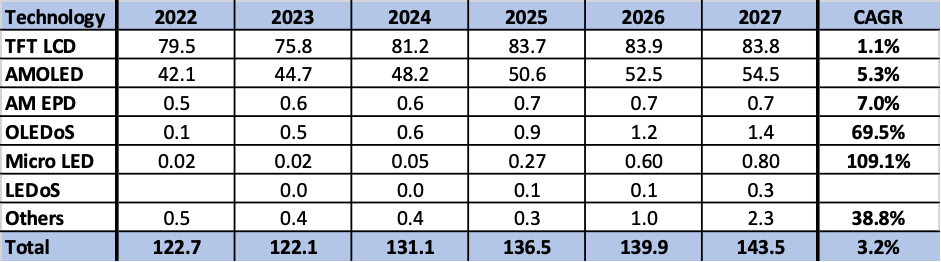

Over the last 5-years, the display industry evolved from a single dominant technology, multi-regionally structure with cyclical growth patterns to one that is bipolar (geographically not mentally), has minimum or negative revenue growth and now supports three primary technologies. Display revenue peaked in 2021 at $157.8b, dropped to $122.7b in 2022 and $122.1b in 2023. Most forecasts have revenue growing at 2-4% thru 2027, never returning to the 2021 peak.

Display revenue by technology – 2022-2027 in billions of dollars. )MicroLED revenue excludes Apple watch. (Source: Omdia)

With Sharp closing and/or selling its display assets, Innolux and AUO consistently operating in the red and China’s BOE and CSOT acquiring most LCD production capacity, the industry has condensed into these 2 companies plus the OLED based Samsung Display, which over the past 5-years has been the only profitable panel maker. In addition, LGD and HKC border on long term viability. HKC has been unable to transition from its LCD large area panel strategy and is dependent on the utilization strategy and pricing moves of its two large Chinese competitors. LGD is still in the process of converting to an all-OLED provider and is current strapped for the capital to expand its OLED business. In a most unusual event, LGD is being aided by Samsung VD’s 5m WOLED panel order, at a time when LGD would otherwise not be able to maintain full production in its two OLED TV fabs. Samsung VD is not making a beneficial move but as the leader in TV sales Samsung faces a growing challenge in the LCD TV segment by low cost set makers, TCL and Hisense and must evolve its high-end strategy to include OLEDs, which are only produced by SDC and LGD. Despite the recent slowdown in TV set sales to below 200m annually, they still consume 67% of display capacity. Observers say the sale negotiations for LGD’s Gen 8.5 LCD fab in Guangzhou will be completed as early as the first half of this year, which would help finance LG’s Gen 8.7 IT OLED fab.

In addition several other changes have occurred,

- Apple, which stole the initiative on MicroLEDs, when it announced a program to eventually take over the design and production of its display purchases, starting with the Apple Watch X, concluded that the technology was both too expensive and lacked the expected benefits vs. OLEDs. In the plans for MicroLEDs to take over the display world Apple’s decision is at best a set-back pushing mass adoption to the end of the decade or at worst a delegation to niche products like the current wall TVs.

- Apple also opened up the market for mid-range OLED panels for tablets and notebooks and in response, Samsung and BOE started construction of Gen 8.7 fabs, designing a new hybrid OLED architecture that consists of thinned glass, tandem organics, essentially 2 sets of RGB patterned sub-pixels with a color filter in the encapsulation layer. The hybrid design is expected to support 2x the luminance and 3x the lifetime of current OLED smartphone panels but at a higher cost/sq. inch than smartphone panels.

- Chinese OLED panel makers finally reached the yields that made their smartphone panels acceptable, and their pricing has opened up the low-mid range smartphone market, which prompted SDC with an 85% share of rigid OLED capacity to recognize that by lowering the price they could also compete in the same market, solving a multi-year problem of low rigid OLED utilization due to low demand.

- BOE is making great strides in upgrading its OLED technology and is the first to release a tandem panel for smartphones, where its panels boast max luminance of 6000 nits: a wake-up call to the Koran display leadership.

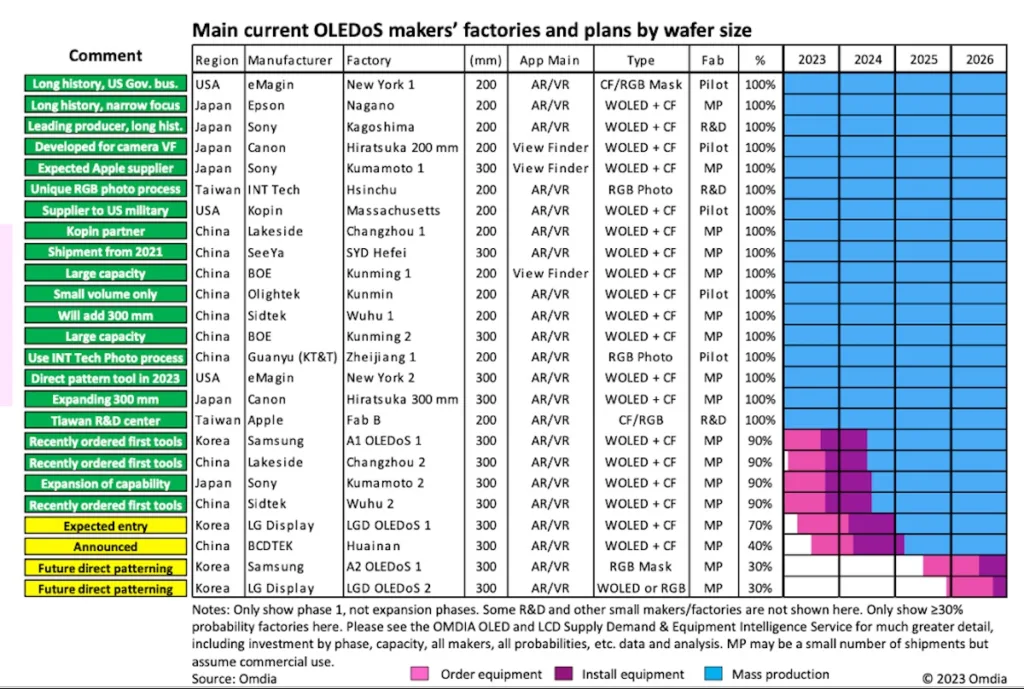

- The release of the Apple Vison Pro has raised expectations for OLEDoS demand creating a rush to create capacity as shown in the next table.

Given the near and mid-term outlook, and the lack of any new capacity-demanding applications, the era of the crystal cycle is over, to be replaced by a more consistent but low growth pattern. While AI will stimulate some new replacement patterns for smartphones and PCs, the only high growth opportunity is AR (see through smart glasses), which has been widely mis-forecasted as a groundbreaking app for the current decade. If Apple, Google, Samsung, Meta or others, figure it out, AR could compete with the high-end smartphone ($700 to $1,000+), a 400m unit market. But the displays for the glasses (2 1”+ micro displays) would be replacing 7” smartphone displays, a decrease in display area. If the AR proponents are correct, AR would also reduce TV and monitor sales.

Barry Young serves as the CEO of the OLED Association, helping to solve industry wide issues, such as standards development for the OLED display and lighting industries, promotion of the technology and working on development. Mr. Young is one of the industry’s leading authorities on OLEDs and flexible displays and has worked with and consulted for most of the major display companies in the world.