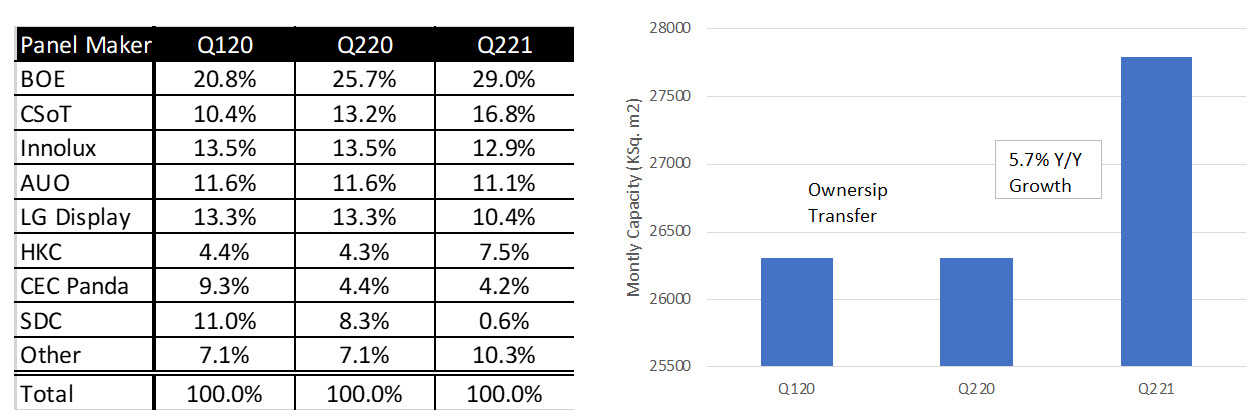

Large panel capacity is up 5.7% Y/Y, due to the growth in China, offset somewhat by Samsung’s partial exit from LCD production. Samsung’s large area display capacity share has dropped from 11% in Q120 to 0.6% in Q221. A major part of the change was Samsung sale of a majority interest in their Gen 8.5 fab in China to CSoT.

Samsung’s new QD-OLED fab will hardly move the needle as it is only 30,000 substrates/mo. BOE has the most capacity and their share went from 20.8% in Q120 to 25.7% to 20% by purchasing former rival CEC adding Gen 10.5 fabs. CSoT also gained in share by taking control of Samsung’s China assets and adding Gen 10.5 fab and is now #2 in capacity.

Table 1: Large Area Display Capacity & Growth

Source: Mizuho Securities Equity Research, OLED-A

Source: Mizuho Securities Equity Research, OLED-A

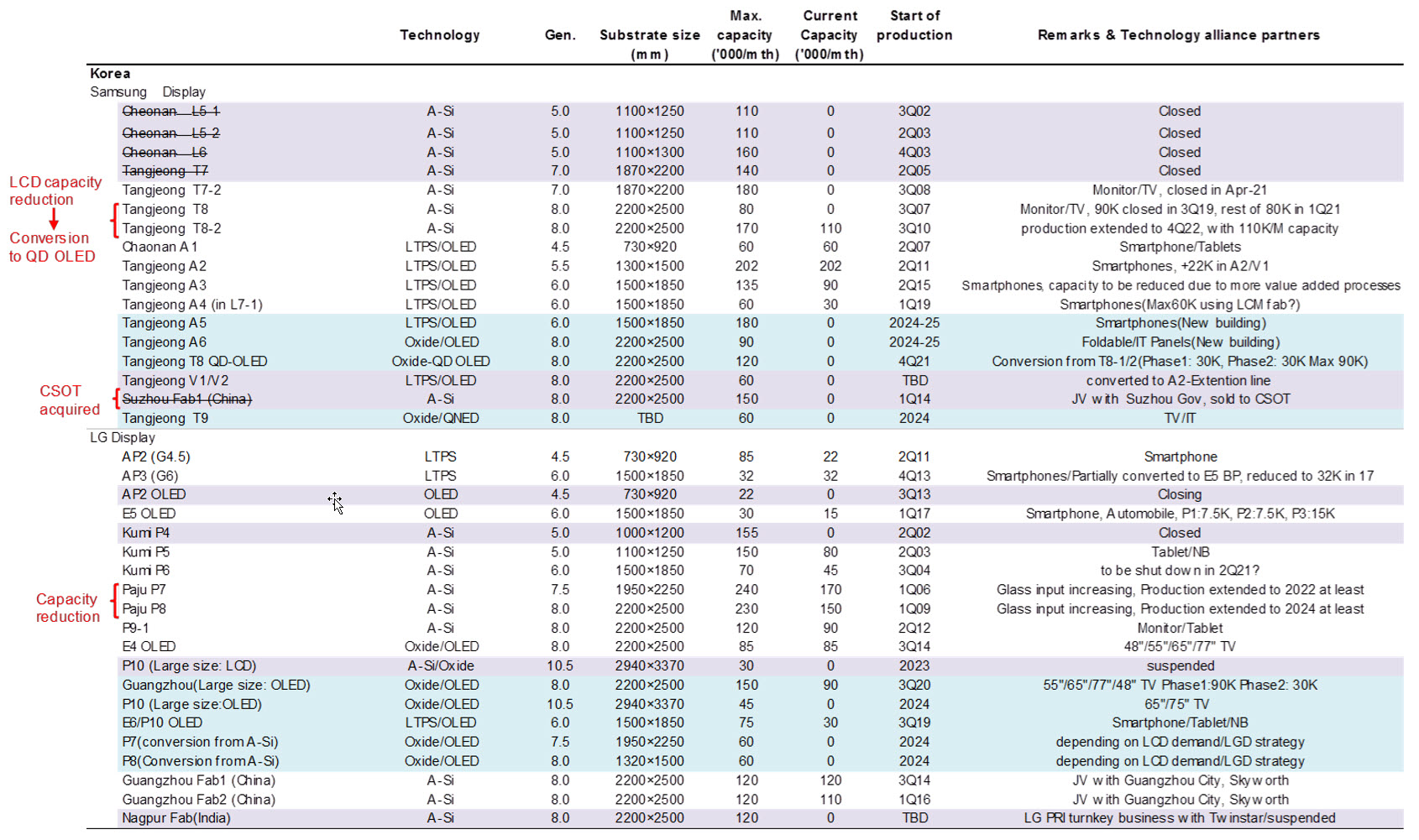

The changes by fab for Samsung and LG Display are listed in the following table.

Table 2: SDC/LGD Large Area Capacity Changes

Source: Mizuho Securities Equity Research – Click for higher resolution

Source: Mizuho Securities Equity Research – Click for higher resolution

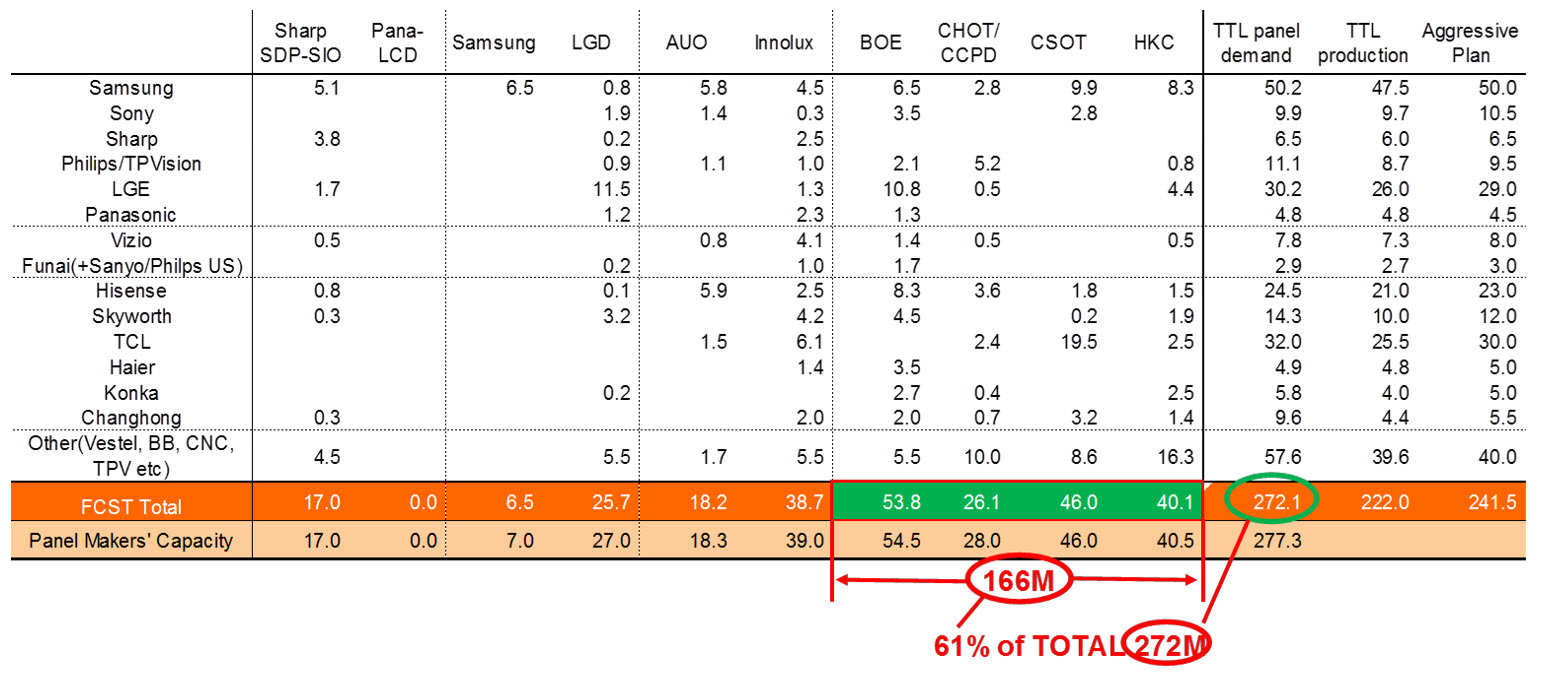

TV Set market leader, Samsung Visual Display, will source ~13% of its demand from SDC in 2021. As TV panel prices come down, SDC is likely to shut down the rest of its LCD fabs, leaving it captive to the Chinese hegemony, until Foxconn’s (SDP) Gen 10.5 comes on-line. BOE, CSoT, CHOT, HKC are the top providers of TV panels providing 61% of TV set demand

Table 3: TV Panel Production and Usage

Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

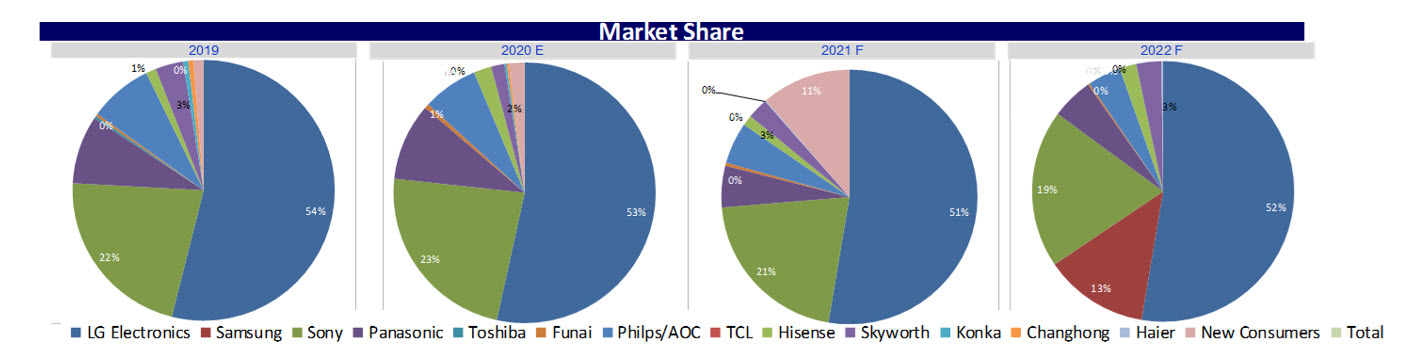

Figure 1: TV Set Market Share – 2019 -2021e

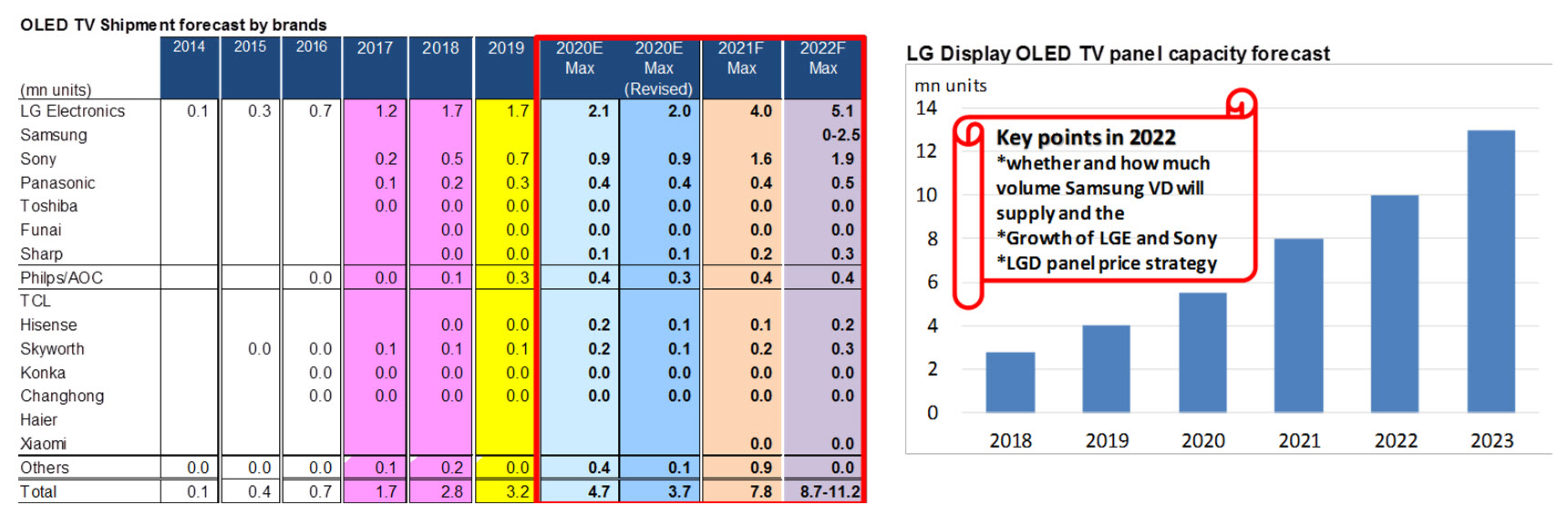

OLEDs remain a small portion of the large area panel capacity with a 3% share. But LGD’s OLED panel business is expected to grow from 4.7m units in 2020 to 7.8m in 2021 and as much as 11m in 2022, if their 30K expansion goes well.

Table 4: OLED TV Set Sales and Supply Sourcing

Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

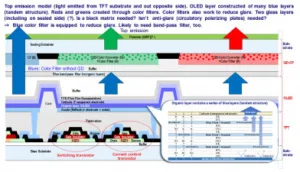

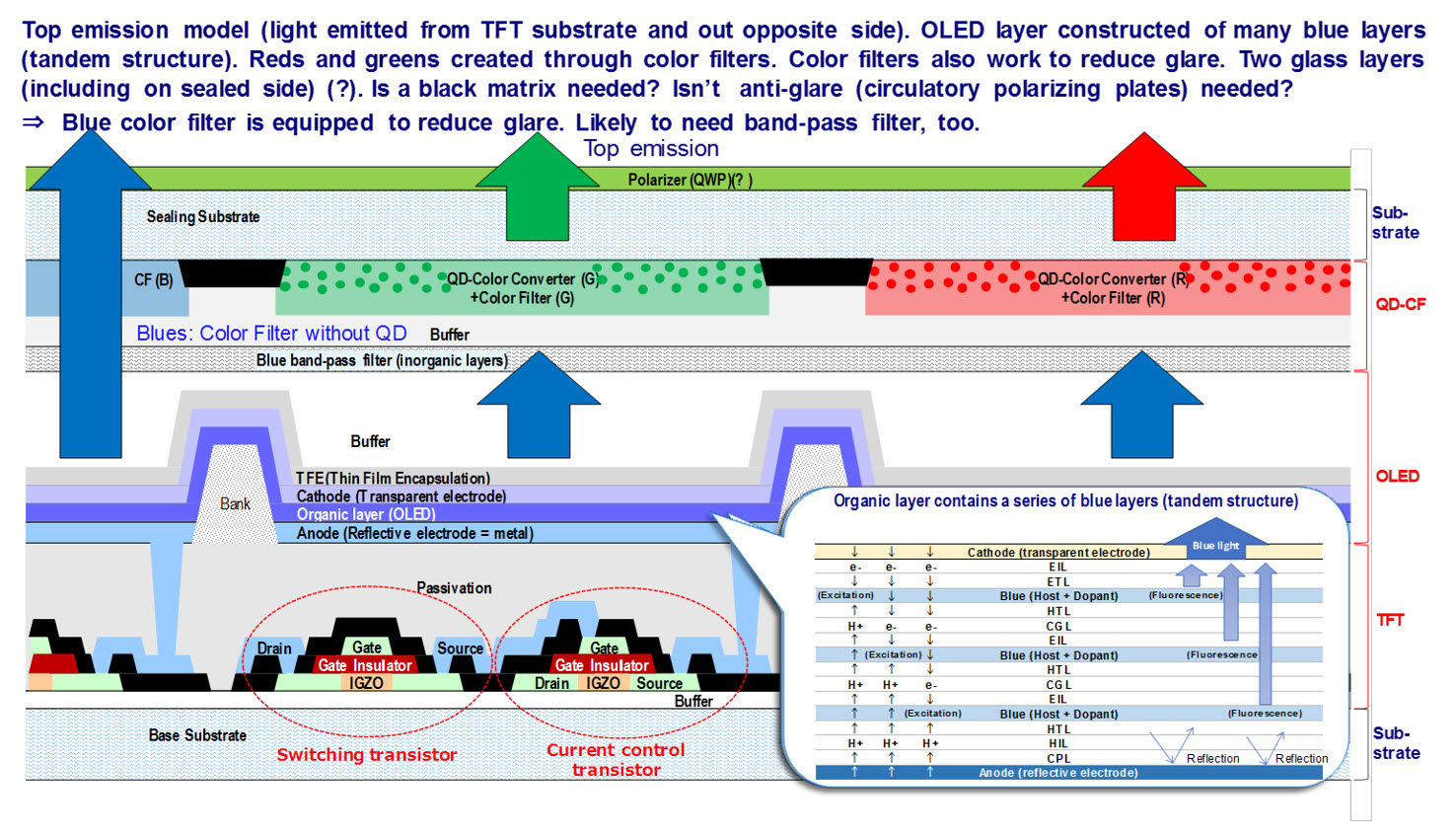

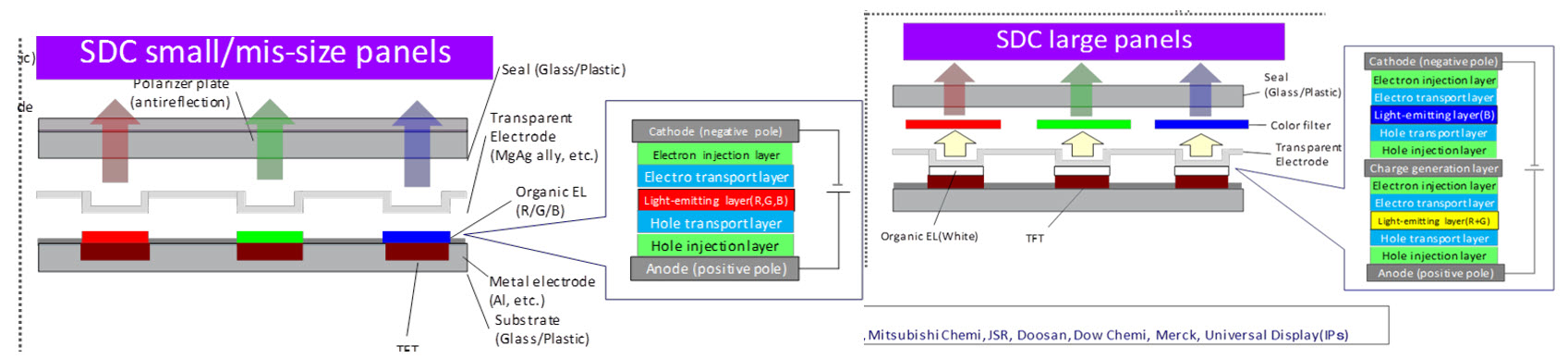

Unlike the mature LCD manufacturing process, where all fabs, large, medium or small use a top emission structure with color filters and either a-Si, LTPS or IGZO for backplane active material, OLED manufacturing is less consistent; medium fabs use a bottom emission model with no color filter, large fabs use a top emission model and others use IJP to deposit the material in lieu of VTE. Moreover, the active material can be LTPS, IGZO or a combination of both (LTPO). And Samsung is working on a Gen 8.5 with top emission and another Gen 8.5 with a vertically held deposition process. Samsung uses the top emission process as shown the next figure.

Figure 2: OLED Top-Emission Architecture

Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

Figure 3: Samsung’s Architectures

Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

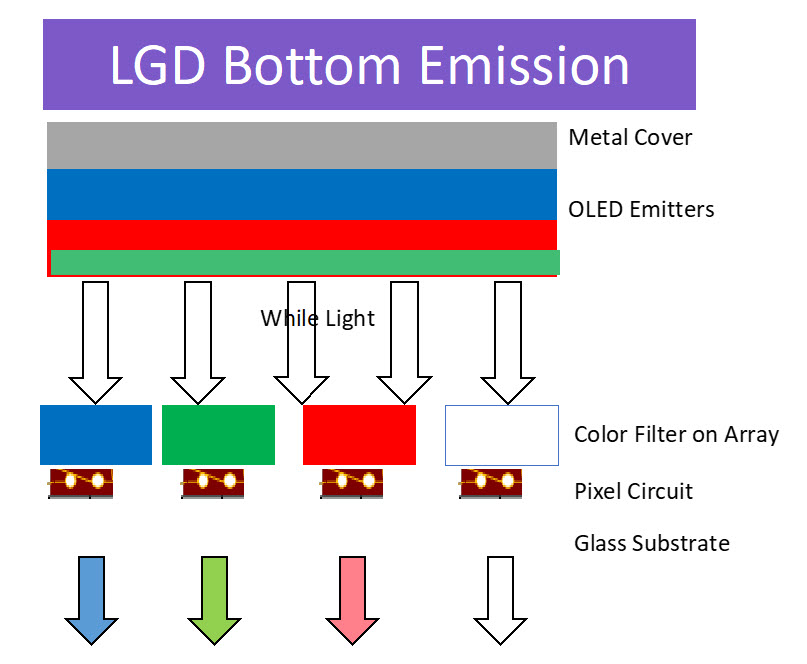

LGD has been using bottom emission for their Gen 8.5 fabs, where red, green and blue layers (unpixellated) are deposited, and then white light flows through a color filter (RGBW) to create the sub-pixels. The color filter is built into the active matrix as opposed to being printed on glass as typical for LCD panels.

Figure 4: OLED Bottom-Emission Architecture

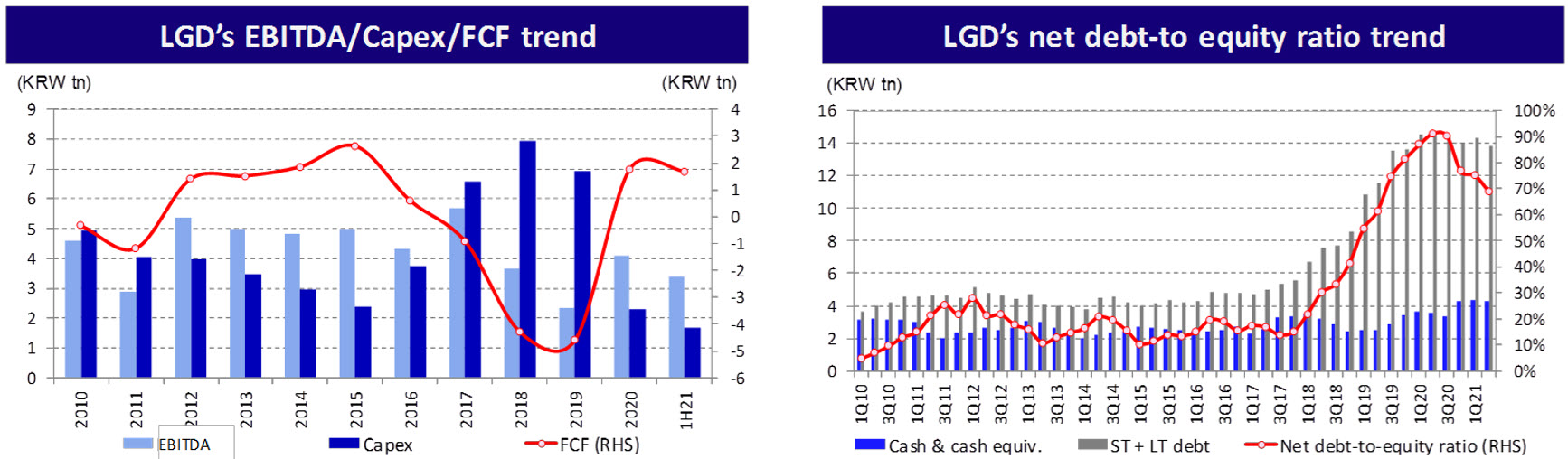

LGD is the only supplier of large OLED panels, so the OLED TV industry is totally dependent on them to be productive, technologically creative and financially secure. The company has suffered through losses form 2017 thru 2020 and is just starting to recover. LGD’s Fee Cash Flow (FCF) has risen to ~ $2 billion for the first half after hitting a low point in 2018 when free cash flow dropped to a -$5 billion per year. The company’s debt-to-equity ratio, which reached a peak of 90% in Q121, has dropped to ~70% after a strong first half. LG needs $5-7 billion to build a Gen 10.5 fab, so lowering the ratio, which comes with increased FCF is a must. (BY)

Figure 5: LGD’s FCF and Debt -to-equity Ratio Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

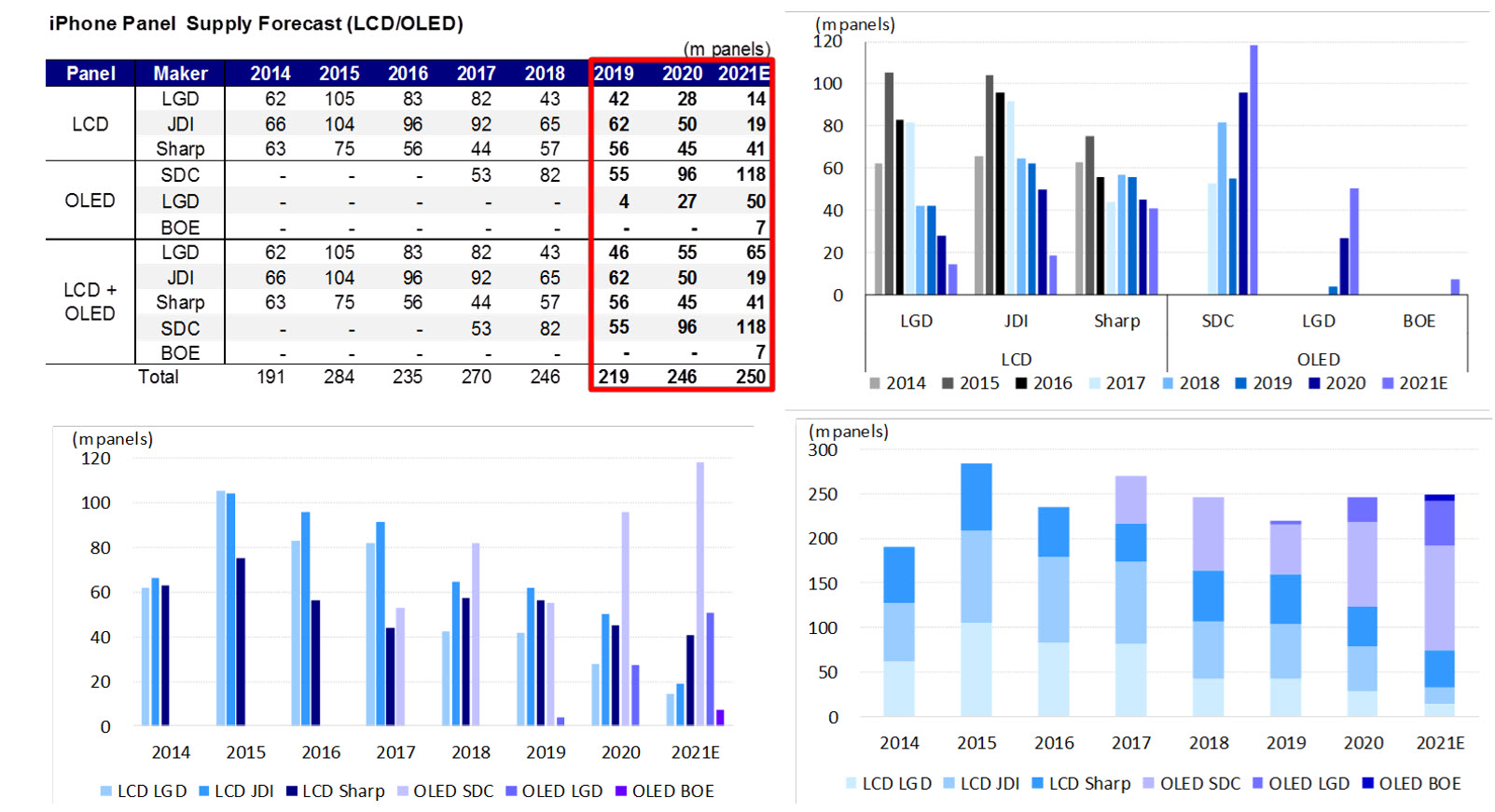

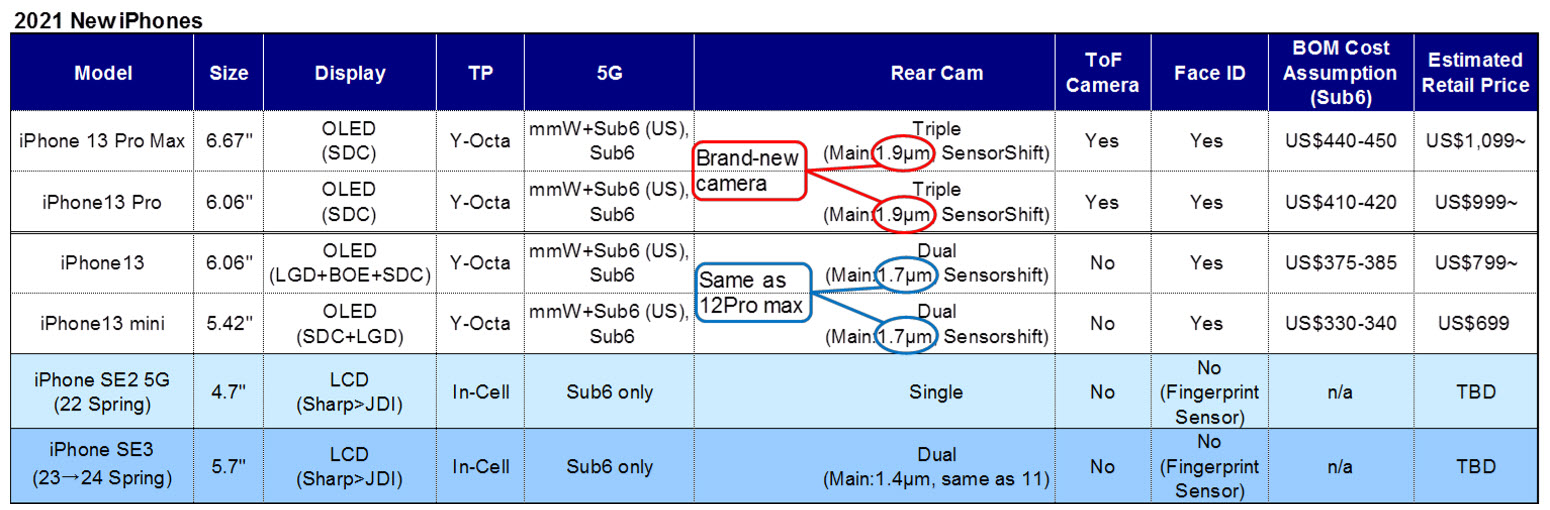

In 2021, Apple became the leader in OLED display usage, and it will be sustained with the soon to be released iPhone 13 series and over the next 2-3 years. Apple incorporates the 6.7” size for the Pro and the Pro Max, a 6.06” in the basic model and a 5.42’ in the Mini. These sizes are expected to remain the same thru 2022. OLED supply is ~70% Samsung and LGD supply 70% and 28% respectively. LCD panels sourcing is moving almost completely to Sharp.

Figure 6: iPhone Panel Supply

Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

Table 5: General Specs for iPhone 13 and SE

Source: Mizuho Securities Equity Research

Source: Mizuho Securities Equity Research

Note that most of the charts and tables in this article can be viewed in higher resolution by clicking on them.

Barry Young is the CEO of the OLED Association