TCL came within striking distance of Samsung’s global television market leadership in November 2025, closing the share gap to a single percentage point as its shipments surged 22% year-on-year while the overall market contracted 1%, according to Counterpoint Research’s Global TV Shipments Monthly Tracker.

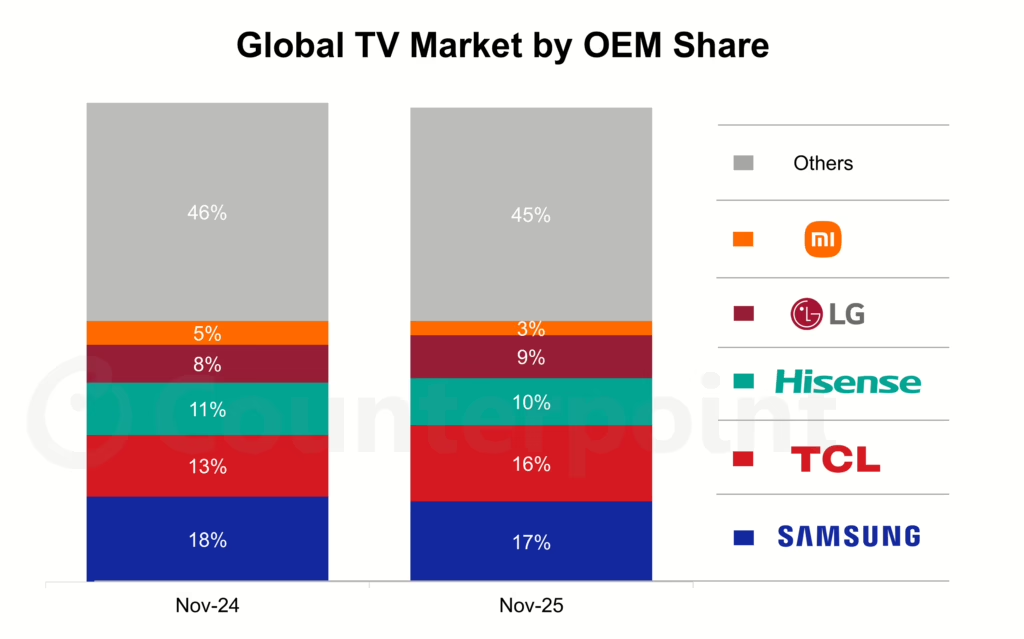

Samsung retained the top position with 17% market share in November, down from 18% a year earlier as shipments declined 3% year-on-year. TCL captured 16% share, up from 13% in November 2024, a three-point gain that represents the most significant challenge to Samsung’s leadership position in recent years.

TCL’s performance stands in sharp contrast to fellow Chinese manufacturers Hisense and Xiaomi, both of which remained in the global top five but suffered substantial year-on-year declines. Hisense shipments fell 11% while Xiaomi dropped 35%, with both companies bearing the impact of severe weakness in their home market.

Mainland China TV shipments collapsed 24% year-on-year in November, extending a difficult year that has seen the market decline 10% on a year-to-date basis. The downturn followed the expiration of appliance subsidies that had supported demand earlier in the year. TCL’s ability to grow through this domestic headwind, achieving 22% global shipment growth despite the China market implosion, underscores the company’s successful international expansion strategy.

LG Electronics gained share from 8% to 9% in November as shipments increased 7% year-on-year. With minimal exposure to the Chinese market, LG capitalized on strength in the Americas, where North American shipments grew 8% and Latin American volumes surged 29%.

The regional divergence highlights geographic portfolio risk. Brands heavily concentrated in China faced significant headwinds, while those with diversified international footprintsm, TCL, LG, and to some extent Samsung, navigated the market more successfully.

While November’s single-month data shows TCL nearly matching Samsung, the year-to-date view presents a wider gap. Through November 2025, Samsung maintained 16% global share versus TCL’s 12%, with Hisense at 11%, LG Electronics at 9%, and Xiaomi at 4%.

Worldwide TV shipments increased 0.6% through the first eleven months of 2025, with regional performance varying considerably. The Middle East led growth at 9% year-on-year, followed by Latin America at 8% and Asia Pacific at 7%. These gains offset the 10% year-to-date decline in Mainland China and weakness across both Eastern and Western Europe.

OLED television shipments grew 3% through November, slightly outpacing the overall market. LG maintained commanding leadership in the premium segment with shipments exceeding all other brands combined, though its share edged down from 54% in 2024 to 51% in 2025.

Samsung made notable gains in OLED, rising from 24% share in 2024 to 31% in 2025—a seven-point improvement that reflects the company’s QD-OLED push at premium price points. The top five OLED brands, LG, Samsung, Sony, Panasonic, and Philips, collectively controlled 96% of worldwide OLED TV shipments, leaving minimal room for challengers in the premium technology segment.

TCL’s November performance arrives as the company prepares to assume operational control of Sony’s television business through a newly announced joint venture, adding the Bravia brand and Sony’s image processing expertise to TCL’s manufacturing scale. The combination of organic share gains and the Sony partnership positions TCL for a potentially decisive challenge to Samsung’s longtime market leadership.

For Samsung, the narrowing gap reinforces competitive pressure in a market characterized by sub-1% annual growth and intense price competition. The Korean company’s strength in premium OLED and its technology leadership provide differentiation, but volume share erosion to aggressive Chinese competitors represents an ongoing strategic challenge.