8.7 million tablets were shipped to Western European countries in Q3’15, which was down just 1% from last year, says IDC. The firm believes this to be a ‘clear sign’ of stabilisation in the market. However, there is a trend towards detachable devices.

Vendors of detachable tablets doubled between Q3’14 and Q3’15, with shipments breaking the 1 million mark in the most recent quarter. They represented almost 14% of the overall tablet market in Western Europe. The form factor is becoming more popular due to their wide-ranging specs and increased productivity compared to a traditional tablet. Most of the new detachable products were introduced for home users.

Despite the growth of detachable tablets, the overall consumer segment fell 5% YoY, as demand for the slate tablet form factor contracted 11%. There were few reasons to renew existing devices, and a dwindling number of first-time buyers.

Q3 shipments began to show some signs of seasonality, as the market prepared for the end-of-year shopping season. There was an increase in child-friendly tablets, and Amazon returned to the top 10 vendor rankings with a renewal of its Kindle Fire series.

Commercial tablets rose 24% YoY, driven by rising adoption and seasonal deployments in education. Growth for the slate form factor, which is popular with verticals, remained in the high single digits – but detachables increased 74%. Total volume and commercial market share remained small, however, as businesses looked at their hardware strategies in light of upcoming product releases, which are expected to use Intel’s new Skylake chips and Windows 10.

New designs based on Intel’s sixth-gen CPUs and Windows 10 are expected to support shipment volume in the coming quarters. IT departments will focus their purchasing decisions on increased security features, application costs and device and app management across multiple devices.

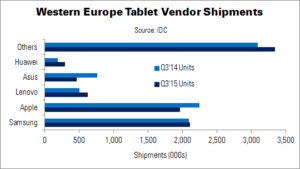

Samsung and Apple continued to lead the market. Samsung grew slightly (0.5%), thanks to new products. Apple suffered from slow replacement rates – due to an expected new iPad in Q4 – while the average price paid for its tablets rose.

Lenovo took third place, and Asus regained its leading position in the detachable market – although overall shipments contracted sharply, and the vendor fell to fourth. Huawei entered the top five, in fifth place.

| Western Europe Tablet Vendor Trends (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q3’15 Units | Q3’14 Units | Q3’15 Share | Q3’14 Share | YoY Change |

| Samsung | 2,105 | 2,094 | 24.0% | 23.6% | 0.5% |

| Apple | 1,961 | 2,247 | 22.3% | 25.3% | -12.7% |

| Lenovo | 620 | 498 | 7.1% | 5.6% | 24.5% |

| Asus | 457 | 759 | 5.2% | 8.6% | -39.8% |

| Huawei | 295 | 186 | 3.4% | 2.1% | 58.6% |

| Others | 3,347 | 3,090 | 38.1% | 34.8% | 8.3% |

| Total | 8,785 | 8,874 | 100.0% | 100.0% | -1.0% |

| Source: IDC | |||||