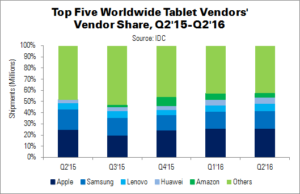

Worldwide tablet shipments (including both slates and detachables) shrank 12.3% YoY in Q2, says IDC, to 38.7 million units. Vendors are beginning to ‘refocus’ their product lines and consumers are delaying purchases.

65% of tablets shipped in Q2’16 were based on Android, followed by 26% using iOS and 9% using Windows. This is a continuation of the trend seen in recent years, but there are signs that the number of Android vendors is contracting in favour of Windows.

Jitesh Ubrani of IDC said that consumers and businesses are looking for more productive form factors and operating systems – part of the reason for the rise of both detachable tablets and the Windows OS. However, he says, “the next 12 to 18 months will be very interesting as Google launches the next version of Android with better multi-tasking support and as they begin to bring together their two operating systems [Android and Chrome].”

Despite the continuing fall of slate tablets, they still represent more than 75% of the market. Some vendors, like Amazon with its focus on positioning and price, have captured a considerable market share.

| Top Five Tablet Vendors’ Shipments, Share and Growth, Q2’16 Preliminary Data (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q2’16 Share | Q2’15 Share | YoY Change |

| Apple | 10.0 | 11.0 | 25.8% | 24.9% | -9.2% |

| Samsung | 6.0 | 8.0 | 15.6% | 18.2% | -24.5% |

| Lenovo | 2.5 | 2.5 | 6.6% | 5.6% | 3.1% |

| Huawei | 2.2 | 1.3 | 5.6% | 2.9% | 71.0% |

| Amazon | 1.6 | 0.1 | 4.0% | 0.3% | 1208.9% |

| Others | 16.4 | 21.3 | 42.4% | 48.2% | -22.9% |

| Total | 38.7 | 44.1 | 100.0% | 100.0% | -12.3% |

| Source: IDC | |||||

Apple remained the market leader; its launch of the second detachable iPad helped to smooth the company’s decline to 9% YoY, and also raised APSs and revenues. Price reductions on older iPads and the latest iPad Pros are expected to have the same effect through 2016.

Second place went – again – to Samsung, with its wide product portfolio. Samsung’s results are expected to climb as it is mostly leaving the detachable category alone. IDC does not include the Galaxy View in its tablet results.

Lenovo remained strong in APAC and EMEA, raising its share with some unusual form factors. Models like the Yoga Tab 3 Pro, with an integrated projector, have differentiated Lenovo from its competition. The majority of shipments still come from the low-end Tab 2 and Tab 3 lineups, however.

Huawei, at number four, experienced a rocky start to the launch of its first detachable, the Matebook, as it has been seen as overpriced for its specs. The company continued to do well in APAC and MEA, though.

Amazon took the fifth place spot, thanks to its low-cost and well-promoted Fire tablets. IDC expects Amazon to perform well in Q3, as well, due to its Prime Day sale. Note that IDC did not include Amazon’s 6″ tablets in its coverage in Q2’15, and so growth appears to be very high.