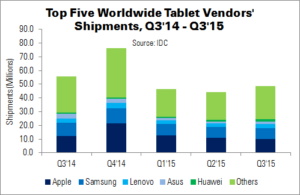

Q3 was the fourth consecutive quarter of falling worldwide tablet shipments, says IDC. Despite signs of a slight seasonal improvement, shipments slipped 12.6% YoY to 48.7 million units.

Many mature markets, such as North America, Western Europe and APAC, are now saturated with tablets – there are thought to be more than 100 million in each region. IDC continues to see owners holding on to their devices for four years or more.

“We believe the traditional slate tablet has a place in the personal computing world”, said programme director Ryan Reith. “However, as the smartphone installed base continues to grow and the devices get bigger and more capable, the need for smaller form factor slate tablets becomes less clear. With shipment volumes slowing over four consecutive quarters, the market appears to be in transition”.

New form factors, such as detachables, continue to be of interest to vendors. Although detachables currently hold a single-digit market share, IDC predicts that this will rise quickly over the next 18 months. However, this shift presents new challenges to the tablet market: in particular, the traditional PC OEMs that are producing these devices will face pressure from traditional smartphone OEMs, many of whom are used to delivering low-cost products.

| Top Five Tablet Vendors’ Shipments, Market Share and Growth, Q3’15 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q3’15 Units | Q3’14 Units | Q3’15 Market Share | Q3’14 Market Share | YoY Change |

| Apple | 9.9 | 12.3 | 20.3% | 22.1% | -19.7% |

| Samsung | 8.0 | 9.7 | 16.5% | 17.4% | -17.1% |

| Lenovo | 3.1 | 3.1 | 6.3% | 5.5% | 0.9% |

| Asus | 1.9 | 3.4 | 4.0% | 6.1% | -43.4% |

| Huawei | 1.8 | 0.7 | 3.7% | 1.3% | 147.9% |

| Others | 23.9 | 26.4 | 49.1% | 47.5% | -9.6% |

| Total | 48.7 | 55.7 | 100.0% | 100.0% | -12.6% |

| Source: IDC | |||||

Apple held on to the top position in the global tablet market, although the iPad is starting to lose its spot as ‘the ultimate tablet’. Apple’s self-cannibalisation, and PC vendors’ detachable models, have contributed to declining shipments. However, the upcoming iPad Pro could boost the tablet’s fortunes again.

Closing the gap between itself and Apple with its continual marketing push, Samsung is one of the few remaining premium Android tablet vendors – although the bulk of its shipments focused on the low-end. Samsung is one of the manufacturers looking at the detachable segment.

After multiple quarters of positive growth, Lenovo finally felt the pressure of the slowing market. The company’s flat growth in a down market ‘should be viewed as a positive sign that the vendor is committed to being a market leader and has the means to achieve that goal’, said IDC.

Asus drove volume with its low-cost detachable devices over the past year; however, the company struggled to maintain detachable momentum in Q3. Its refreshed Transformer lineup has been less successful, and other vendors have been able to offer similar devices at comparable price points.

Huawei has found its niche in cellular-enabled tablets. More than 65% of the company’s tablets are connected models.