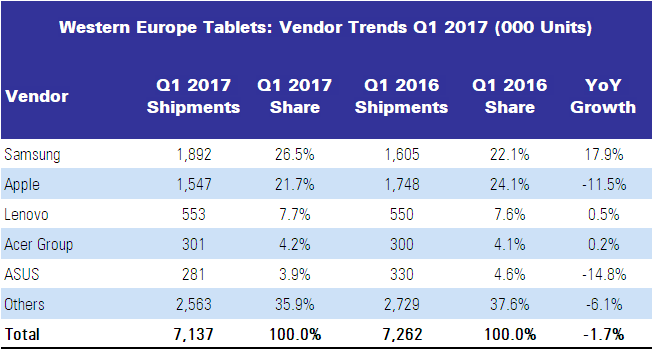

IDC said that in Q1, the tablet market in Western Europe posted a slight 1.7% YoY contraction. In total, 7.1 million devices were shipped in the region, a performance above expectations that shows some resilience in the tablet market after many quarters of decline. The recovery in Android-based slates in consumer and the continuous progress of tablet in enterprise were the main drivers of Q1 2017 results. Detachable tablets grew 5.8% YoY and continued to positively impact the market — there was particular traction in the commercial segment, with strong 16.6% YoY growth.

Overall, the commercial segment performed positively with 5.4% YoY growth. Android- and iOS-based devices with keyboards, mainly adopted by enterprises to address the specific needs of certain groups of users drove detachable growth in the commercial segment in Q1 2017.

As expected, the adoption of Windows-based detachables slowed down in Q1 2017. Several factors affected the penetration of Windows, such as the growing focus on convertibles by major OEMs, sluggish Windows 10 adoption in large and very large corporations, and the lack of a Surface Pro refresh.

“Despite the weak Q1 2017, the Windows detachable category will continue to progress going forward. This form factor is ideal for many usage scenarios and it perfectly fits the mobility needs of mobile professionals nowadays. It’s just a matter of time until we see the number and pace of deployments accelerating,” said Daniel Gonçalves, senior research analyst, IDC Western Europe Personal Computing Devices.

Despite the growth in detachables, the major contribution for a stronger-than-anticipated tablet performance in Western Europe came from Android-based slates, which have always been the largest part of the market. Their affordability and the diversity of brands available continued to attract a large number of consumers but until recently this category has been strongly affected by the erosion in consumer demand. In Q1 2017 Android slates had their first YoY increase since Q3 2014 (4.8%) and contributed to the larger-than-expected volume in the market. Major OEMs like Samsung and Huawei posted YoY growth, pushing their midrange 10in. offers. Most prominent vendors have moved out from the entry-level space and now operate in the €200+ price bands, due to the low profitability of the lower part of the market, which has been dominated by white brands and the Amazon Fire 7.

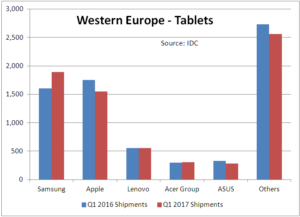

Samsung posted growth and gained the top position in Western Europe thanks to its strong positioning in slates. Apple introduced its new iPad late in the quarter and that should sustain a stronger second quarter. iOS-based devices still account for around 50% of all tablets above €600. Lenovo closed the top three and gained share due to a stronger performance than the market.