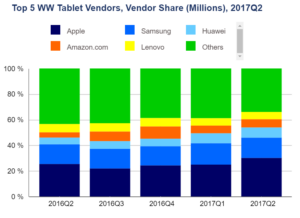

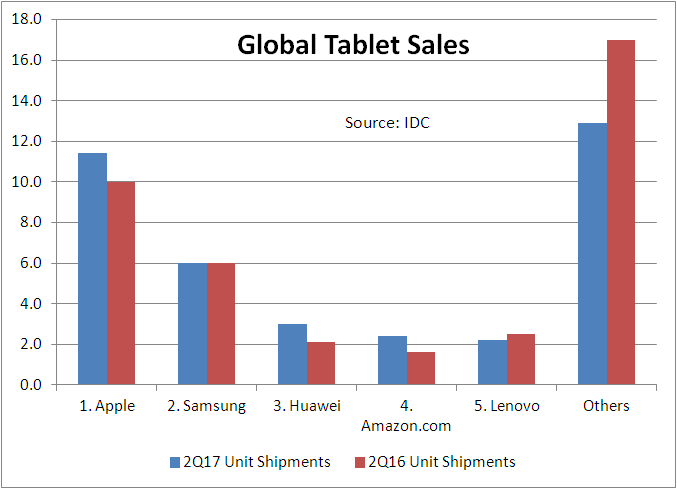

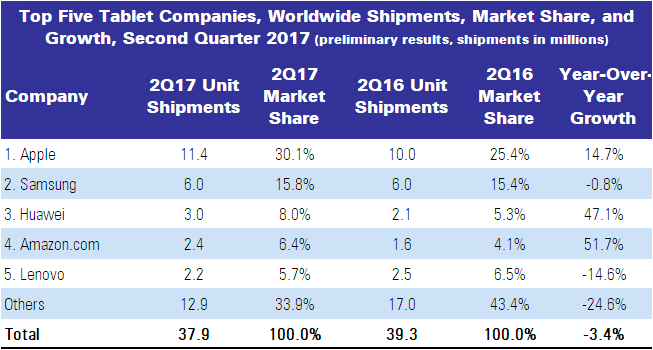

The latest figures from the IDC’s Worldwide Quarterly Tablet Tracker show that, despite some small relief from product price drops, the market has continued its downturn through the second quarter of the year and declined by 3.4% to 37.9 million.

Once touted as the savior of the market, detachable tablets also declined in the second quarter as consumers waited in anticipation of product refreshes from high-profile vendors like Apple and Microsoft. However, with new product launches towards the end of the second quarter, the detachable market is expected to maintain a stronger position in the second half of the year. The Surface and IPad Pro dominate shelf space and mindshare, IDC said, but other PC vendors and smartphone vendors are starting to have more impact.

Apple continues to dominate, following the release of the relatively low-cost fifth-generation iPad and its premium counterpart, the iPad Pro.

Samsung was able to gain share simply by sustaining flat growth in this declining market. The company appears to be the third major contender in detachables, after Apple and Microsoft, and in typical Samsung fashion offers multiple detachable tablets with a choice of either Windows or Android. On a worldwide basis, Samsung’s slates have a significant presence though, like many other vendors, this portion of the business continues to struggle.

Huawei’s investment in brand marketing in Europe and Asia has continued to work well as the company finds itself among the top five for tablets as well as smartphones. With plenty of low-cost and cellular-enabled options, Huawei has been able to slowly steal share from rivals like Lenovo. However, the company has been fairly cautious of the detachable market and recent products have had very limited launches.

Amazon.com’s aggressive pricing strategy has worked well due to its ever-growing ecosystem. Amazon also managed to update its lineup, offering new tablets at a better price and expanding its Alexa service to the UK. Amazon is also the only major vendor that actively targets the kids’ tablet market by offering a dedicated bundle inclusive of kid-friendly content – an approach that seems to have paid off as the company has managed to maintain a stronghold in the tablet market.

Despite the annual decline, Lenovo has managed to slowly increase the share of detachable tablets within its product portfolio, which tend to have a higher average selling prices (ASPs). A low-cost strategy focused on Asia has worked so far, but that strategy is starting to lose its legs.

Jitesh Ubrani, senior research analyst with IDC, said,

“There’s been a resetting of expectations for detachables as competing convertible notebooks offered a convincing and familiar computing experience for many.

To date, the 2-in-1 market was bifurcated as Apple and Microsoft led with detachables while the PC vendors led with convertibles. Though that is slowly changing as smartphone vendors and traditional PC vendors begin to offer compelling alternatives, the pace has been rather slow as Surface and iPad Pro still dominate shelf space and mindshare”.

As the market leaders continue to push their prices down to encourage growth, IDC predict that more and more smaller companies will begin to shift out of the tablet industry.

The speed of Android updates makes supply chain management very difficult in the tablet market. Small brands and white box sales are steadily losing out to the top few brands.