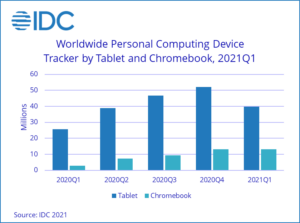

While much of the world is still dealing with the COVID-19 pandemic, sales of tablets and Chromebooks remain on fire. Tablets had an outstanding first quarter of 2021 (1Q21) with 55.2% year-over-year growth and shipments totaling 39.9 million units, according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

Growth of this magnitude has not been seen since the third quarter of 2013 when the tablet market grew by 56.9% year over year. While Chromebooks and tablets can serve different customers, both remain in high demand. Chromebook shipments totaled 13 million units in 1Q21, up from 2.8 million in the first quarter of 2020.

“While vaccine rollouts and businesses returning to offices may slow down the work-from-home trend, we are still far from returning to ‘normal’ working conditions and hence the demand for tablets, especially detachables, is expected to continue for a while,” said Anuroopa Nataraj, research analyst with IDC’s Mobility and Consumer Device Trackers. “However, as buyers increasingly turn towards competing products, such as thin and light notebooks for work or entertainment and Chromebooks for education, the future of tablets will remain under constant competition, leaving the heavy lifting to larger brands such as Apple, Samsung, Amazon, and Microsoft.”

Previously, schools around the world had shown a strong preference for the tablet form factor due to its low cost and easy manageability. However, the rising popularity of Chromebooks is quickly leaving little room for tablets in markets such as the United States, Western Europe, and more recently, Japan.

“There’s no doubt that Chromebooks have supplanted tablets in many education markets. However, price and the dependence on cloud services have prevented them from becoming mainstays in all regions,” said Jitesh Ubrani, research manager with IDC’s Mobility and Consumer Device Trackers. “Besides, Chromebooks have yet to break into the consumer market in a meaningful way as competing notebooks as well as tablets, such as the iPad, Galaxy devices, and Fire tablets, maintain a strong presence.”

|

Top Five Tablet Companies, Worldwide Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (Preliminary results, combined company view for the current quarter only, shipments in millions) |

|||||

|

Company |

1Q21 Shipments |

1Q21 Market Share |

1Q20 Shipments |

1Q20 Market Share |

Year-Over-Year Growth |

|

1. Apple |

12.7 |

31.7% |

7.7 |

30.0% |

64.3% |

|

2. Samsung |

8.0 |

20.0% |

5.0 |

19.3% |

60.8% |

|

3. Lenovo |

3.8 |

9.4% |

1.6 |

6.1% |

138.1% |

|

4. Amazon.com |

3.5 |

8.7% |

1.4 |

5.6% |

143.0% |

|

5. Huawei* |

2.7 |

6.8% |

2.7 |

10.4% |

1.7% |

|

Others |

9.3 |

23.3% |

7.3 |

28.5% |

26.5% |

|

Total |

39.9 |

100.0% |

25.7 |

100.0% |

55.2% |

|

5. Huawei (including 1Q20 Honor volume)** |

2.7 |

6.8% |

3.0 |

11.8% |

-9.2% |

|

Source: IDC Worldwide Quarterly PCD Tracker, April 29, 2021 |

|||||

Notes:

* Since Huawei sold its Honor business, data for Huawei in the top line excludes Honor volume for both 1Q21 and 1Q20.

** For year-on-year comparison, an extra line has been added below the table to show what Huawei’s growth would have looked like including Honor volume in 1Q20.

|

Top Five Chromebook Companies, Worldwide Shipments, Market Share, and Year-Over-Year Growth, Q1 2021 (Preliminary results, combined company view for the current quarter only, shipments in millions) |

|||||

|

Company |

1Q21 Shipments |

1Q21 Market Share |

1Q20 Shipments |

1Q20 Market Share |

Year-Over Year Growth |

|

1. HP Inc |

4.4 |

33.5% |

0.6 |

20.9% |

633.9% |

|

2. Lenovo |

3.3 |

25.6% |

0.7 |

25.6% |

356.2% |

|

3. Acer Group |

1.9 |

14.5% |

0.8 |

26.4% |

150.9% |

|

4. Dell Technologies |

1.5 |

11.3% |

0.3 |

12.1% |

327.1% |

|

5. Samsung |

1.0 |

8.0% |

0.2 |

6.1% |

496.0% |

|

Others |

0.9 |

7.2% |

0.3 |

8.9% |

267.2% |

|

Total |

13.0 |

100.0% |

2.8 |

100.0% |

357.1% |

|

Source: IDC Worldwide Quarterly Personal Computing Device Tracker, April 29, 2021 |

|||||

Table Notes:

-

Data is preliminary and subject to change.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted under the company/brand under which they are sold.

-

The “Company” represents the current parent company (or holding company) for all brands owned and operated as subsidiary.

• Chromebook numbers include Notebook PCs running Chrome OS.