Inflation has gripped household budgets and consumer sentiment is on the decline, yet mobile computing demand persists as user behaviors favor hybrid work and tablet shipments continue to outpace pre-pandemic levels, according to a new report by Strategy Analytics.

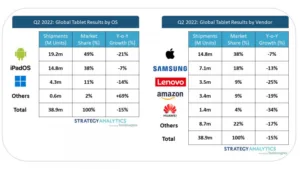

Tablet demand in Q2 2022 followed this pattern of higher shipments for premium and detachable tablets, thus favoring Apple, Windows OEMs, and to some extent, Samsung – pushing Android market share down to 49%. Mounting macro-economic pressures, lower consumer sentiment, the evolving threat of COVID, and a prolonged Russia/Ukraine conflict could turn the second half of the year much more challenging.

Eric Smith, Director – Connected Computing said:

These two factors of inflation and hybrid work create an remarkable dynamic where: 1) wealthy consumers continue spending on premium devices, while average consumers pull back on spending in lower tiers; and, 2) purchases favor detachable tablets to get work done rather than solely serve entertainment needs. All the top vendors now have detachables in their line-ups, spanning implementations on five different operating systems. In order to be successful in this new environment, brands must continue improving tablet hardware and software with the goal of improving user productivity.

Chirag Upadhyay, Industry Analyst added:

Android tablet demand pulled down market performance as all other operating systems outpaced the market decline of -15%. Apple benefitted from a wealthier customer base than Android, but supply issues kept them from reaching even more demand than they did during the quarter. Windows OEMs, led by Microsoft, also performed well as commercial demand is stronger than consumer demand, favoring premium Windows devices. We should also highlight the rising strength of HarmonyOS from Huawei – and the company’s reach into Russia as other top vendors left the market after the invasion of Ukraine – as a factor in siphoning Android demand. Perhaps Android’s fortunes will change with Prime Day in Q3 and year-end promotions in Q4.

- Apple iPadOS shipments (sell-in) fell -7% year-on-year to 14.8 million units in Q2 2022, with worldwide market share climbing 3.3 percentage points to 38% as the vendor outpaced the market

- Samsung led the Android market with a -13% year-on-year decline in Q2 2022 to 7.1 million units; market share increased by 0.2 percentage points to 18% during the same period as this was performance was stronger than the overall market

- Lenovo returned to the third ranking globally in Q2 2022, though shipments fell by -25% year-on-year to 3.5 million units; market share fell -1.3 percentage points during the same period to 9% as competition in North America and EMEA intensified

- Amazon was close behind Lenovo with 3.4 million shipments, registering a -19% year-on-year decline and a -10% sequential decline typical of a pre-Prime Day quarter; accordingly, market share fell -0.5 percentage points to 9%

- Huawei tablet shipments fell year-on-year -34% to 1.4 million units in Q2 2022, which is the company’s best performance in over a year as sanctions and new competitors have fundamentally changed their tablet strategy; market share fell -1.1 percentage points to 4% during the same period

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need.