The growth of MiniLED TVs in the premium segment has been remarkable. When it comes to product competitiveness, sell-through is the key factor. TCL and Hisense are unlikely to face significant challenges in this regard. Even if a QD quality test or rating for TVs were introduced, it would hold little influence because the momentum is driven by sell-through figures rather than concerns over color gamuts.

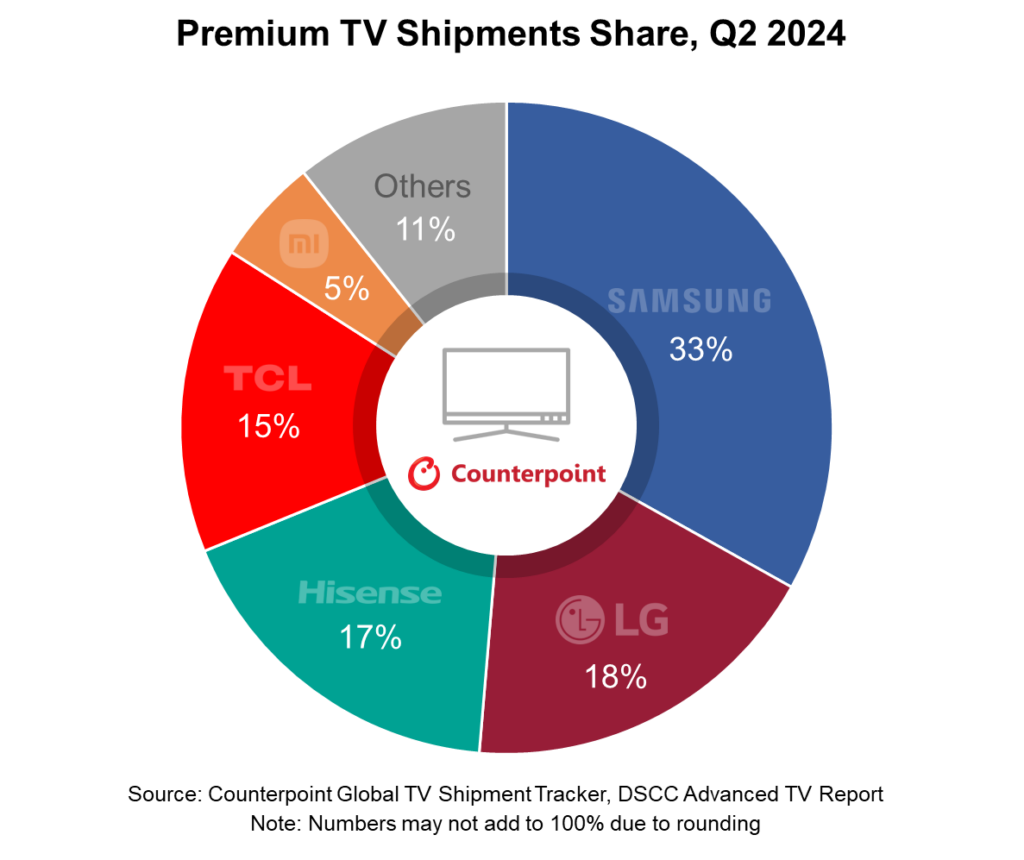

In the premium TV segment, shipments grew by 45% YoY, led by Chinese brands Hisense and TCL. Samsung saw modest growth but experienced a drop in its market share in this segment, falling below 40% for the first time. In response, Samsung expanded its OLED lineup, introducing new 42-inch and 48-inch OLED TVs featuring LG Display’s WOLED panels, building on last year’s release of an 83-inch model. Despite a 21% YoY increase in OLED shipments, their market share remained limited, as MiniLED LCD TVs in the premium segment surged by 69% YoY, surpassing OLED for the first time.

In a sluggish TV industry, Chinese manufacturers are thriving, particularly in the premium segment. As Samsung and LG face increased pressure in this market, they find themselves cornered. This highlights the challenges of branding strategies for products with minimal differentiation on the shelf, where the primary factors are screen size, price, and perceived quality, not actual quality. It’s a “pick two” scenario.

While OLED display reviews are consistently positive, they almost always conclude with a caveat: having an OLED TV or monitor is great—if you can afford it. By the time more consumers are able to invest in premium OLED TVs, Chinese manufacturers will likely be prepared to capture that market as well. There is a window of opportunity for Korea’s display industry to maintain its lead, but it appears to be lacking in options.

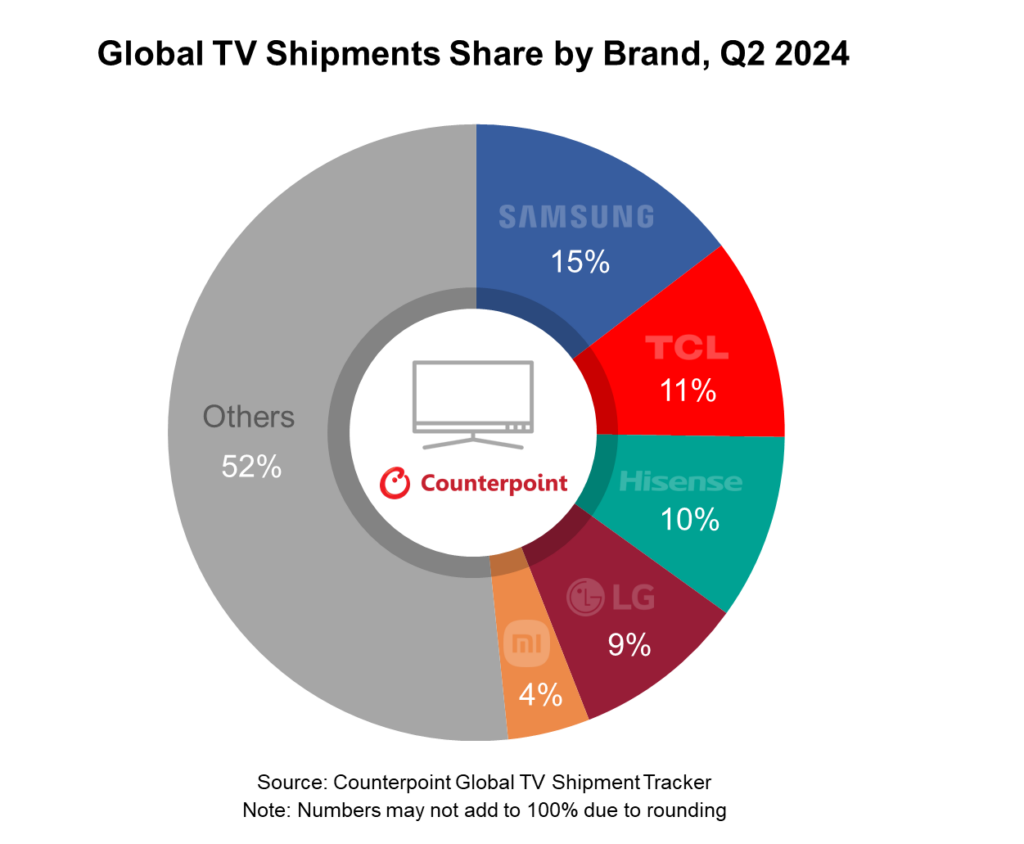

As for the global TV market, shipments grew by 3% YoY in Q2 2024, reaching 56 million units, according Counterpoint Research and DSCC. This marks a recovery after four consecutive quarters of YoY declines. Growth was led by the European market, which saw a 13% increase due to demand ahead of the Paris Olympics, while the Chinese market continued to struggle with saturation.

Samsung maintained its position as the leading brand, although its market share dropped to 15%. Hisense and TCL remained in close competition for second place, with TCL narrowly reclaiming the spot. LG, in fourth place, posted an 8% YoY increase in shipments, driven largely by strong performance in Europe and Paris 2024.

There’s no Olympics or major sporting event to grow the market. DSCC is reporting that LCD panel prices are likely to drop even as Chinese manufacturers look at reducing production to control supply. If there is no fight in the premium segment, there is nothing to fight for in LCD TV. The market is monopolized by Chinese companies, and we may see price drops on a range of display products in the second half of the year. The TV doldrums seem to have no end.