This week, we have published our report on the BETT show which took place at the end of last week and we’ve got into the serious build up for ISE. It’s a busy time of the year and already activity has started for Mobile World Congress. I had a big choice of topics for my editorial this week, but I took my cue from the news.

This week sees the start of the quarterly financial reporting season, so there were reports from three of the key panel makers, LG Display, Samsung and AUO. All had good quarters of profits as demand remained moderately good, but supply didn’t grow, so panel prices have been doing reasonably well.

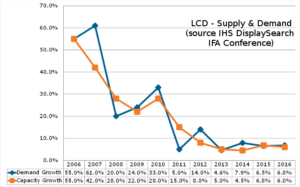

Going forward for the panel business, as DisplaySearch reports on our front page, area growth is heading for a period of steady growth of between 4% and 6% over the next few years. The key question is what will happen to supply.

Traditionally, when panel making has been profitable, panel makers have been able to raise capital to boost investments in increasing the capacity of the industry. The new capacity leads to an oversupply and then profits rapidly evaporate. The top four panel makers, LG Display, Samsung, AUO and Innolux have seen this many times – it’s the well known “Crystal Cycle” which has seen boom and bust cycles multiple times over the years. None of these suppliers is keen to pour money into the ground to build lots more capacity to take market share any more. They are all trying to win more value by focusing on revenues rather than just units or area.

However, there is a new factor in the equation this time, and that is the actions of the Chinese. As Chris and I reported after SID (http://tinyurl.com/mmllcvl), at that event, BOE made strong statements about its ambitions and we have reported on its investment plans for OLED and LCD capacity over the next couple of years several times since. BOE is the fifth biggest panel maker by area, based on its share in notebooks, monitors and TVs. Over the last year, BOE has taken share mostly from LG Display (which, of course, on the back of Apple’s success, has done really well in small and medium panels and got 23% of its revenue from mobile device panels in Q4).

At IFA, David Hsieh of DisplaySearch reported that supply and demand growth should be, broadly in balance this year and that will be tough for set makers as there is limited growth in demand in the key applications, and extra growth will not be possible by simply driving prices down. Samsung and LG are said to be aggressively buying TV panels to ensure they have enough for their TV set businesses, and that will be another obstacle for the rest.

So, the stage looks set for a year of stable pricing for panels, with some tough times ahead for set makers who will be squeezed between consumers that are looking for better and better deals and panel makers who are looking to make profits while they can.

Bob

LCD Supply Demand – Given the time and money that is needed to build capacity, the supply side of this chart should be very accurate and stable