I was thinking about the TV market and it seems to me that we are at something of a turning point for the entire industry. We had a period of good growth, with the arrival of LCD TVs that consumers really wanted to buy. For a short time there was an explosion of brands that wanted to enter the market, few of whom have made it through to today as the dynamics of the LCD supply chain have made the big brands bigger. At the same time, there was a huge battle between the Japanese and European brands that were the traditional ‘A’ brands and the Korean vendors. This battle was particularly fierce between Sony and Samsung.

When we started to track the TV market in detail some seven years ago, Sony was the benchmark for pricing and quality. Even Samsung believed it needed to be cheaper than Sony, and at my first IFA show, a small maker of CRT TVs said to me that his business was very simple. “If my sets cost more than half of Sony, I’m dead”, he told me. Sony, having by its own admission, missed out on the importance of LCD and started to lose market share, especially to Samsung which has done a great job in building its TV brand with new technology, strong marketing and good industrial designs.

Sony’s cost base was too high and differentiation was too small because it had to use the same panels as the rest and eventually, in the spring of last year, Sony sold its factories to Foxconn and started to get much more aggressive on pricing. This forced Samsung to put its prices down and everybody below had to react to that.

The market has been ‘crushed’ because the high end has simply come down too far. Lower brands have been choked of opportunity, caught between the battle of the giants and the almost undifferentiated cost of LCD panels and sets. All LCDs were pretty good and they all, more or less, cost the same. That made it hard to achieve any cost advantages – even the ‘kings of the supply chain’ in Taiwan have been squeezed out of the TV market.

Part of the reason for this lack of differentiation is that, for the end user, there is not that much difference in picture quality between the most expensive and cheapest sets.

It seems to me that we have come to an inflection point. Sony has formally renounced its drive for volume and market share in TV and seems to have settled for being squeezed into a smaller market share. That ought to take pressure off the market and off pricing. There ought to be a chance for prices to stabilise.

OLED, which will be very expensive to start with, will effectively raise the possibility that the high end of the market will be set back to a high level – Samsung’s new ‘luxury’ set, may also help with this. That made me think that there could allow a bit more space for other brands – or even for some profits for TV makers!

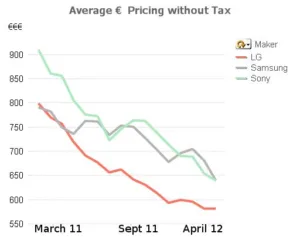

However, looking at the street pricing report from Meko’s DisplayCast service, the trend in pricing seems to be relentlessly down in April. I looked at just LED sets in the 32″ to 46″ segments in the major countries – in fact, Samsung pricing seemed to come down even more than it has in the last year! The question is whether Samsung sees the end of the battle with Sony as the end of a phase in its drive for market share, or whether it now sees LG as its next target. LG was broadly at the same pricing as Samsung a year ago, but brought its pricing down much faster in 2011. So far, it has been relatively stable in 2012, but that, we think, is the stability of ‘the ocean bed’.

So, it seems to me that there is room for a ‘breathing space’ and some profit, but can Samsung change its habits of the last few years? As I have said before, I think that Samsung is getting to the market share that is close to its limit as the sales channels may start to seriously resist further increases.

The period between now and IFA will be fascinating….