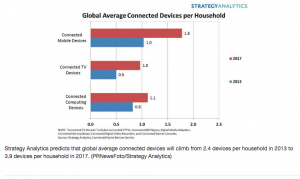

Business and Strategic – Sony TV Group does have some good things going for it, according to Strategy Analytics which tracks global connected devices, including smart TVs, game consoles and media streaming devices.

It seems that Sony leads the pack when it comes to connected TV devices (that includes Sony BD and DVD players) by a surprisingly large margin. Almost one in four connected sets globally (24.8%) carry a Sony brand, and that is an installed base growth in Q2-14 (YoY) of 27.9% for the company, according to numbers from Strategy Analytics’ earlier report.

Strategy Analytics said the market size has grown to one-half Billion (yep 500M connected) fixed devices and the current clip was at 7.0% quarter on quarter (in Q2-2014.) The Sony TV Group is far from alone in this field with 16 brands currently competing for market share, and some of the top rivals are growing at a much faster clip. Korean rivals LG and Samsung, for instance, were reported with an installed base growth of 101.9% and 80.9% in Q2-2014 (year on year), a much faster adoption than Sony’s almost 28% mentioned above. Japanese rivals are also on the quick pace growth curve here, with connected installed base growth for Toshiba (98.8%), Sharp (52.7%) and Panasonic (52.4%) all coming on strong. Other CE brands also booming in the space include Philips (70.0%), Roku (51.9%) and Apple TV (44.7%) global growth in their installed base year on year.

But for Sony, bragging rights of fixed connected devices may seem a bit of a hollow victory in the wake of vanishing corporate profits overall. In particular, its Sony’s Wireless Smartphone business that’s dragging down the other groups, as recently reported by Meko analyst, Pete Putman. He documented Sony’s financial woe’s in a recent Display Daily story stating that the company revised down to $2.14B, (yes a minus $2,140,000,000) its forecast for the current fiscal year (that ends in March 2015.) And the $2B in losses came as a nasty (almost one order of magnitude) surprise from original estimates of $255M with some investors (Pelham Smithers Associates in London) saying, “It’s a bit of a bellwether moment”, and some now crying for Sony to get out of consumer electronics altogether.

Meanwhile, Sony’s TV Group can still hope, as the connectivity trends are on its side. Even though the company has yet to see profits from selling TVs since the CRT Trinitron days, it is riding the digital wired home trend where things continue to change at a rapid clip in the face of cord cutting, and the “cord-never” generation. Last April, FierceCable.com reported that OTT (over the top delivery) on connected TVs is directly linked to cord cutting, “As devices like Roku, Apple TV and Google Chromecast become more common and as televisions themselves are increasingly connected to the internet directly, we should expect to see the number of cord-cutters grow”.

As part of this strategy, in China, Sony is executing a content policy that helps drive its number one connected position. The company announced in August that it was teaming up with Xiaomi Box and Wasu Media for its line of UHD sets. This is all part of the Sony “e-commerce reform” as the company builds its ecosystem by also including Tencent, Baidu Music and Baidu Photo. In China the company expects to sell up to 10M UHD (4K) sets, where it currently claims a 20% market share, according to a China Times report in August, 2014.

Admittedly, Sony is not going to fix all of its problems with connected TV sales, but for the once top brand name that dominated the TV space, it’s nice to see headlines linking the company to the number one slot once again. And in the wake of continued problems (now smartphones) Sony is working to use its brand strength and continues to leverage this in key regions including the US and China. Whether it’s too little too late is still to be determined, we’ll see. – Steve Sechrist