SNL Kagan released the latest report on the US multichannel subscriber report and said that the combined cable, Direct-broadcast-satellite (DBS) and telecommunications (telco) sectors lost 430,000 video customers during the period. DBS ended in positive territory, but telco again weighed heavily on the multichannel universe. Meanwhile, the cable sector continues to show progress in mitigating losses.

For the space, the third-quarter decline brings the year-to-date drop to 1.3 million, which is the the largest ever drop for the first nine months of the year.

Additional highlights from SNL Kagan’s 3rd-quarter U.S. Multichannel Subscriber report include:

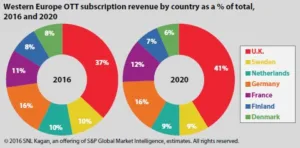

Separately, the company said that the OTT subscription video on demand (SVOD) market in Europe will grow from $2.17 billion to $3.76 billion in 2020, a CAGR of 14.6%. Kagan said that the rate of adoption is lower than in the US because of the lack of localixed content offered by the SVOD services, and partly due to the wide availability of free alternatives.