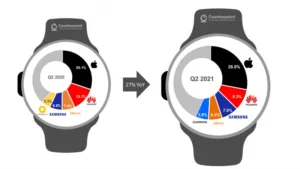

Showing a full recovery from COVID-19, global smartwatch shipments in the second quarter of this year increased 27% compared to the same period last year, according to Counterpoint Research’s recently published Global Smartwatch Model Tracker.

Apple maintained its solid No. 1 position in terms of shipments, but its market share declined slightly compared to the same period last year due to intensifying competition with Chinese and Indian brands. Among the global Top 5 smartwatch OEMs, Samsung and Garmin showed a remarkable shipment growth of 43% and 62% YoY, respectively, exceeding the average market growth rate and recording higher growth rates than other top brands.

Thanks to the steady popularity of the Galaxy Watch 3 and Watch Active 2, Samsung showed a quick recovery from last year’s somewhat sluggish performance. Garmin recorded its highest shipments ever during the quarter. Among the Top 5 brands, only Huawei fell compared to the same period last year. The decline in its smartphone business seems to have affected its smartwatch sales, as the smartwatch from such a vertical player is tightly optimized with the brand’s smartphones and the users’ loyalty to the brand’s ecosystem of offerings.

Shipments of Global Top 5 Smartwatch OEMs: Q2 2021 vs Q2 2020

Apple Watch active user base crosses 100 million; sub-$100 segment grows 547% YoY

Commenting on the smartwatch market outlook, Senior Analyst Sujeong Lim said, “The smartwatch attach-rates for smartphones have been steadily rising. Apple’s ecosystem is seeing a greater attach rate as the brand continues to bake in attractive designs, health features and related services around it. Apple Watch’s user base crossed the 100-million mark for the first time during the quarter ended June, capturing the lion’s share of the smartwatch user base globally. The US continues to be the key Apple Watch market, contributing to more than half of its user base, with an attach rate of close to 30%.”

Lim added, “Looking at the success of Apple Watch, more OEMs have entered the smartwatch market with a relatively less advanced OS but comparable fitness and health-related features, and stylish designs at affordable prices targeting hundreds of millions of potential users globally. The pandemic has further pushed consumers towards being more health-conscious and features such as SPO2 and heart rate monitoring have trickled down to the sub-$100 smartwatch segment. The sub-$100 smartwatch segment grew a massive 547% annually, highlighting its mass-market reach.”

North America largest, India fastest growing market

China, the second largest market after North America, grew in terms of volume but its growth rate was somewhat lower than that of other regions, and its share by region decreased. As seen in the smartphone market, the recovery of consumer spending here after the pandemic has been slower than in other regions. Also, the space vacated by Huawei–HONOR in China is yet to be filled.

Commenting on high growth markets, Senior Analyst Anshika Jain said, “India was the smallest market in the second quarter of last year, accounting for less than 2% of the total market, but its share increased to 6% in just one year. The proliferation of sub-$100 affordable, feature-rich smartwatches from Chinese brands such as Xiaomi, realme and OPPO, and Indian brands such as boAt and Noise has been one of the key growth drivers.”