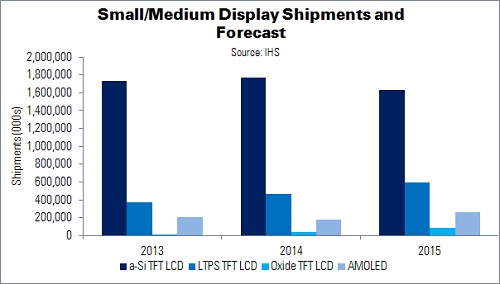

Continued increases in smartphone display performance is leading to rising demand for high-resolution panels with low power requirements – which are not supported by common a-Si backplanes. Worldwide shipments of sub-9″ a-Si TFT LCD panels will fall 7% YoY in 2015, says IHS, to 1.6 billion units, because of this. At the same time, AMOLED panel production will rise 44%, to 260 million units.

There will be a growing shift away from a-Si TFT LCD panels and towards LTPS/oxide TFT LCD and AMOLED units, said Hiroshi Hayase of IHS. Production of these latter panel types will begin to accelerate next year.

IHS’ latest data shows that a-Si TFT LCD will continue to lead flat panel display growth overall. However, the rise of smartphones has also caused demand for simple function applications using these displays – feature phones, digital still cameras, portable games and so on – to erode.

“The smartphone performance revolution requires much higher displays resolution and lower power consumption, which at this time can only be supported by LTPS TFT LCD, oxide TFT LCD and AMOLED technologies”, said Hayase.

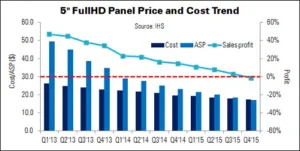

IHS also released its data on smartphone panel prices recently. A continued fall in smartphone panel ASPs has forced display makers to focus on new ways to lower production costs, in order to maintain profit margins. IHS says that 5″ 1920 x 1080 panel shipments fell 34% YoY in 2014, and prices also fell while manufacturing costs were only down 14%. If these trends continue, these panels will cost more to produce than they can be sold for by the end of the year.

IHS also released its data on smartphone panel prices recently. A continued fall in smartphone panel ASPs has forced display makers to focus on new ways to lower production costs, in order to maintain profit margins. IHS says that 5″ 1920 x 1080 panel shipments fell 34% YoY in 2014, and prices also fell while manufacturing costs were only down 14%. If these trends continue, these panels will cost more to produce than they can be sold for by the end of the year.

“Growing numbers of panel makers are increasing their production allocations; however, in the current smartphone market, only mainstream and low-end products show any demand growth at all. Manufacturers are therefore looking at cost-saving measures, in order to bolster their bottom lines”, said IHS’ Jimmy Kim.

Some panel makers are replacing LTPS substrates with oxide technology. Others are reducing costs by introducing multi-chip LED packages; RAM-less driver ICs; composite optical sheets; and other cost-effective component solutions.

Although premium smartphone panels are approaching the saturation point, some panel vendors are still expected to increase their smartphone capacity allocation this year. Demand for mainstream and low-end units is still growing – although any capacity increases will add pressures to even lower prices for these products.