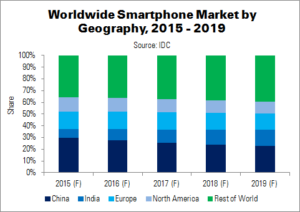

2015 will be the first-ever full year of single-digit smartphone growth, according to IDC. The firm forecasts 9.8% growth YoY, to a total of 1.43 billion units. This is a revision from IDC’s previous prediction (see comments in Q2 Smartphone Growth Was ‘Slowest Since 2013’), based on the slowing performance of the APACxJ, LATAM and Western Europe regions. Growth is expected to continue to slow between 2015 and 2019, due to lower shipment forecasts for Windows Phone and ‘alternative’ (non-Android/iOS/Windows) platforms.

The economic slowdown in China has lowered growth figures worldwide, due to the sheer size of the market. However, IDC now classifies China as as a replacement market, and expects shipment growth in the low single digits. The MEA region will experience the highest growth, of almost 50% YoY.

Maintaining smartphone momentum will depend on several factors, says IDC’s Ryan Reith: “The main driver has been and will continue to be the success of low-cost smartphones in emerging markets. This, in turn, will depend on capturing value-oriented first-time smartphone buyers as well as replacement buyers. We believe that, in a number of high-growth markets, replacement cycles will be less than the typical two-year rate, mainly because the components that comprise a sub-$100 smartphone simply do not have the ability to survive two years. Offering products that appeal to both types of buyers at a suitable price point will be crucial to maintaining growth and vendor success”.

Anthony Scarsella, research manager on IDC’s mobile phones team, expects consumers to look at affordable high-value handsets, as well as financing options on more expensive models. Vendors, meanwhile, will seek to promote device financing and trade-in options across developed markets. Growth in these regions is expected to mainly come from replacement purchases and second devices. Apple’s iPhone Upgrade Programme has given the vendor a head start, and competitors are expected to follow in the coming months.

| Worldwide Smartphone Forecast by OS (Millions) | |||||||

|---|---|---|---|---|---|---|---|

| Vendor | 2015 Unit Shipments | 2019 Unit Shipments | 2015 Share | 2019 Share | 2015 YoY Change | 2019 YoY Change | 5-Year CAGR |

| Company 1 | 1,161.1 | 1,538.1 | 81.2% | 82.6% | 9.5% | 4.8% | 7.7% |

| Company 2 | 226.0 | 263.4 | 15.8% | 14.1% | 17.3% | 3.1% | 6.5% |

| Company 3 | 31.3 | 43.6 | 2.2% | 2.3% | -10.2% | 11.4% | 4.5% |

| Company 5 | 11.3 | 17.1 | 0.8% | 0.9% | -16.8% | 6.5% | 4.7% |

| Total | 1,429.8 | 7.0 | 100.0% | 100.0% | 9.8% | 4.7% | 7.4% |

| Source: IDC | |||||||

Android continues to lead the market, with share expected to grow slightly (from 81% to 82%) between 2015 and 2019. No ‘alternative’ platforms have proved successful. The spread of the core Android platform is expected to continue, with companies like Xiaomi making efforts to differentiate themselves. Some form of the OS will lead the market for the foreseeable future.

Based on continued consumer demand for the sixth generation iPhone models, IDC has raised its Q4’15 prediction by 7.6%. iOS market share is predicted to remain between 14% and 15%, with spikes around product launches. Most of Apple’s core markets have now become replacement markets, so the company’s move to the trade-in space is not surprising. There could be a challenge in two-three years with excess inventory in developing markets, into which refurbished iPhones are being sold.

Despite Microsoft’s best efforts with Windows 10, IDC does not expect Windows’ share of the smartphone market to grow significantly in the coming years. ASP of Windows Phones will be $148: $71 lower than Android’s $219, due to the push into the low-end mass market. While this helped to drive shipments to almost 35 million in 2014, IDC forecasts a YoY decline of 10.2% this year, and a further fall in 2016. The weak results are largely due to a lack of support from OEM partners.