Worldwide smartphone sales in Q2 rose 13.5% YoY, to 330 million units – the slowest growth recorded since 2013, according to Gartner. While demand for low-cost units continued to drive emerging markets, overall sales remained mixed on a regional perspective. The fastest-growing regions were emerging APAC (excluding China), Eastern Europe and MEA. However, sales in China fell for the first time YoY, down 4%.

China is the world’s largest smartphone market, taking a 30% market share in Q2. “[The country’s] poor performance negatively affected the performance of the mobile phone market in the second quarter”, said Gartner’s Anshul Gupta. “China has reached saturation — its phone market is essentially driven by replacement, with fewer first-time buyers. Beyond the lower-end phone segment, the appeal of premium smartphones will be key for vendors to attract upgrades and to maintain or grow their market share in China”.

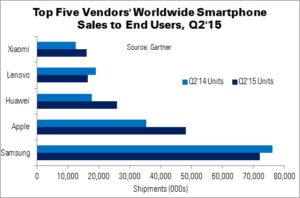

Although Samsung maintained its first-place spot in the worldwide market, the company’s premium phones continued to be challenged by Apple’s large-screen iPhones. Samsung’s share dipped 4.3 percentage points, while its sales fell 5.3%. Huawei, with 46.3% growth, recorded the highest sales increase, thanks to strong sales overseas and of 4G products in China. Apple’s share rose 2.4 percentage points, thanks to a 36% rise in iPhone sales. Strong replacement demand was seen in emerging and mature markets – particularly China, where iPhone sales rose 68% (to 11.9 million units).

Apple’s double-digit growth continued to have an impact on rivals’ premium phone sales and profit margins. ‘Many’ vendors had to realign their portfolios to remain competitive in the mid-range and low-end markets. These moves led to price wars and discounting.

| Worldwide Smartphone Sales to End Users by Vendor, Q2’15 (000s) | ||||

|---|---|---|---|---|

| Vendor | Q2’15 Units | Q2’14 Units | Q2’15 Market Share | Q2’14 Market Share |

| Samsung | 72,072.5 | 76,129.2 | 21.9% | 26.2% |

| Apple | 48,085.5 | 35,345.3 | 14.6% | 12.2% |

| Huawei | 25,825.8 | 17,657.7 | 7.8% | 6.1% |

| Lenovo | 16,405.9 | 19,081.2 | 5.0% | 6.6% |

| Xiaomi | 16,064.9 | 12,540.8 | 4.9% | 4.3% |

| Others | 151,221.7 | 129,630.2 | 45.9% | 44.6% |

| Total | 329,676.4 | 290,384.4 | 100.0% | 100.0% |

| Source: Gartner | ||||

In OS terms, Android continued to lead the global market, but was affected by the slowdown in China, as well as Apple’s strong performance in the country. Share rose just 11%, to 82.2%. Microsoft continued to struggle to create demand for Windows Phone handsets, even at the lower end. Gupta said, “In light of Microsoft’s recent cuts in its mobile hardware business, we’ll await signs of its long-term commitment in the smartphone market”.

| Worldwide Smartphone Sales to End Users by Operating System, Q2’15 (000s) | ||||

|---|---|---|---|---|

| Operating System | Q2’15 Units | Q2’14 Units | Q2’15 Market Share | Q2’14 Market Share |

| Android | 271,010 | 243,484 | 82.2% | 83.8% |

| iOS | 48,086 | 35,345 | 14.6% | 12.2% |

| Windows | 8,198 | 8,095 | 2.5% | 2.8% |

| Blackberry | 1,153 | 2,044 | 0.3% | 0.7% |

| Others | 1,229 | 1,417 | 0.4% | 0.5% |

| Total | 329,676 | 290,385 | 100.0% | 100.0% |

| Source: Gartner | ||||

In total, 446 million mobile phones (smartphones and feature phones) were sold worldwide in Q2. This is a flat YoY result (up 0.4%). Vendors focusing on emerging regions, such as Huawei, ZTE and Micromax, benefited from high demand. Global vendors, such as Sony, Samsung and HTC, struggled to achieve growth at the high end.

Analyst Comment

Shortly after Gartner released its figures, IDC announced its smartphone predictions for 2015. Like Gartner, the firm expects the Chinese slowdown to have a significant effect on the market.

10.4% YoY shipment growth is predicted (to 1.44 billion units) – lower than IDC’s earlier original forecast of 11.3%. However, shipments in China are expected to grow at just 1.2%, down from 19.7% in 2014. The country will remain the world’s largest smartphone market, but its share will fall to 23.1% by 2019. India is now perceived as the market with the highest growth potential.

Operating system figures were roughly the same as Gartner’s. IDC expects Android’s share to remain at around 81% to 2019. The markets with the highest growth potential are very price-sensitive, so Apple will face a challenge to take share from Android over the period – even if it were to introduce another low-cost iPhone. Android shipments will rise from 1.06 billion in 2014 to 1.54 billion in 2019. iOS will grow from 192.7 million to 269.6 million. Windows will remain marginal.

On the device front, 5.5″ – 7″ handsets (phablets) will continue to drive shipment volumes. Similar results are seen in the tablet market, with hybrid devices (Microsoft Enters Tablet Top Five). Demand for these units is at a record high. IDC expects shipments of 5.5″ – 6″ smartphones to grow 84% this year. Phablets will have an overall shipment share of 71% by 2019. (TA)