The tablet market in Western Europe stabilised in Q2, says IDC, with shipments falling 1.2% YoY to 7.5 million units. This was a significantly better result than the 10.5% shipment fall in Q1. The result was the smallest decline since the downturn – caused by weak consumer demand and increasing interest in hybrid devices for business use – began last year. The fall in tablet shipments stabilised at 4.4%, while hybrid devices grew 71%.

Despite the relatively high sales growth, hybrid device volumes remained low. However, demand is increasing. In Q2, these products had a 7.3% share of the total tablet market in Western Europe. Growth was driven by increasing consumer and commercial demand, as well as an increased supply of new models and market entrants.

Marta Fiorentini, senior research analyst at IDC, said, “The most notable new 2-in-1 model is probably the Microsoft Surface 3, a smaller and more affordable version of Surface Pro 3, but other new 2-in-1s were introduced by well-established international players as well as several local or sub-regional vendors. The latter not only contributed to broaden the 2-in-1 offering but, thanks to the strength of their brand at a local level and the usually lower price points of their products, also helped boost the volume of the market for detachable devices, where their share jumped sequentially from below 1% to over 4%. Local and sub-regional vendors continued to play a key role in the tablet market, as their shipments contributed to some stabilisation of the market”.

The tablet vendor landscape was largely unchanged, with Samsung and Apple continuing to dominate. However, the growth of local vendors means that the market is still evolving. Traditional smartphone makers, such as Huawei and Alcatel, have also been steadily making progress.

The commercial market was described as ‘ a silver lining’ for tablets. Shipments rose more than 50% YoY. While commercial adoption varies significantly by country, demand appears to be solid for both tablets and hybrid devices. Slate tablets tend to be preferred for specific vertical functions, while detachables are favoured amongst larger companies and in education. Hybrid models still have a marginal presence compared to portable PCs, however.

“Unlike the PC market, which has gone through a consolidation phase, the tablet market seems to be undergoing a share redistribution phase, with country or sub-regional champions increasingly able to capture local demand”, said IDC research manager Chrystelle Labesque. Smaller players have been able to capture specific local demands or segment needs, at the expense of large vendors.

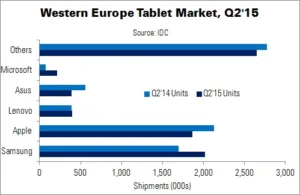

Samsung posted double-digit shipment growth in Q2, thanks to ‘good’ demand for several flagship models and a favourable YoY comparison. Apple lost a few percentage points, owing to slow replacements of existing devices. Growth flattened at Lenovo, as the good response to its Windows products offset weak Android demand. Asus’ shipments contracted sharply, as the vendor prepares for a product range renewal. Microsoft entered the top five thanks to good take-up of the Surface Pro 3 and Surface 3.

The top five vendors accounted for two thirds of the market. The remaining vendors showed varying performances; their combined share fell 4.4% YoY but rose 5.4% QoQ.

| Western Europe Tablet Market, Q2’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’15 Units | Q2’14 Units | Q2’15 Market Share | Q2’14 Market Share | YoY Change |

| Samsung | 2,015 | 1,696 | 26.8% | 22.3% | 18.8% |

| Apple | 1,867 | 2,125 | 24.8% | 27.9% | -12.2% |

| Lenovo | 394 | 393 | 5.2% | 5.2% | 0.2% |

| Asus | 388 | 556 | 5.2% | 7.3% | -30.1% |

| Microsoft | 213 | 74 | 2.8% | 1.0% | 187.5% |

| Others | 2,650 | 2,773 | 35.2% | 36.3% | -4.4% |

| Total | 7,528 | 7,617 | 100.0% | 100.0% | -1.2% |

| Source: IDC | |||||