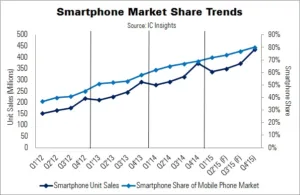

Smartphone sales are still an important driver for the global integrated circuit market, according to IC Insights. These devices are rapidly gaining share in the overall mobile phone market – taking 50% of shipments in Q1’13. Smartphones are expected to have 80% of the mobile phone market by Q4’15 (435 million units). By 2018, they will represent 93% of the market.

In contrast, feature phone shipments fell 18% in 2013 and 23% in 2014. IC Insights expects the 2015 decline to be even steeper: 27%. Meanwhile, the total mobile phone market is expected to grow only 3% this year, after 5% growth in 2014.

The smartphone market has been dominated by Samsung and Apple for the last two years. These companies shipped 457 million smartphones between them in 2013, with a compared share of 47%. This climbed to almost 504 million in 2014; however, combined share fell to 40%. IC Insights believes that both companies are losing share to new market entrants from China, such as Xiaomi, Yulong and TCL.

While smartphone sales faltered at Nokia, Blackberry and HTC in 2013/2014, other companies are enjoying fast gains. Sales from Lenovo, Huawei, Xiaomi, Yulong/Coolpad and TCL have surged. Combined, the top six Chinese smartphone makers shipped 359 million smartphones last year: a 79% YoY rise. As a result, they had a combined market share of 29%; up eight points from 2013.

There have been several reports of China’s slowing smartphone market this year. In total, the top six Chinese firms – which mostly sell to Chinese customers – sold 83.4 million smartphones in Q1’15, taking a 25% share of the global market.

Many Chinese smartphone makers produce budget units for between $50 and $200. IC Insights expects the majority of market growth to come from emerging nations in the near future, so these low-cost products are forecast to be a driving force.