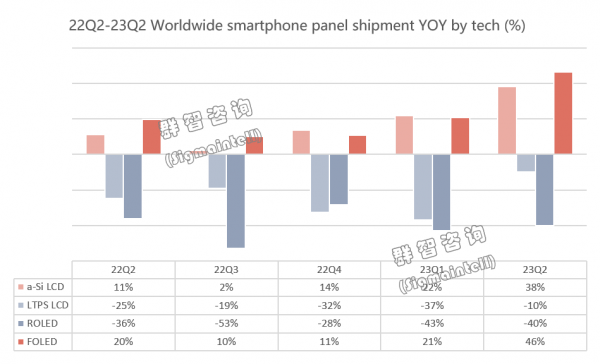

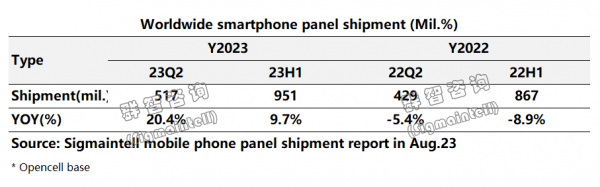

China’s Sigmaintell is reporting a significant year-on-year (YoY) increase of around 9.7% in global smartphone panel shipments for the first half of 2023, reaching approximately 950 million units. The normalization of inventory levels in some brands has helped lead to active stockpiling in the South China market. As for panel technology, a-Si LCD and flexible OLED panel shipments experienced growth, while mid-end LTPS LCD and rigid OLED panels faced a decline in demand and shipments.

Digging deeper into the specific technologies, a-Si LCD panel shipments stood out with approximately 520 million units, surpassing expectations due to low prices and stocking by Chinese phone manufacturers. This marked a notable YoY increase of about 30.6%. LTPS LCD shipments encountered a decline in demand, totaling around 150 million units, reflecting a decline of about 24.2% compared to the previous year. Flexible OLED shipments continued to show promise, achieving a YoY increase of approximately 32.8%, driven by their incorporation into mid-range smartphone models.

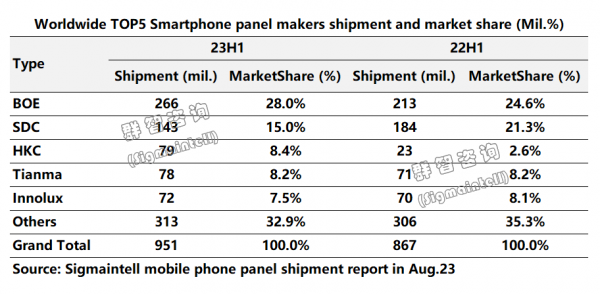

Sigmaintell’s data shows BOE and Samsung Display (SDC) as the frontrunners. BOE secured the top position by shipping around 270 million smartphone panels, capturing a notable 28.0% market share. This growth was attributed to robust shipments of a-Si LCD and flexible OLED panels. Samsung Display (SDC) held the second position, shipping about 140 million OLED smartphone panels, commanding a 51.1% share in the OLED smartphone segment. Despite a decline in rigid OLED shipments, the company’s flexible OLED technology maintained a strong foothold. HKC was in third place, shipping nearly 79 million pieces.

Regionally, mainland China witnessed impressive growth, shipping about 120 million OLED panels, marking a substantial YoY increase of 74.1%. This surge in shipments was attributed to the increased production capacity of domestic OLED panel factories and aggressive marketing strategies. Notably, mainland China’s market share of smartphone OLEDs exceeded 40%, reflecting a significant rise in its influence.

Looking ahead, however, the smartphone panel market is expected to remain turbulent. Despite short-term rebounds, sustained recovery in the consumer market remains uncertain. Panel manufacturers are advised by Sigmaintell to avoid hasty price reductions, nevertheless. Instead, they should focus on stabilizing prices and invest in continuous technological innovation to enhance product competitiveness and retain customer loyalty.