Worldwide smartphone shipments declined 9.7% year over year to 301.9 million units in the third quarter of 2022 (3Q22), according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. The drop marks the largest-ever third quarter decline and the fifth consecutive quarter of decline for the smartphone market as shipments continue to struggle amidst weakened global demand and economic uncertainties.

“A majority of the decline came from emerging markets where lack of demand, rising costs, and inflation impacted consumers with lesser disposable incomes,” said Nabila Popal, research director with IDC’s Worldwide Tracker team. “With high inventory coming into the quarter, shipments and orders by OEMs were further reduced in an attempt to deplete inventory. Although Chinese vendors continue to suffer the most, all vendors were impacted, including Samsung and Apple. While Apple is the only vendor to deliver positive growth this quarter, it still faced challenges as its growth was stunted in many markets, including China, due to the poor macroeconomic situation. Looking to 2023, the market’s expected recovery, which we continue to believe will happen, will be pushed further into the year. Moreover, we now expect a steeper shipment decline for 2022 and a softer recovery in 2023.”

From a regional standpoint, all regions except for Central and Eastern Europe are expected to decline in 3Q22 and for the entire year. Previous expectations for China should remain relatively unchanged at a decline of just over 12% for the quarter. Given the size of China, that has a significant impact on the global results. Developed markets like North America, Western Europe, and Japan will do moderately better, but this still implies low to mid-single-digit declines. Emerging markets in Asia/Pacific, Latin America, the Middle East, and Africa should see a more significant double-digit declines.

“We’re seeing some unique dynamics unfold across the globe regarding smartphone sales,” said?Ryan Reith, group vice president with IDC’s Worldwide Mobile and Consumer Device Trackers. “Developed markets that often sell more premium devices are faring better than emerging markets where smartphones sell for a fraction of the cost. We believe this is largely supported by the expansion of installment plans offered through telcos, retail channels, and even direct from vendors. Promotional activity around trade-in offers also supports that shift. However, as we look toward next year and beyond, if the global market is going to grow, it will need a strong recovery in emerging markets to make that happen.”

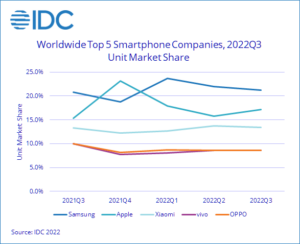

Despite the challenging environment, vendor positioning did not change from last quarter. Samsung held the top spot with a 21.2% share, Apple came in second with a 17.2% share, while Xiaomi came in third with a 13.4% share. vivo and OPPO ended the quarter tied* for the fourth position, each with 8.6% share. Except for Apple, all the top vendors suffered year-on-year declines. However, while Samsung and Xiaomi registered single-digit declines, vivo and OPPO continued to suffer high double-digit decreases.

Top 5 Companies, Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q3 2022 (Preliminary results, shipments in millions of units) |

|||||

|

Company |

3Q22 Shipments |

3Q22 Market Share |

3Q21 Shipments |

3Q21 Market Share |

Year-Over-Year Change |

|

1. Samsung |

64.0 |

21.2% |

69.5 |

20.8% |

-7.8% |

|

2. Apple |

51.9 |

17.2% |

51.1 |

15.3% |

1.6% |

|

3. Xiaomi |

40.5 |

13.4% |

44.3 |

13.3% |

-8.6% |

|

4. vivo* |

25.9 |

8.6% |

33.3 |

10.0% |

-22.1% |

|

4. OPPO* |

25.8 |

8.6% |

33.2 |

9.9% |

-22.3% |

|

Others |

93.6 |

31.0% |

102.7 |

30.7% |

-8.8% |

|

Total |

301.9 |

100.0% |

334.2 |

100.0% |

-9.7% |

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, October 27, 2022 |

|||||

Notes

* IDC declares a statistical tie in the worldwide smartphone market when there is a difference of 0.1% or less in the share of revenues or shipments among two or more vendors.

• Data are preliminary and subject to change.

• Company shipments are branded device shipments and exclude OEM sales for all vendors.

-

The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

-

Figures represent new shipments only and exclude refurbished units.