According to the latest results from the International Data Corporation (IDC) Worldwide Smartphone ODM Qview, smartphone ODM/EMS assembly shipment volumes increased 7.6% quarter over quarter during the third quarter of 2019 (3Q19) with total shipments of 358 million units. The increase was largely the result of tier-one vendors moving quickly into lower-priced markets worldwide.

“With downstream tier-one brand vendors aggressively developing the lower price segment of worldwide markets, the first-tier ODM and EMS smartphone manufacturers enjoyed increases in shipments,” said Sean Kao, senior research manager with IDC’s Worldwide Smartphone ODM Research. “An increasing percentage of the world’s smartphone production is concentrated within the top 10 smartphone assembly manufacturers and, as a result, the percentage of the market this group owns increased from 74.3% in 2Q19 to 78.8% in 3Q19.”

In order to get a cost advantage for low-tier product lines and to keep internal R&D resources for 5G smartphones, Samsung, LG, Nokia, and OPPO are increasing ODM percentages. First-tier Chinese ODMs such as Wingtech, Huaqin, and Longcheer will become critical actors in the competitive dynamics of the worldwide smartphone industry in the near future.

|

Worldwide Top 5 Smartphone Assembly Vendors’ Shipment Volume Ranking, 2015 – 3Q2019 |

|||||||

|

2015 |

2016 |

2017 |

2018 |

1Q19 |

2Q19 |

3Q19 |

|

|

1 |

Samsung |

Samsung |

Samsung |

Samsung |

Samsung |

Samsung |

Samsung |

|

2 |

Foxconn |

Foxconn |

Foxconn |

Foxconn |

Foxconn |

Foxconn |

Foxconn |

|

3 |

Pegatron |

OPPO |

OPPO |

OPPO |

Flex |

VIVO |

VIVO |

|

4 |

LG |

Pegatron |

VIVO |

VIVO |

VIVO |

OPPO |

BYD |

|

5 |

Huaqin |

VIVO |

Pegatron |

Pegatron |

OPPO |

Huaqin |

OPPO |

|

Source: IDC Worldwide ODM & Display Industry Research Group, November 2019 |

|||||||

Notes: The ranking on this list is based on complete knock-down (CKD) assembly, which includes in-house assembly but excludes design without assembly.

Looking ahead, IDC expects smartphone ODM/EMS assembly volumes to increase in the fourth quarter of 2019 due to rising demand in the upcoming hot season and the launch of 5G SoC chip smartphones.

IDC Worldwide ODM & Display Industry Research

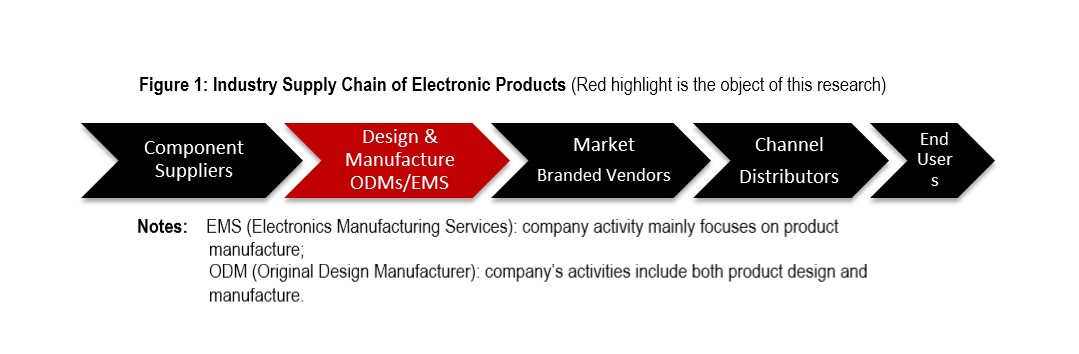

The object of IDC’s Worldwide ODM & Display Research is the compilation of manufacturers who provide ODM and EMS services to their clients – branded vendors. The ODM/EMS manufacturers are in the upstream of the industry supply chain, as indicated by the red mark in the figure below. ODM/EMS manufacturers include Foxconn, Huaqin, Compal, Quanta, Compal, Wistron, and others. Their clients are branded or white-box vendors, such as Apple, Amazon, Lenovo, Huawei, Oppo, and others.