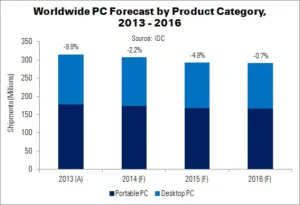

PC shipments worldwide will fall by 4.9% YoY in 2015, says IDC, which has revised its previous forecast down from a 3.3% fall. At the same time, growth predictions for 2016 and 2017 were raised slightly.

In Q4’14, PC results were 1.7% ahead of IDC’s forecast. Total 2015 volume is expected to reach 293.1 million units, falling to 291.4 million by 2019. In value terms, the market was worth $201 billion in 2014 (a 0.8% fall), and is expected to decline 6.9% this year. Small declines in the following years will bring market value to $175 billion by 2019.

There were real demand improvements in the second half of 2014 in some market areas, but IDC believes that the more positive Q4’14 result was the result of inventory build-up. It is thought that retailers were stocking up on ‘Windows 8.1 Plus Bing’ systems ahead of Microsoft lowering subsidies in 2015.

A short-term impact of the above is expected to affect consumer channels, as they seek to clear stock. Average prices are likely to rise in the near future, due to subsidy scale backs, the strong US dollar (making systems more expensive overseas) and the continued shift to slim, convertible and touch-based PCs. In addition, IDC believes that OEM product updates and consumer demand will be delayed until the end of 2015, due to the release of Intel’s Skylake platform and Microsoft’s Windows 10.

Emerging markets are especially struggling, ending last year with shipments down 9.5%. 2015 growth projections are for a 4.7% fall. Spending in these regions has been limited by political instability, commodity pricing pressures and currency devaluations. Additionally there has been competition from other devices, such as mobiles and wearables. Although emerging regions are expected to see positive growth in 2017, shipment estimates will remain below 160 million units through 2019 – down from 163.7 million last year.

Mature regions are expected to fare better, having ended 2014 at 8.4% growth – the first positive result since 2010. XP system replacements; slowing tablet demand; and aggressive PC pricing supported the result. Despite this, IDC expects shipments to fall 5.1% YoY in 2015, followed by incremental declines in coming years. IDC has revised its previous forecast up slightly, and now expects 134 million units to be shipped to mature regions in 2019, up from 130 million.

| PC Shipments by Region and Product Category (Shipments in Millions) | ||||

| Region | Product Category | 2014 (A) | 2015 (F) | 2016 (F) |

| Emerging Markets | Desktop PC | 80.4 | 76.8 | 75.2 |

| Portable PC | 83.2 | 79.1 | 83.7 | |

| Total PC | 163.7 | 156.0 | 159.0 | |

| Mature Markets | Desktop PC | 53.4 | 48.7 | 45.8 |

| Portable PC | 91.1 | 88.4 | 86.7 | |

| Total PC | 144.5 | 137.1 | 132.5 | |

| Worldwide | Desktop PC | 133.8 | 125.5 | 121.0 |

| Portable PC | 174.3 | 167.5 | 170.4 | |

| Total PC | 308.1 | 293.1 | 291.4 | |

| Source: IDC | ||||

Windows 10, to be introduced later this year, is expected to be well-received and support the Windows ecosystems. It will also provide a better mouse-and-keyboard experience, relieving some pressure to move towards touch, and support non-PC devices like convertibles – likely without significantly boosting total PC shipments.

Loren Loverde, VP of worldwide PC trackers at IDC, said, “The gains in mature regions for 2014 helped stabilise the market, but any opportunity for long-term growth depends on reviving growth in emerging regions, and that seems unlikely with the shift toward mobile devices…Even including 2-in-1 systems would only boost the compound annual growth rate for total PC shipments through 2019 from -1.1% to 0.5%. Vendors can focus on growth segments of the PC market such as AIO, slim and convertible PCs, or consolidate share, but pressure on pricing and from competing devices will continue to make it a challenging market”.

Analyst Comment

Bob O’Donnell once of IDC but now of TECHnalysis Research is more positive than this and expects just 1% or so drop this year. Other commentators have pointed out that there are two schools of thought on PC forecasts – there are those that see the more negative results as “normal”, while better quarters are the exception, and others who see the positive quarters as “normal”, with the negative ones the real variations! (BR)