According to IHS Markit, despite there being a slight downward trend in the first quarter of 2017, the semiconductor industry achieved near record growth in the second quarter, with a 6.1% growth compared to the previous quarter, Global revenue increased to $101.4 billion, which was up from $95.6 billion in the first quarter. According to IHS Markit, this represents the highest growth the industry has seen in the second quarter since 2014.

Another record growth in the second quarter was for the memory chip market, growing 10.7% to a new high of $30.2 billion with DRAM growing 14% and NOR flash memory growing 12.3%.

In terms of revenue, consumer electronics grew 7.9% and data processing saw an increase of 6.8%, possibly attributed to the continual growth in memory pricing, as supply still remains tight.

Industrial semiconductors showed the third highest growth rate at 6.4%, attributable to multiple segments, such as commercial and military avionics, digital signage, network video surveillance, HVAC, smart meters, traction, PV inverters, LED lighting and medical electronics including cardiac equipment, hearing aids and imaging systems.

Increasing factory automation, which alone is driving growth for discrete power transistors, thyristors, rectifiers and power diodes, is expected to reach $8 billion in 2021, up from $5.7 billion in 2015.

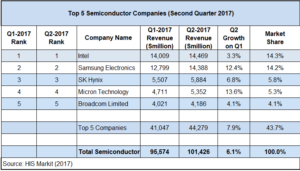

Intel remains the number one semiconductor supplier in the world, closely followed by Samsung Electronics and SK Hynix. Among the top 20 semiconductor suppliers, AMD and nVidia achieved the highest revenue growth by 24.7% and 14.6% respectively. There was no market share movement in the top 10 semiconductor suppliers. However, seven of the 10 companies in the 11 to 20 market share slots did change market share.

IHS Markit does not include foundry operations and other non-semiconductor revenue in the semiconductor market rankings.

Top Semiconductor Suppliers Q1 and Q2 2017 – IHS Markit

Analyst Comment

There were expectations that Samsung might go past Intel this quarter to become the biggest supplier in the market. In the end, the companies were close enough to effectively be a ‘dead heat’, as the results were close enough for the difference to be in the margin of error for market research. However, as a researcher, you would have to be very confident of the result to depose Intel from top position after its many years at the top! One of the key reasons for the high revenues is the high price of memory at the moment. A downturn in the price of memory would see Samsung dropping back. (BR).