The Global Pay TV Innovation Landscape Industry 2017 Research

Nagra, in partnership with the research consultancy MTM, have published the final conclusions of the 2017 Pay-TV Innovation Forum. The global research programme examined the state of innovation in the pay-TV market and provides perspectives on the most attractive areas of opportunity for both service providers and content owners in Europe, Asia Pacific, Latin America and North America.

For this current year, the pay-TV industry is in a period of unprecedented global change, with many service providers facing slowing growth and more competition and threats to their business models. 82% of executives agree that competition is set to increase over the next five years, and 71% believe that during this period, service providers will struggle to grow their businesses.

The research also identified that the proliferation of cheaper OTT services, changing consumer behaviour and demand, and the rise of content piracy are challenging the industry. Some 67% of executives agree that competition from subscription VOD services will have a negative impact on pay-TV, pushing down prices and increasing churn, and 66% percent agree that there will be a new wave of mobile-first services due to consumer demand.

The research found that 50% of executives believe content piracy will lead to greater pressures on the industry over the next five years, which is up from 41% in 2016. Online streaming, peer-to-peer downloads and IPTV piracy were cited as the most important forms of piracy affecting service providers and content owners today. It is estimated that service providers could stand to gain $7 billion in unrealised pay-TV revenue annually, if at least one in four consumers of pirated pay-TV services would switch to a legitimate option. Also, 72% of pay-TV providers believe that engaging in anti-piracy activities, combining technology, legal and enforcement action and consumer education, will bring benefit to the industry.

The research highlights a strong consensus amongst executives that innovation is becoming more and more important in the industry with 85% agreeing that in order to grow, pay-TV service providers will have to innovate strongly over the next five years (up from 78% in last year) with 74%, considering innovation to be a top strategic priority.

Other research results indicated the pay-TV executives will be focusing on delivering other services in the coming years:

- 64% on standalone OTT services.

- 67% on multiscreen TV Everywhere.

- 61% on app-based TV services.

- 53% on advanced functionality, such as voice and 4K.

- 74% on innovative content propositions.

- 78% on new pricing and packaging models.

Half of the more advanced service providers are also increasingly investing in advanced advertising and data solutions, with 42% investing in IoT and Smart Home solutions, and 45% in new content and technology services such as licensing or white-labelling in-house technical solutions.

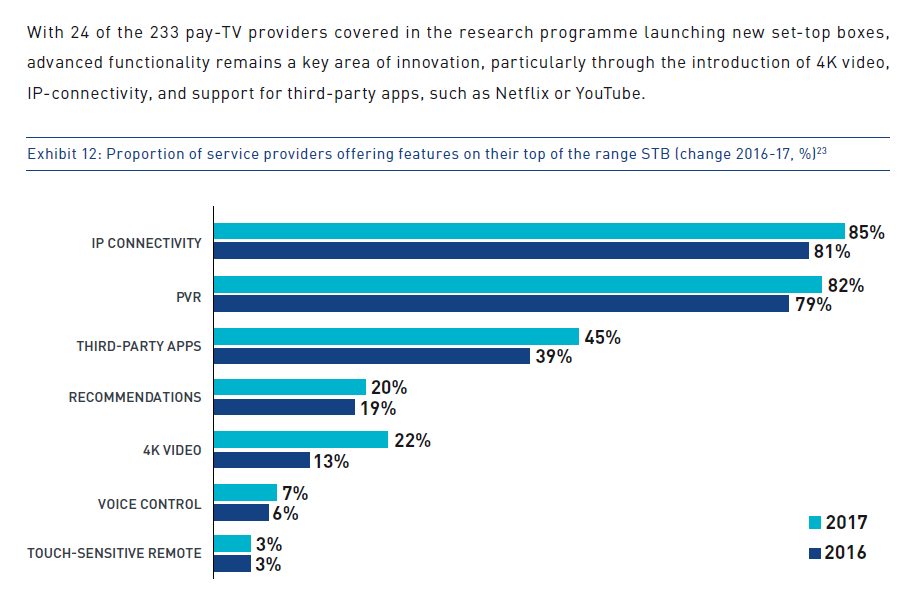

The report shows the STB teatures that are being implemented

The report shows the STB teatures that are being implemented

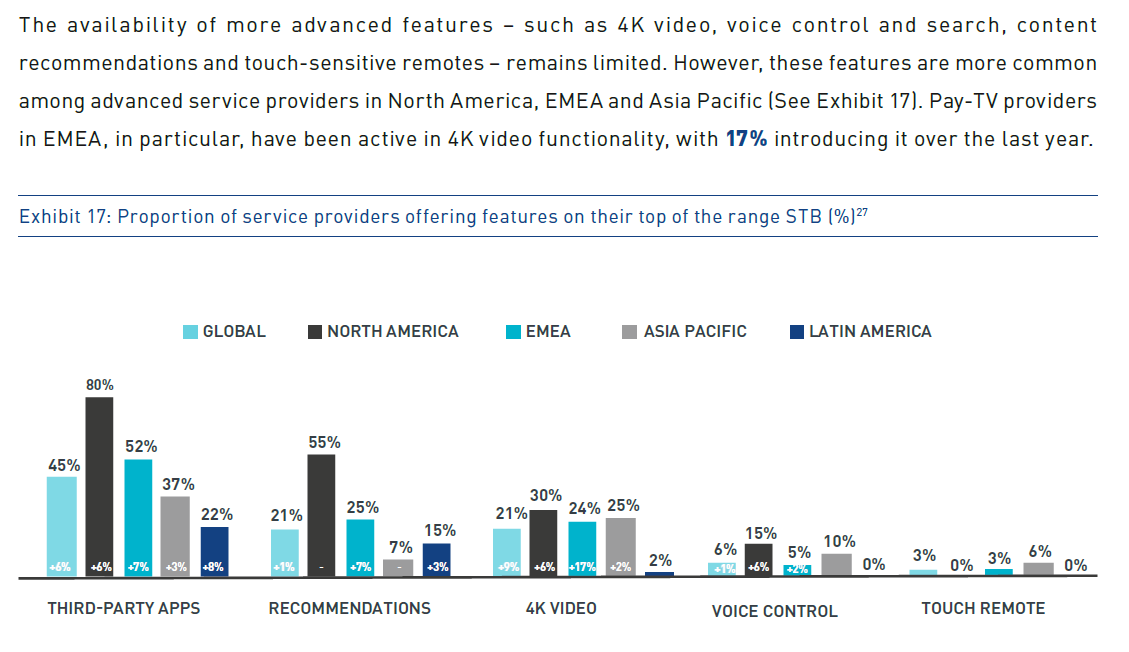

STB Features by region – UltraHD is most widely supported in North America

STB Features by region – UltraHD is most widely supported in North America

The full report can be downloaded here.