Terry Gou has big ideas. In 1974,he founded Foxconn, now China’s largest private employer and exporter assembling the largest share of iPhone and hundreds of other products. But he wanted to move up the ‘food chain’ and supply components for electronic products.

He began by buying Innolux the largest LCD maker in Taiwan to get a foothold in the display industry. In July 2012, he injected cash into the Sharp’s ill-conceived Sakai 10 Gen plant and becoming involved in its management the following month. The plant started to turn a profit in 2013 and remained profitable until the end of 2015. With the Sakai’s early profitability, he expanded the plan to include building a Gen 10.5 fab, SDP Global (China) and started romancing President Trump with the promise of building another Gen 10.5 Gen fab. in Wisconsin of all places, where he was rewarded with promises of China-like subsidies.

But in 2018 the bottom dropped out of the market; too much LCD capacity in China caused LCD prices to drop and Innolux reported losses, Sharp was near bankruptcy and the Wisconsin deal looked to be dead. Gou tried to cancel equipment orders for SDP Global, but the penalty clauses were so substantial that Foxconn chose to install the equipment and then had to infuse capital in Sharp. Foxconn took over management control, but after some early profitable quarters, Sharp’s display business was in the red. Gou quit being Foxconn’s CEO and ran for president of Taiwan, where he was defeated in a primary and LCD ASPs continued downward thru 2019 when the pandemic hit.

The industry recovered when the woking from home phenomenon increased demand for IT products, Samsung and LG cut their LCD capacity and large area ASPs more than doubled from the low point in 2020. Innolux became profitable with positive free cash; SDP completed its equipment install and is ready for production, even as Sharp’s display business continues to hemorrhage cash. A refreshed Terry Gou, still Foxconn chairman and back from the political wars, retook control of the company’s moribund display strategy.

To Today

A couple of weeks ago, Innolux announced it will sign a 12-year (2021-2033) contract with another Foxconn entity, SDP Global (China), which has a Gen 10.5 fab. Panel shipments are planned for the 2021-2033 timeframe and Innolux will pay CNY4 billion ($618 million) in instalments. Innolux said the 10.5G-produced panels will allow the company to maintain its strong presence in the TV panel market, and a portion of the supply from SDP Global will be provided for Foshan Optoelectronics, Innolux’s China-based subsidiary, to make TV-use LCD modules.

The decision is underscored by Sakai Display Products owner, Terry Gou, the Chairman of Hon Hai (Foxconn) with the company owning a controlling stake in both Sharp and Innolux. It’s an ‘all-in-the-family’ deal that benefits all parties, including Terry Gou as an individual. The 10.5G panels are most efficient for 65-, 75-inch and larger TV applications, a category that Innolux current fabs are woefully weak in. This relieves Innolux from the burden of spending NT$200 billion ($7.2 billion) to own a 10.5G line, allowing the company to use existing TV panel production capacity for high value-added applications for medical, automotive and industrial displays, as well as aerospace and satellite instruments, said observers. SDP Global could expand its monthly production capacity from 90,000 10.5G glass substrates to 120,000 and 150,000 eventually.

Innolux said it expects its total LCD panel shipments in the third quarter of 2021 and the corresponding average selling price (ASP) to both rise 1-3% sequentially.

Innolux expects global demand for large-size TV applications, and panels used in mid-range and high-end notebooks to remain strong in the third quarter. Global demand for small- to medium-sized panels used in automotive displays and smartphones will rebound in the third quarter, Innolux said.

Innolux Result

Innolux shipped panels totaling 7.09 million m² at an ASP of $464/m² in Q2, with the area remaining unchanged sequentially. Area shipments of 842,500 m² for small- to medium-size applications in the second quarter grew 6.9% on quarter. Innolux posted consolidated revenues of $3.33 billion, gross margin of 33.10%, operating profit of $848 million and net profit of $764 million.

To put this deal in perspective, SDP’s Gen 10.5 Fab can produce 10m 65” at current yields and for every 2m 65” TVs sold/quarter, Innolux could increase their revenue by 20%, a minor increase in operating costs.

TERRY GOU IS BACK!

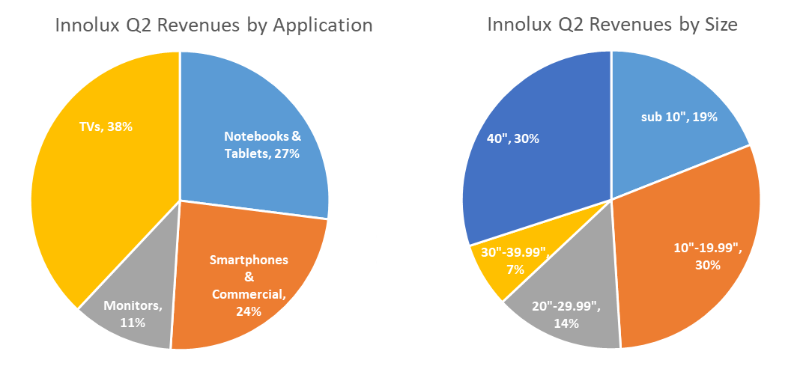

Table 1: Q221 Innolux Panel Shipments, ASP and Revenue

Source: Company Data

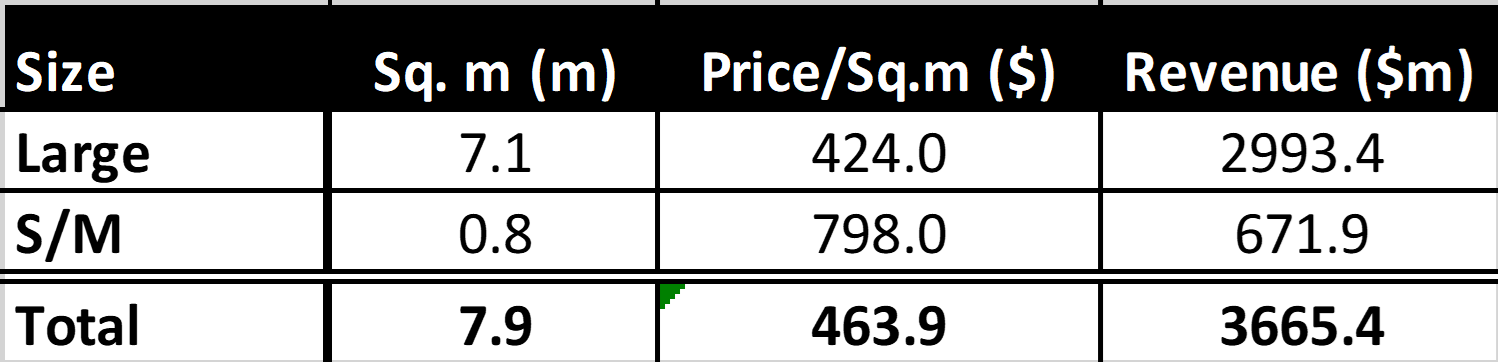

Figure 2: 65” LCD Panel Prices –June ‘19 to May ‘21

Source: SCMR, LLC

Samsung’s Concerns

Samsung Visual’s concerns over TV panel shortages, due to the reluctance of China’s panel makers to ship panels to a Korean competitor, could be reduced. BOE and CSoT would lose leverage if Samsung could buy 65” and larger panels from a non-Chinese controlled source. In 2020, Innolux shipped 6.3 million panels to Samsung, but with the availability of large TV panels that number could double.

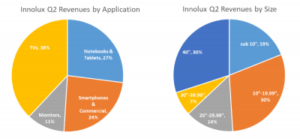

Innolux currently operates one Gen 7.5 and two Gen 8 LCD fabs, with the Gen 7.5 fab most efficient at producing panels in the 42” to 46” range, and the Gen 8 fabs most efficient producing 55” panels. As shown above, TV panels represent 38% of Innolux’s 2Q sales. Sakai (SDP in Japan) is expected to increase its capacity from 90,000 sheets/month to 120,000 and eventually to 150,000, but no timetable has been given and Foxconn has a long history of making investment promises and not fulfilling them, so I am maintaining my model at current capacity until I get confirmation that new lines have been added and are operating.

Innolux Earnings

Innolux’s earnings performance were even better than AUO’s, with both gross profit margins (GPM) and operating profit margins (OPM) reaching record highs of 33.1% and 25.5%, respectively. Key to the improved performance were

- High sales ratio of panels up to 55”, which have seen robust rates of price increase since the start of 2021

- Lower inventory levels, with relatively ample inventory putting the company in a strong position during periods of rising component prices

- Balance of customers between major and marginal brands, proving a pricing edge when supply and demand is tight.

These factors are likely to continue in Q321, as there is a gradual easing of the supply-demand balance for large panels after a topping out such that earnings deterioration at Innolux could be faster than at AUO from Q421.

During his Q2 earnings call, CEO Jim Hung commented on the tight supply of glass substrate, noting the ongoing supply shortages caused not only by continued production increases at panel makers, but also by a series of problems at the three major manufacturers (Corning, AGC, and Nippon Electric Glass) since Q320, with Corning’s Beijing plant the latest to experience difficulties. The impact has been felt relatively strongly by Taiwanese and Japanese panel manufacturers with low production capacity shares as measured by surface area, as well as by Samsung Display, which is likely to withdraw from the LCD market, and HKC and other Chinese manufacturers with a weak market presence. I suspect he aimed to stress how glass supply could be a bottleneck for production increases and earnings growth. (BY)

Barry Young is the CEO of the OLED Association