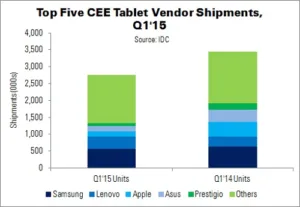

Shipments of tablets and hybrid devices in Central and Eastern Europe (CEE) fell more than 20% YoY in Q1. IDC says that Russia and Ukraine’s poor economies and the strength of the US dollar – relative to the depreciation of local currencies – contributed to the fall. 2.7 million devices were shipped to the region in Q1.

As well as economic factors, the CEE tablet market is maturing. This is reflected in longer product lifecycles and the popularity of competing devices, such as phablets. Still, growth potential exists in some areas, such as detachable hybrids and products with 4G connectivity. Cellular-enabled tablets are outgrowing the market, providing an additional revenue stream for both OEMs and mobile operators.

IDC advises tablet OEMs to focus on potential growth areas, such as cellular and hybrid devices. The commercial segment is one to watch for both form factors; adoption is expected to increase in EMEA regions less affected by the downturn than Russia and Ukraine,

Samsung led the market, retaking its position after several consecutive quarters. The vendor shipped 640,000 devices and had a 20.8% market share (up 2.2 percentage points YoY). Lenovo follows, pursuing a strategy of competitive pricing and high-value-for-money offers – although some of the company’s growth is the result of a low base in Q1’14.

Apple’s share and shipments continued to fall, due to the cannibalisation of tablet sales by new, larger iPhones. The appreciation of the dollar also hindered the vendor, as price-sensitive customers looked towards older and cheaper Pad models. An increased mix of iPads with higher storage capacities partially offset the decline in ASPs.

Asus came in fourth place, having launched its new Transformer line in February. Although these models were not widely available in CEE throughout Q1, they represent the rising popularity of hybrid devices. Finally, Prestigio took fifth place. The vendor competed aggressively in terms of pricing and focused on the x86 architecture and Windows platform. This focus helped to partially offset margin pressures from falling Android prices.

“In the latter months of the year, some vendors (particularly the smaller ones) will not be able to sustain their revenue flows, due to increasing competitiveness in the lower-tier segment and increasing market concentration in the upper-tier segment”, said IDC analyst Jiří Teršel. “They will thus be faced with a decision: to either consolidate or exit the market”.

| Top Five CEE Tablet and Hybrid Vendors’ Shipments, Market Share and Growth, Q1’15 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’15 Units | Q1’14 Units | Q1’15 Market Share | Q1’14 Market Share | YoY Volume Change |

| Samsung | 570 | 639 | 20.8% | 18.6% | -10.8% |

| Lenovo | 359 | 297 | 13.1% | 8.6% | 20.9% |

| Apple | 158 | 425 | 5.7% | 12.3% | -62.9% |

| Asus | 155 | 360 | 5.7% | 10.4% | -57.0% |

| Prestigio | 81 | 192 | 3.0% | 5.6% | -57.9% |

| Others | 1,421 | 1,529 | 51.8% | 44.4% | -7.1% |

| Total | 2,774 | 3,442 | 100.0% | 100.0% | -20.3% |

| Source: IDC | |||||