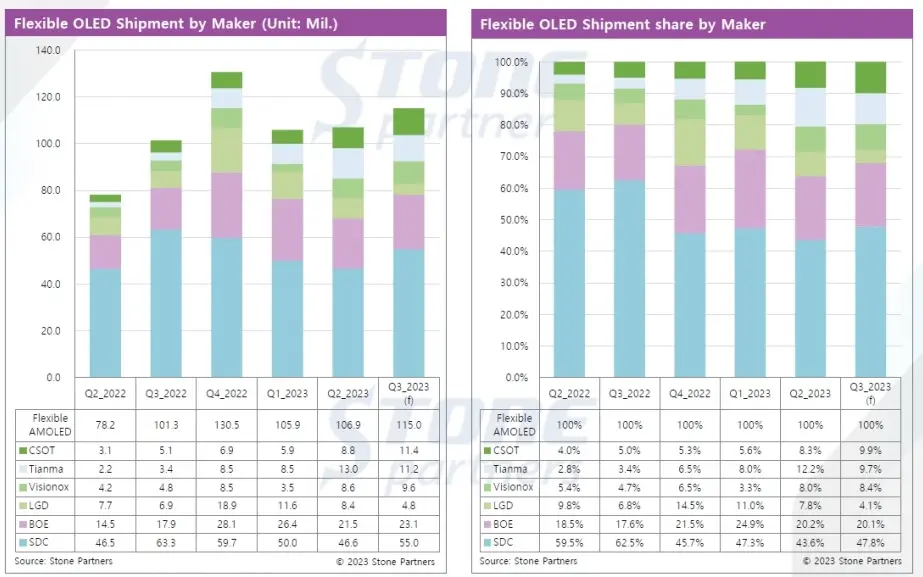

Samsung was the leading supplier of smartphone flexible OLEDs in the third quarter, shipping 55 million units, according to Stone Partners. However, its market share in this category dropped to 47.8%, marking the fourth consecutive quarter where it fell below 50%. In the previous year’s third quarter, it held a 62.5% market share. Samsung faces competition from other manufacturers like LG and BOE as Apple diversifies its supplier base. Chinese smartphone companies are also increasing their purchases of low-cost flexible OLED panels from domestic panel companies, reducing Samsung’s dominance.

BOE was the second-largest supplier of smartphone flexible OLEDs in the third quarter, shipping 23.1 million units and capturing a 20.1% market share. CSOT, Tienma, Visionox, and LG also played significant roles in this market.

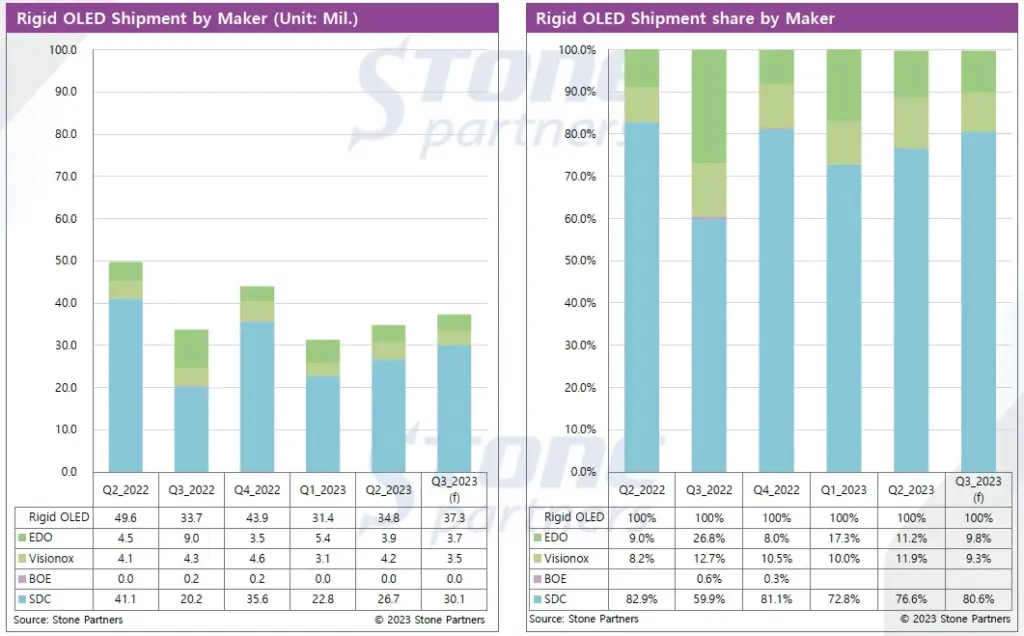

Rigid OLED Shipments

In the third quarter, a total of 37.3 million smartphone rigid OLED units were shipped globally, marking an increase from both the previous year (33.7 million units) and the preceding quarter (34.8 million units). This segment represents a substantial part of the OLED market alongside flexible OLEDs.

Samsung played a prominent role in the rigid OLED market, too, shipping 30.1 million units during the third quarter. This figure marked significant growth compared to the same period the previous year when they shipped 20.2 million units. Samsung Display’s rigid OLEDs accounted for an impressive 80.6% of the market share during the third quarter.

The demand for Samsung Display’s rigid OLEDs was boosted by smartphone models such as the Galaxy A24, A34, and A54 produced by Samsung Electronics.