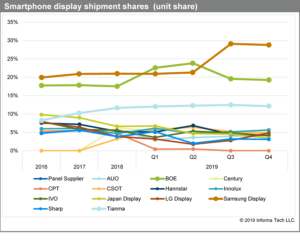

Samsung Display in the third quarter reclaimed the top position in the global smartphone display market as the company capitalized on record-high demand for active matrix organic light emitting displays (AMOLEDs).

The South Korean tech giant accounted for 29 percent of smartphone display shipments in the third quarter, a major leap from its 21.3 percent share during the second quarter, according to IHS Markit | Technology, now a part of Informa Tech. The increase propelled Samsung past BOE display to take the market lead for the first time since the fourth quarter of 2018.

“Smartphone makers have seen the future—and that future lies in AMOLED technology,” said David Hsieh, senior director at IHS Markit. “All the major smartphone brands—including Samsung, Apple, Huawei, Oppo, Vivo and Xiaomi—have adopted AMOLED technology in their high-end models in 2019. By leveraging its reputation as the highest-quality and highest-capacity supplier of AMOLEDs, Samsung was able to take advantage of that demand and return to the leading position in the global smartphone display business.”

Smartphone AMOLED shipments totaled 146 million units in the third quarter, up from 93 million in the second quarter, a record quarterly high for the display technology. In comparison, a-Si TFT LCD shipments totaled 177 million.

Meanwhile, LTPS TFT LCD shipments for smartphones totaled 144 million. This marks this first time that quarterly AMOLED shipments have surpassed LTPS TFT LCD shipments in the smartphone market.

Samsung tears up the AMOLED record book

Along with the all-time-high market shipments of AMOLEDs, Samsung also achieved a company record, with 136 million units shipped in the third quarter. To meet high levels of customer demand, the company’s is maintaining a 70 percent capacity utilization rate in its Gen-5.5 and Gen-6 fabs.

Chinese firms make AMOLED plays

“As more and more smartphone brands adopt AMOLEDs for their high-end and even mid-range models, the market is expected to continue to boom,” Hsieh said. “This is opening the door for up-and-coming Chinese AMOLED suppliers like BOE, Visionox, ChinaStar, Tianma and EverDislpay to make gains in the market.”

However, these firms may have difficulty catching up in critical manufacturing technologies with market-leader Samsung. Today’s AMOLED business requires support for many form factors that are challenging to produce, including 3.5D edge curved cover, touch-on thin-film encapsulation, chip on polyimide (COP) driver IC bonding, OLED module contrast and brightness adjustment and compensation.

Samsung Display’s manufacturing processes for these form factors are much more mature than those of its competitors’.

Market share moves

In other third-quarter competitive developments, BOE’s share of the smartphone display market decreased to 19.6 percent, down from 23.8 percent in the second quarter of 2019. No.-3 ranked Tianma held a 12.5 percent share, up slightly from 12.3 percent in the second quarter.

The IHS Markit | Technology Smartphone Display Intelligence Service

The IHS Markit | Technology Smartphone Display Intelligence Service delivers quarterly updates of all smartphone display shipment and revenue by technology, size, and resolution, including with analysis of the supply chain between display makers and smartphone set brands.

If you prefer not to receive email messages from IHS Markit | Technology, please email [email protected]. To read our privacy policy, click here.