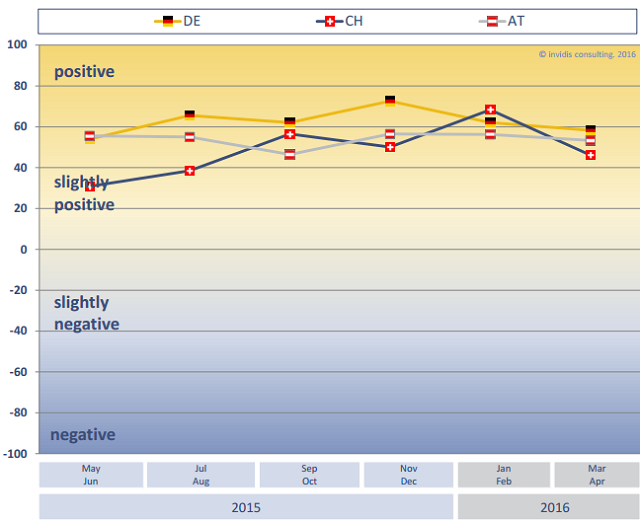

The DSFE has also revealed May/June results for the DACH market, which were not as positive as Russia’s increase, but came from a much higher base. Sentiment around signage displays is significantly up in the region.

DACH’s DBCI fell by 8.15 points, from 62.8 to 54.65. Despite this, the outlook remains positive; almost 70% of respondents said that the current business situation was ‘good’ and 27.1% called it ‘satisfactory’. Only 4.7% called it ‘poor’.

The outlook towards the next six months is more conservative, however. The number of stakeholders expecting an increase in their business fell from 62.8% to 52.3%, while those expecting no change rose from 33.1% to 41.1%.

On a country-by-country basis, sentiment fell the most (-32.4%) in Switzerland, which had been on top in the most recent survey. German sentiment was down 6% and Austrian sentiment fell 5.2%. However, each country was up compared to same period last year: 19.9% in Switzerland, 9.3% in Germany and 6.6% in Austria.

Display vendors’ sentiment doubled YoY, rising 99.7%, and 13.3% compared to the previous survey. Big trade shows like ISE are having positive knock-on effects and filling order books. Sentiment was down amongst system integrators (3% YoY, 25.7% from last survey) and software vendors (6.1% YoY, 22.9% since last survey). Overall, the DACH DOOH industry was found to be positive about the future, with overall sentiment rising 22.7% YoY and 12.3% since the last survey.

Display vendors’ sentiment doubled YoY, rising 99.7%, and 13.3% compared to the previous survey. Big trade shows like ISE are having positive knock-on effects and filling order books. Sentiment was down amongst system integrators (3% YoY, 25.7% from last survey) and software vendors (6.1% YoY, 22.9% since last survey). Overall, the DACH DOOH industry was found to be positive about the future, with overall sentiment rising 22.7% YoY and 12.3% since the last survey.

The DSFE examines a different aspect of the market in each of its surveys. This time, it looked at operating systems used in digital signage. Windows dominates in DACH, with a 55.5% market share, followed by Android at 11.2%. However, Linux is climbing, at 10.5% and 10.3% for Linux Embedded. Cost and security issues are dictating this rise. SoCs are rising, with a 7.4% market share. In last place was Apple, at 4.1%. The DSFE feels that Apple could establish a niche segment; however, many IT managers dismiss it as a signage OS.