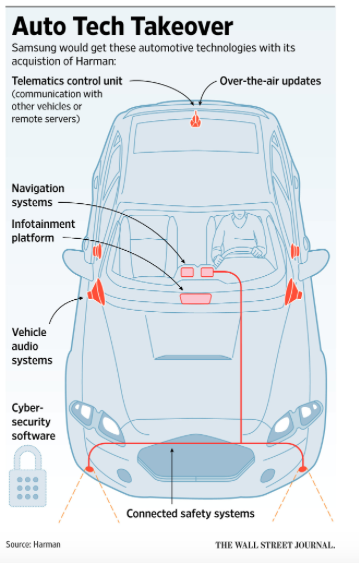

Samsung Electronics made an $8B (all cash) tender offer to acquire US based Harman International Industries, Inc., a leading auto system integrator with a heavy focus on business to business (B to B) IoT (internet of things) technology that goes far beyond just the car.

For Samsung, the auto focus is a “strategic priority” and the company was no doubt tempted by the +30 million existing vehicles that currently use Harman products. It serves the auto industry as a leading system integrator in telematics, and infotainment systems. The group reported auto related sales were about 65% (roughly $4.55B) of Harman’s $7.0 billion in total sales over the last 12 months (Q4-15 to the end of Q3-16). The joint corporate press release also reported Harman had a $24B order backlog for this market as of June 30, 2016, and Samsung analysis estimates the market for connected technologies, (“particularly automotive electronics”) is expected to grow to more than $100 billion by 2025.

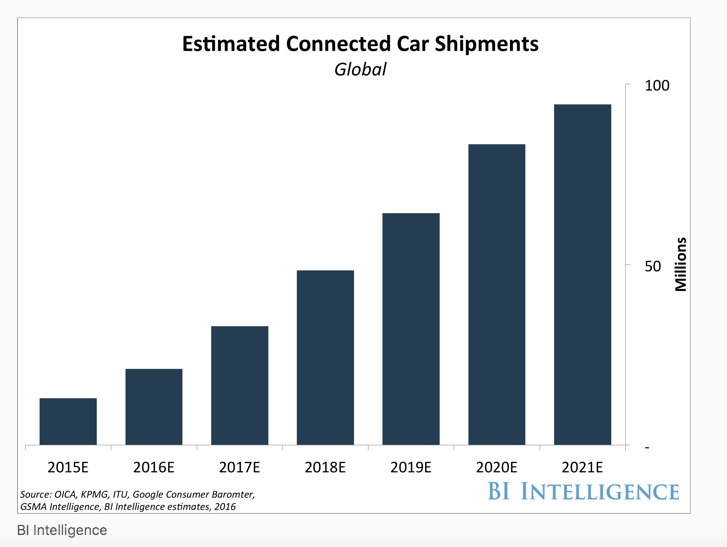

Meanwhile, on the auto market demand side, BI Intelligence, reports that connected cars are on a stellar growth path with over 380 million connected cars (cumulative) forecast by 2021. That year, the number of connected cars that will be sold will be just shy of 100M according to that research company’s Connected Car Report published on June 10, 2016, with around 30M cars worldwide considered as connected today.

Meanwhile, on the auto market demand side, BI Intelligence, reports that connected cars are on a stellar growth path with over 380 million connected cars (cumulative) forecast by 2021. That year, the number of connected cars that will be sold will be just shy of 100M according to that research company’s Connected Car Report published on June 10, 2016, with around 30M cars worldwide considered as connected today.

According to that BI Intelligence report: “The connected car is already on the market and generating significant revenue for car makers and tech companies. Over the past year, there has been a significant uptick in the number of connected cars on the road. And as internet integration becomes more commonplace, the automobile as we know it will transform.Over the next five to 10 years, this internet integration is expected to change the car ownership model, create a new platform for consumers to access content, lead to fully autonomous vehicles, and revolutionize the auto industry.” But not all changes will be good for car makers, as they find their relationship with customers move from an arm’s length “dealer model” to an update-based model much like wireless device providers Apple and Samsung in the smartphone market.

But the connected car concept is at best a moving target that covers distinct areas of technology focus that some see as ultimately leading to the driver-less vehicle, (oops make that “piloted vehicle”) as the industry likes to refer to it. Early moves in the space came in the form of car infotainment. This now goes well beyond the car radio /DVD and and rear seat entertainment, and into streaming navigation, and safety systems connected to hundreds of sensors attached to high horsepower GPU’s from the likes of Nvidia. It’s also not uncommon today to find a mobile hot spot in current generation cars, along with middleware technology from leading wireless device OS makers such as Apple and Google. The technology is also merging with car telematic systems that monitor vehicle engine (power) and safety systems that will eventually be uploaded into a cloud services infrastructure, where new business are just now emerging.

But the connected car concept is at best a moving target that covers distinct areas of technology focus that some see as ultimately leading to the driver-less vehicle, (oops make that “piloted vehicle”) as the industry likes to refer to it. Early moves in the space came in the form of car infotainment. This now goes well beyond the car radio /DVD and and rear seat entertainment, and into streaming navigation, and safety systems connected to hundreds of sensors attached to high horsepower GPU’s from the likes of Nvidia. It’s also not uncommon today to find a mobile hot spot in current generation cars, along with middleware technology from leading wireless device OS makers such as Apple and Google. The technology is also merging with car telematic systems that monitor vehicle engine (power) and safety systems that will eventually be uploaded into a cloud services infrastructure, where new business are just now emerging.

Another growth area in this space, is enhanced situation awareness technology that keeps drivers aware of their surroundings. This includes rear-view and wide-angle camera applications. Harman said on the horizon, they are using virtual reality modeling to blend with the camera images creating a full surround view of the vehicle (from any angle) that can assist in safer driving and parking. Telematics too is morphing in the direction of Vehicle-to-Vehicle, (V2V) communications (very handy at a 4-way stop sign) and ultimately to infrastructure (Vehicle to Infrastructure/V2I) that also uses the internet of things moniker.

So Samsung is betting (to the tune of $8B) that BI Intelligence is correct when they say, “The market position of the car today is similar to where the smartphone was in 2010 — it’s just taken off and is ready to explode.” No pun intended, but this is the kind of explosion that Samsung needs more of. – Steven Sechrist

Harman showed this concept at MWC in February with alternate Left or Right hand drive. Image:Meko

Harman showed this concept at MWC in February with alternate Left or Right hand drive. Image:Meko