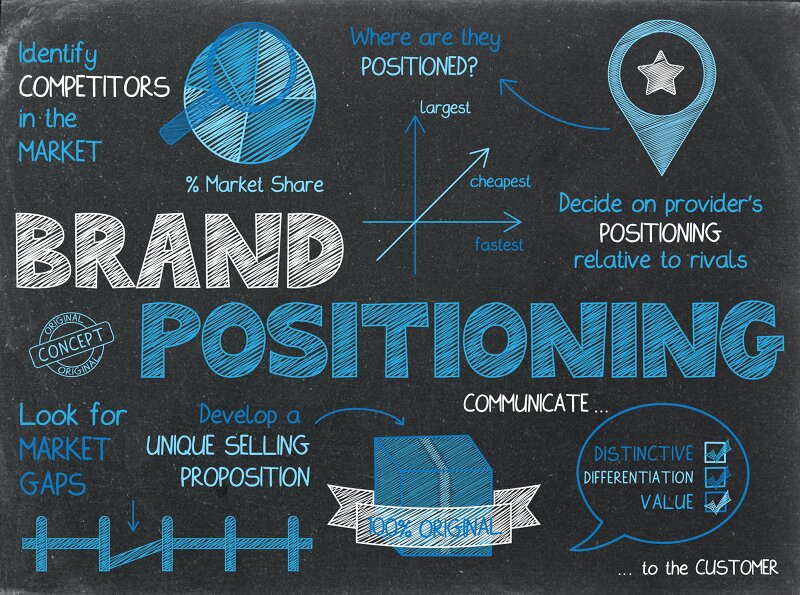

Back before I became an analyst, editor and writer, I spent a lot of time in display and brand marketing. One of the topics that I tried to bear in mind the concept of ‘positioning’ for brands. I was very influenced by reading books by specialists such as Al Ries.

The main idea is that brands can, with consistent messaging and marketing activities, hold a particular point in a customer’s mind. I’m sure that marketing thinking has evolved a lot since I read those books several decades ago but I still think of Volvo cars as ‘safe’ and BMWs as ‘fun to drive’. Those brands occupy particular places in my mental map. In the same way, technologies and the brands/terms used to describe them can occupy particular places and that’s why companies such as Samsung have worked so hard on the branding of LCD TVs as LED TVs in recent years (even if, to industry specialists, they are absolutely not LED displays!).

There have been three important flat panel TV technologies up to now. They have been (and I have put my personal ‘positioning’ with them):

-

PDP: Great image quality, poor efficiency, relatively low resolution, heavy, bulky, obsolete

-

LCD: Great brightness but weak contrast or viewing angles, poor motion response, high resolution.

-

OLED: Great contrast, colour and image quality for movies/drama; good motion but weak in high brightness; reliability unclear (burn in).

The good image quality of OLED has meant that it has been successful in winning those that really value image quality. OLED TVs invariably win in ‘shoot outs’. That has allowed the technology to command the premium segment of the TV market and has allowed LG Display (which makes all the OLED panels for TVs at the moment) to build a roster of TV brands including image quality specialists such as Sony and Panasonic. Samsung, on the other hand, which was not successful in developing its own large OLEDs until now, and has been limited to LCD. It is testament to the firm’s engineering, marketing and manufacturing that it remains strong in the TV market but it will have been dismayed by LG’s success.

(From here, all the OLEDs I’m talking about are those based on LG Display’s WOLED technology. I know that, in theory, you could make other OLEDs that would have different characteristics, but the reality is that they don’t exist in the market and positioning is about the market).

So, now we have two new technologies in the mainstream of flat panel displays (I’m excluding laser projection here). One is microLED and that has a huge potential to take over the high end of the TV market in the long term. There’s nothing that is a disadvantage from a viewer’s perspective. Unfortunately, for the next few years they will continue to be so expensive that they will not be in the mainstream TV market. So microLED will be at the very top, but in a niche, for now.

Next down you have QD-OLED, the new display technology from Samsung Display and which has now been announced in a TV series from Sony and are likely to be announced soon by Samsung. Dell has announced a monitor and Samsung will follow. QD-OLED is somewhere between OLED and miniLCD in terms of brightness, and has better colour than OLEDs because of the narrow emissions of the QDs which will deliver higher saturation. QD-OLED has better viewing angles than OLED but QD-OLED will have all the other advantages of OLED in terms of deep blacks and extreme thinness. The QD-OLEDs shown at CES 2022 have better detail in the shadows than OLED TVs using LG’s WOLED panels.

LCD has evolved to adopt miniLED backlights and displays with very good implementations are very good looking. They are also able to go to 8K relatively easily (compared to OLEDs). The driving circuitry for OLEDs is significantly more complicated than for LCDs, so 8K OLEDs are always going to be challenged with getting yields as good as those for LCD and that means a significant cost penalty for OLED. However, at the moment, miniLED backlights are relatively expensive to make.

There have been years of arguments about the relative importance of different image quality metrics such as colour gamut coverage, dynamic range, black levels and spatial resolution. 3M did some interesting work on creating a single number of merit that balanced the different factors, but I haven’t seen anything about it recently and, being the cynic that I am, I suspect the firm dropped its work in this area when it decided to get out of making QD films (which boosted the colour gamut).

With the new technologies, in my mind the positioning for TV is now like this:

-

microLED

-

QD-OLED

-

OLED

-

miniLED LCD

-

LCD

However, according to reports from Korea, Samsung wants to position miniLED 8K LCD at the top of the mainstream TV technologies. That means that its list will be:

-

microLED

-

miniLED LCD

-

QD-OLED

-

OLED

-

LCD

Another strong rumour that industry analysts (including me) now believe is true is that Samsung’s TV business wants to buy some OLEDs from LG Display so that it has a wider range of OLED-type image quality sets. As there will only be a single factory making QD-OLED for the next couple of years, volumes will be limited and Samsung’s TV business is a big one, so it is reported to be looking to buy up to two million OLEDs from LG to add to the less than one million QD-OLEDs that it is likely to sell.

The problem, according to reports, is that for Samsung to push the price of its OLED sets down far enough to position the OLED TVs as a couple of steps down from miniLED 8K and still make a profit from its TV business, it has to push down the price it pays for OLED panels. It would be a tremendous boost for LG Display’s OLED business to gain a substantial customer like Samsung and a strong endorsement of its technology. However, there’s a ‘double whammy’. If it meets the price that Samsung is said to want, it will have to cut the prices it charges other brands (including LG Electronics) and Samsung will push down the positioning of OLED as the premium TV display technology. The discussions within LG Display and between the firm and Samsung must be as intriguing as the ones between Samsung and Sony when the Japanese firm made a huge investment in S-LCD to get access to LCD panel supply.

At CES, Sony was the only brand to launch QD-OLED and 8K miniLED TVs (its first) and the firm really promoted its processing technology, the Cognitive XR, rather than the display technology differences. It also shows QD-OLED as just ‘part of its OLED range’ with the QD-OLED panel technology relegated to a subsection of the specification. We’ll really understand how Sony and Samsung are positioning the technologies when we see their pricing, which has not yet been released. (BR)