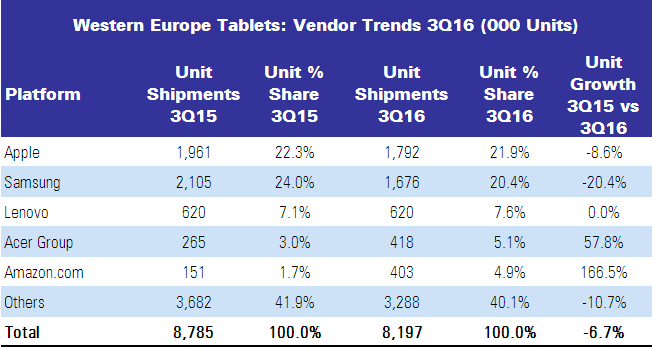

IDC reported that sales of tablets in Western Europe declined to 8.2 million units, a drop of 6.7% year on year, although detachables and commercial sales increased by 48.4% and 13.1% respectively. Although volumes dropped, value grew.

Detachable devices, especially those targeting the commercial segment, are normally positioned at higher price bands, due to the specification requirements in the space, IDC said. As a result, the number of devices in the over-€600 price band in Western Europe grew 66.7% YoY, accounting for 10.6% of the total tablet market in 3Q16. The total value of the market grew 4.8% YoY to €2.5 billion, despite the overall market unit decrease.

Detachables continue to increase their share in the overall tablet market, accounting for 21.9% of all tablet devices in 3Q16 compared with 13.8% in 3Q15. This category continues to be dominated by Apple and Microsoft, through their respective iPad Pro and Microsoft Surface series. Together they account for 46.4% of detachable volume.

“Surface Pro and iPad Pro success comes from them being a notebook replacement, as well as the quality of the devices,” said Daniel Goncalves, research analyst, IDC Western European Personal Computing. “The devices are increasingly adopted across consumer and commercial segments, and while in the consumer segment both appeal to the ‘prosumer’ user, in commercial the adoption varies depending on the activities of the end user. iPad Pro is more popular for creative types of jobs, whereas Surface is more likely to be adopted by top executives, partly due to Windows’ strong legacy in enterprise.”

The slate market declined 15.5% YoY, and this was the main reason for the overall tablet market decrease in Western Europe. Slate sales have been affected by increasing saturation in the market, a lack of innovative features in new models, and sluggish replacement cycles. The consumer segment, which contracted 10.8% YoY, was strongly affected by this.

In terms of OS, Windows made gains year over year due to the boost in detachable sales. Android increased its share QoQ to 65.9%, as many vendors started building their stock in September for Black Friday and holiday season promotions. iOS and Windows maintained their second and third positions in the ranking by OS with 21.9% and 12.2% respectively.

By vendor ranking, Apple maintained its leadership in Western Europe and remains well ahead of the competition in the consumer segment. On the commercial side, Apple benefits from a strong engagement in education. Samsung was second, just behind Apple. Samsung has been gradually reducing its entry-level offer, which resulted in some loss of market share. Lenovo was third, leveraging its wide portfolio in both slates and detachables to avoid a YoY decline. Acer and Amazon were fourth and fifth respectively, boosted by seasonality. Amazon has boosted sales in the entry-level segment with its aggressive Kindle pricing.