Researchers at Pacific Media Associates (PMA) specialise in market forecast on projectors and displays. The research company announced the latest installment of its Pico Projector Research to celebrate the New Year and much to our surprise, PMA says 2015 was a very happy one for small projectors, especially in China. The group’s research covers standalone, battery-powered pico-projectors, as well as wall- and USB-powered personal projectors.

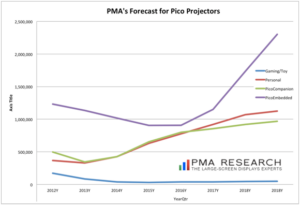

Rise and fall: The Pico Market according to PMA is dominated by embedded projectors, but analyst Nick Rogers sees personal projectors making a comeback. (Source: PMA Research)Looking at the first nine months of 2015, PMA researchers found worldwide unit sales of pico projectors rose 49% over the same period in 2014; while revenues rose 40% year over year. PMA researchers say they are confident shipments and revenues will hold steady and the sector will close out the year with a 50% increase in shipments.

A check with PMA principal, Nick Rogers, puts it all in perspective. PMA reported that 1.9 million pico projectors shipped in 2014 adding up to a $385 million dollar market. Even more fascinating however is the trajectory of the pico projector, which has broken hearts. Even after a decade the pico project market is still aborning. The growth the market is seeing in 2015 and presumably for the future brings it back to where it was in 2010-2011 when we were all fascinated with personal projectors.

Pico projectors are mighty cool little things, but they don’t always make a lot of sense. In their heyday of 2012, sales were at around 2.3 million units, says PMA. In 2012, the projectors were embedded in phones, camcorders, and still cameras and even in some heads-up displays (HUD) for cars, but sales didn’t keep going up as you might expect. According to analyst Alan Nogee at Strategies United, sales dropped off. PMA saw that as well.

The idea of a personal projector ceased to make sense. The quality and brightness just wasn’t good enough to justify carrying around another device. The idea has been that projectors get embedded into phones or tablets but they’re relatively expensive, says Nogee, adding as much as $100 to the cost of the device. And, common sense still dictates that you can’t have bright light without drawing down your battery.

The market took a pause for the technology.

However, hope springs eternal in the technology industry and 2015 has seen some significant milestones for projector technology. PMA believes that new chipsets enabling HD resolutions (1080p/720p) are a contributing factor to the resumption of growth. They also highlight new laser-based products, the arrival of embedded projectors in mobile devices (again), and small projectors enabling mini-home theaters. The market is also seeing expanded lines of products with an attractive range of price points, and more HUDs in automobiles are expected.

The market for personal projectors has grown in China. PMA notes that China has overtaken the US as the single, largest market for pico and personal projectors. They also expect to see streaming projectors contribute to demand in China during 2016. What is a streaming projector, you ask? Well, for instance, 3M makes a device for Roku to enable people to project their shows at home or on the road. In this, they’re dual use because road warriors are also reporting that the devices are handy for presentations using a laptop, tablet, or phone as a source. So, they’re personal projectors with an additional streaming source.

In their monthly Pico and Personal Tracking Reports, PMA says U.S. unit sales through retail and distribution channels increased 20% and 55%, respectively, on a year-to-date basis through November. The reports provide sell-through volumes, street prices, and revenues for the top pico and personal projector models from brands such as AAXA, Acer, Asus, Cellulon, Dell, InFocus, LG, Optoma, Philips, ViewSonic, and Vivitek.

In their monthly Pico and Personal Tracking Reports, PMA says U.S. unit sales through retail and distribution channels increased 20% and 55%, respectively, on a year-to-date basis through November. The reports provide sell-through volumes, street prices, and revenues for the top pico and personal projector models from brands such as AAXA, Acer, Asus, Cellulon, Dell, InFocus, LG, Optoma, Philips, ViewSonic, and Vivitek.

Embedded for the future

We found additional research on Pico Projectors that backs up PMA’s work. San Francisco-based Grand View Research sees pico projectors riding into the market on the backs of mobile devices. In addition, they credit improved contrast ratios, high quality pixels, and wide support for Wi-Fi, WiMax, and 3G/4G technologies with increasing growth.

Grand View says North America accounted for 30% of the overall revenue for pico projectors in 2014, however the researchers agree with PMA and say there is tremendous growth potential in Asia Pacific.

One of the interesting bullet points cited by Grand View is that over 35% of the overall revenue for pico projectors came from embedded devices and smart phones are a significant driver.

PMA and Grand View expect to see increased demand from key market segments including aerospace & defense, automotive, business & education, consumer electronics, and healthcare. However, they expect to standalone devices to lose market share because of their relatively high cost. They also cite the low brightness associated with many standalone devices.

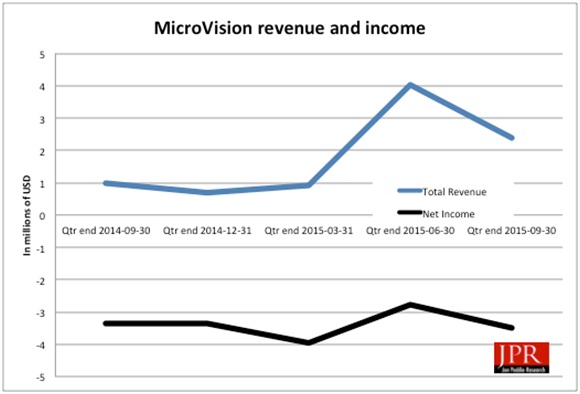

Countering the brightness issue is LBS (laser beam scanning), which is offered by Washington-based MicroVision. Grand View sees interest in LBS growing thanks to its ability to product better images and relatively high brightness compared with other technologies. According to an article in The Street, MicroVision has been in the doldrums until it got a component order, which the website says is from Sony.

MicroVision is still waiting to prove its point about its laser technology. Revenues are mostly flat and the company is still operating in the start-up zone of no-profits. However, the company got a nice deal with Sony in the summer of 2015 and that accounts for their pop and some enthusiasm in the industry.TechNavio, a research firm in Williamstown, Ma, identifies 22 major pico projector companies: 3M, Microvision, Optoma Technology, Syndiant, Texas Instruments, AAXA, Acer, AIPTEK, ASK Proxima, BenQ, Canon, Light Blue Optics, Luminous Device, Greenlight Optics, Microsoft (Lempotix), Samsung, Maradin, Micron Technology, Mesmerize, Opus Microsystems, Toshiba, and Wowee Group.

MicroVision is still waiting to prove its point about its laser technology. Revenues are mostly flat and the company is still operating in the start-up zone of no-profits. However, the company got a nice deal with Sony in the summer of 2015 and that accounts for their pop and some enthusiasm in the industry.TechNavio, a research firm in Williamstown, Ma, identifies 22 major pico projector companies: 3M, Microvision, Optoma Technology, Syndiant, Texas Instruments, AAXA, Acer, AIPTEK, ASK Proxima, BenQ, Canon, Light Blue Optics, Luminous Device, Greenlight Optics, Microsoft (Lempotix), Samsung, Maradin, Micron Technology, Mesmerize, Opus Microsystems, Toshiba, and Wowee Group.

“The market is beginning to blossom,” says Rogers. I think the market did a big disservice to itself at the beginning — showing ads for the family sitting round a tiny projector (probably with VGA resolution and less than 20 lumens.) Now we have reasonable brightness — at least 100 lumens and WXGA resolution. The products are now recovering from the original hype.

What do we think?

Pico projectors seem to be a casualty of multiple technologies including tablets; “throwing” technologies like Apple AirPlay, Chromecast, Intel’s Widi, which sends content to TVs; and cloud-based content, to name the obvious. There are multiple ways to get to content and presentations even if you didn’t bring them along with you on a trip, or a business call. Add to that, the standalone pico projectors represent one more device to take along, one more power supply adding to the weight, one more battery back, etc.

One of the most interesting developments we noticed was that Lenovo is adding pico projectors to its Android-based Yoga Tab Pro. The company has showed tablets and phones with projectors that can create virtual keyboards as well as play movies. And since we started looking into this, we’ve seen quite a few small card-deck size pico projectors to be used in conjunction with a mobile device.

PMA’s Nick Rogers and Bob Raikes of Meko’s Display Daily are also seeing HUDs as a growing market opportunity for pico projectors. It’s very possible, that this market segment has moved through its slough of despond on the hype cycle and is moving into a new adoption phase.

Note: If you’d like to travel down the same rabbit hole I did, here are some sites to check out:

http://www.strategies-u.com/articles/2015/06/sales-of-laser-pico-projectors-projected-up.html

http://www.picoprojector-info.com/pma-pico-projectors-grow-six-fold-2016

– Kathleen Maher

Kathleen Maher is an editor and analyst who edits “Jon Peddie’s Techwatch” from which this article is reproduced.