The Europe, Middle East, and Africa (EMEA) market for gaming desktops and notebooks boomed in the second quarter of 2020, growing 33.0% YoY, and totaling 2.0 million units, according to International Data Corporation (IDC). The market for PC gaming is expected to be similarly optimistic in the third quarter (26.3% YoY), with continued strength in final quarter (10.1% YoY) resulting in growth of 16.4% YoY for the full year 2020.

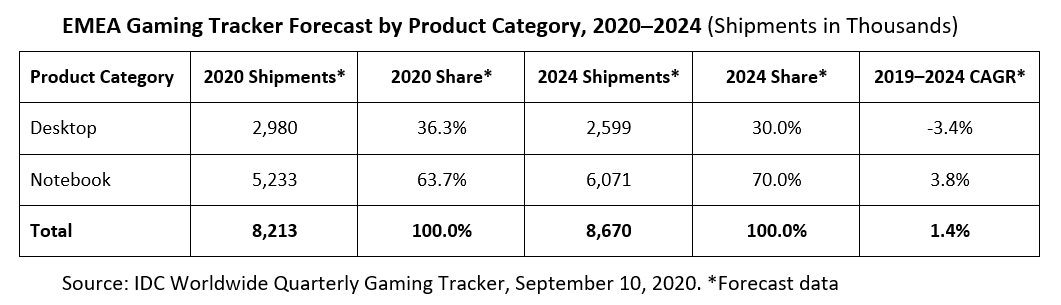

Long term growth is anticipated to continue, and by 2024 the market is expected to increase to 8.7 million units with a four-year compound annual growth rate (CAGR) of 1.4%.

In 2Q20, the Western Europe PC gaming market posted a massive growth of 29.6% YoY. The COVID-19 pandemic continued to drum up demand for mobile form factors, especially in single-device households that sought new devices to enable multiple users to study/consume media and to game. Notebook gaming benefited primarily (40.7% YoY), but there was also sufficient demand for higher end gaming desktops to generate growth (12.9% YoY).

“The number of active gamers has risen as a direct result of the lockdowns, and in 2Q20 all gaming hardware was flying off the shelves just as soon as it arrived,” said Liam Hall, senior research analyst, IDC Western Europe. “Consumers were forced up or down the stack based on availability, and the total volume sold could have been even greater if there was more availability of stock.”

While there has been a huge spike in the consumption of fully fledged gaming PCs, COVID-19 and lockdowns have impacted consumers in different ways.

“While a lot of people have been able to continue working from home, others who work in more impacted industries, like hospitality and tourism, have been less lucky,” said Hall. “Gamers that maintained their employment and perhaps forwent a summer holiday, had some extra cash for a gaming upgrade, but furlough schemes and layoffs have left others in a less financially comfortable position.”

Overall, the TAM for gaming has risen. Consumers have needed a source of entertainment and socialization with friends, but more economically constrained consumers have driven an increased adoption of cloud gaming offerings.

For the second consecutive quarter, the PC gaming market in CEE and MEA recorded strong annual double-digit growth of 39.8% and 36.1%, respectively.

“Strong demand for gaming machines will continue in 3Q20 in both regions but will slow in 2021,” said Nikolina Jurisic, Senior Research Manager EMEA. “The ongoing COVID-19 pandemic has been positively impacting the gaming PC market as lockdown and cautious social measures have ‘forced’ end users to stay home. A growing number of consumers have been increasingly engaged in PC gaming to satisfy their at-home entertainment needs.”

Although there is much stronger demand for notebooks, desktop gaming remains popular especially among gaming enthusiasts, allowing users to easily modify the machine to their needs.

“Additionally, a certain percentage of price-sensitive consumers will opt for cheaper DIY Gaming DTs,” said Jurisic. “In the short term, PC gaming buyers are expected to predominantly opt for performance machines that provide better value for money for full HD gaming. The entry and mid-priced devices are set to dominate over PCs’ premium GPU share inhibited by high prices.”

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.