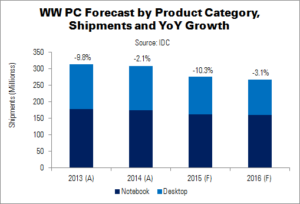

Global PC shipments will fall 10% YoY in Q4’15, which will weigh annual shipments down to -10.3%, says IDC. Short-term effects, such as the strong US dollar, depressed commodity prices and existing inventory have also lowered the firm’s forecast for early 2016. Shipments are expected to stabilise by the end of next year, and grow slightly toward the end of the forecast (2019) as commercial replacements rise.

Certain regions – Japan, MEA, CEE and LATAM – will be particularly affected by disruptions from political and economic transitions in the near future. Japan and MEA will experience growth that is lower by double digits over the next year or more. CEE and LATAM have a short-term growth outlook that is down in the high single digits.

Contrasting the above regions, the outlook for the USA, Western Europe and APACxJ is down only slightly, and is up a small amount in Canada.

Beyond short-term declines, it is expected that the market will eventually stabilise, and even grow. This will be due to replacement of consumer and commercial systems. Commercial adoption of Windows 10, and steady consumer upgrades, are expected to boost demand for PCs over several years. End of support for Windows 7 will have a similar effect to the recent end-of-life for Windows XP. Declining tablet volume and minimal mobile phone growth – despite the continued shift to smartphones – will also reduce pressure for consumers to spend on non-PC products.

“Despite the substantial shift in spending and usage models from PCs toward tablets and phones in recent years, very few people are giving up on their PC – they are just making it last longer”, said IDC’s Loren Loverde. Some users will postpone an upgrade a little, thanks to the free Windows 10 update, but not indefinitely. It is expected that most upgraders on old systems will eventually buy a new device. Some volume will go to detachable tablets, rather than a traditional PC; this will cut into the desktop growth rate, but will still support PC vendors and ecosystems.

| PC Shipments by Product Category and Region (Millions) | ||||||

|---|---|---|---|---|---|---|

| Product Category | Region | 2015 Shipments | 2019 Shipments | 2015 Share | 2019 Share | 5-Year CAGR |

| Notebook | Mature | 87.6 | 91.3 | 31.7% | 33.5% | 1.0% |

| Emerging | 75.5 | 78.7 | 27.3% | 28.9% | 1.0% | |

| Portable PC Total | 163.1 | 170.0 | 59.0% | 62.4% | 1.0% | |

| Desktop | Mature | 42.6 | 35.5 | 15.4% | 13.0% | -4.5% |

| Emerging | 71.0 | 67.1 | 25.6% | 24.6% | -1.4% | |

| Desktop PC Total | 113.6 | 102.6 | 41.0% | 37.6% | -2.5% | |

| Total PC | Mature | 130.2 | 126.8 | 47.0% | 46.5% | -0.7% |

| Emerging | 146.5 | 145.8 | 53.0% | 53.5% | -0.1% | |

| Grand Total | 276.7 | 272.6 | 100.0% | 100.0% | -0.4% | |

| Source: IDC | ||||||

Detachables are forecast to enjoy fast growth, but are still a relatively small part of the market. Combining detachable tablets with PCs would boost growth by around three percentage points. This would result in falling volumes between 2012 and 2015, followed by about 1% growth in 2016 and slightly higher gains in subsequent years.

The PC market remains price-sensitive and slow. However, IDC’s Jay Chou has said that the firm expects continued growth for AIO PCs, as well as convertible and ultra-slim notebooks.

The consumer PC segment will continue to fall in the USA. Mobile devices have increasingly eaten into the consumer PC revenue share, and growth of detachables will only further slow the growth. However, IDC expects these declines to be somewhat offset by commercial growth.