After five consecutive quarters of year-over-year shipment growth, the global PC monitor market hit an inflection point in the third quarter of 2021 (3Q21), registering the first year-over-year decline in shipments since global lockdowns began in the first quarter of 2020 (1Q20), according to the International Data Corporation (IDC) Worldwide Q uarterly PC Monitor Tracker.

While many countries, especially in the emerging economies of Asia/Pacific, continued to show solid demand and fulfilled backorders, key markets in North America and Western Europe saw sizable contractions mainly due to a degree of softening in consumer demand. As a result, third quarter shipments were just over 34.8 million units, declining 7.2% over the same quarter a year ago (3Q20). Moreover, although improved in some respects, supply and logistical challenges persisted from previous quarters, which further cramped a market that was already facing rising prices due to cost pressures.

Company Highlights

As more workers headed back to the office around the world, commercial demand has helped to recoup some volume loss from the decline in consumer purchases. Commercial-heavy vendors such as Dell and Lenovo both outgrew the market and registered year-over-year growth. However, supply constraints and spending priorities also weighed in, bringing total commercial monitor shipments down 2% year over year. Consumer-focused vendors suffered even more as the total consumer monitor market shrank more than 12% year over year.

Top Companies, Worldwide PC Monitor Shipments, Market Share, and Year-Over-Year Growth, Q3 2021 (shipments in thousands of units) |

|||||

|

Company |

3Q21 Shipments |

3Q21 Market Share |

3Q20 Shipments |

3Q20 Market Share |

3Q21/3Q20 Growth |

|

1. Dell Technologies |

7,666 |

22.0% |

6,359 |

17.0% |

+20.6% |

|

2. Lenovo |

4,238 |

12.2% |

3,966 |

10.6% |

+6.9% |

|

3. TPV |

3,971 |

11.4% |

5,679 |

15.1% |

-30.1% |

|

4. HP Inc. |

3,723 |

10.7% |

4,711 |

12.6% |

-21.0% |

|

5. Samsung |

2,875 |

8.3% |

3,370 |

9.0% |

-14.7% |

|

Others |

12,328 |

35.4% |

13,417 |

35.8% |

-8.1% |

|

Total |

34,801 |

100.0% |

37,502 |

100.0% |

-7.2% |

|

Source: IDC Quarterly PC Monitor Tracker, December 2021 |

|||||

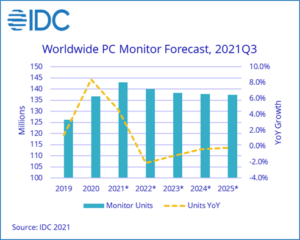

As demand cools, IDC expects a further stabilization in monitor component pricing and a slowing of shipments for the remainder of the year. Nonetheless, results from the first half of the year will carry 2021 to shipment growth of 4.6% over 2020 with volume reaching 143 million units, a level not seen since 2012. IDC forecasts 2022 to be a year of pullback with units expected to shrink a little more than 2% compared to 2021, followed by a near flatlining as the market returns to a replacement-driven dynamic.

“We expect the market to achieved peak volume as we end 2021 with the highest shipment levels since 2012,” said Jay Chou, research manager for IDC’s Worldwide Quarterly PC Monitor Tracker. “Even as things settle back down, we still see areas of opportunity in the years ahead. Commercial segments will once again be the main driver of this space, but consumers will also refresh upon a much bigger installed base, which expanded during these challenging times. We believe the changes wrought by the permanency of hybrid work and flexible learning will enable faster refresh rates across all user segments.”