Worldwide PC shipments reached 64.3 million units in Q2’16, down 5.2% YoY – the seventh consecutive quarter of declines, says Gartner. However, the market is showing some signs of improvement.

Weakening local currencies against the strong dollar has caused an ongoing problem in the worldwide PC market, notes analyst Mikako Kitagawa. This has been effecting EMEA and LATAM for the past year. Shipment declines became “rather modest” in Q2 compared to previous quarters, though, which suggests a fading impact.

All regions except North America experienced a shipment decline. LATAM remained weak due to political and economic instability: shipments in the region are expected to have fallen below 5 million units in Q2’16, which would be a decline of more than 20%. Meanwhile, in Europe, the UK’s vote to leave the European Union did not affect Q2 results much, but is expected to create uncertainty going forward.

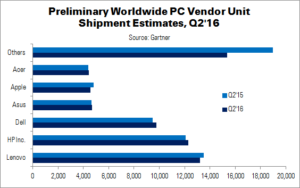

| Preliminary Worldwide PC Vendor Unit Shipment Estimates, Q2’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q2’16 Share | Q2’15 Share | YoY Change |

| Lenovo | 13,198 | 13,491 | 20.5% | 19.9% | -2.2% |

| HP Inc. | 12,284 | 12,063 | 19.1% | 17.8% | 1.8% |

| Dell | 9,788 | 9,490 | 15.2% | 14.0% | 3.1% |

| Asus | 4,695 | 4,637 | 7.3% | 6.8% | 1.3% |

| Apple | 4,559 | 4,793 | 7.1% | 7.1% | -4.9% |

| Acer | 4,417 | 4,401 | 6.9% | 6.5% | 0.4% |

| Others | 15,354 | 18,975 | 23.9% | 28.0% | -19.1% |

| Total | 64,295 | 67,851 | 100.0% | 100.0% | -5.2% |

| Source: Gartner | |||||

Lenovo led the worldwide PC market, despite 2.2% unit decline – the fifth consecutive quarter of falling shipments for the company. Lenovo’s shipments rose in double digits in the US mobile PC market, but EMEA was a challenge due to high inventory. Shipments were down in APAC, but less than the regional average.

HP Inc. returned to positive growth in Q2, after four quarters of falling shipments. The company resolved its inventory build-up issue, which had slowed its sell-in shipments. HP maintained its top spot in EMEA, but could not dislodge Dell in the US. For its part, Dell (number three worldwide) grew faster than the industry average in all regions. The firm performed especially well in the US, LATAM and Japan markets. Mobile PC shipments rose in all regions except EMEA, while desktops were down in most regions.

Preliminary results are still being finalised, but Gartner reports that Asus, Acer and Apple are all contending for the fourth place spot.

In regional terms, US PC shipments were up 1.4% YoY to 15.2 million units, following five quarters of shipment declines. Although most vendors and channels are optimistic, Kitagawa said that are still potential challenges, such as inventory build-up. “This will depend on how PC market demand picks up in the second half of this year for both the business and consumer segments,” she added. “The second and third quarter are typically PC buying season for the US public sectors. Positive second-quarter results could suggest healthy PC sales activities among the public sectors. There is an opportunity for a Windows 10 refresh among businesses, which we expect to see more toward the end of 2016 to the beginning of 2017.”

| Preliminary US PC Vendor Unit Shipment Estimates, Q2’16 (000s) | |||||

|---|---|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q2’16 Share | Q2’15 Share | YoY Change |

| Dell | 4,105 | 3,769 | 27.0% | 25.1% | 8.9% |

| HP Inc. | 4,010 | 3,975 | 26.3% | 26.5% | 0.9% |

| Lenovo | 2,209 | 2,022 | 14.5% | 13.5% | 9.2% |

| Apple | 1,873 | 2,064 | 12.3% | 13.8% | -9.3% |

| Asus | 751 | 721 | 4.9% | 4.8% | 4.2% |

| Others | 2,277 | 2,457 | 15.0% | 16.4% | -7.3% |

| Total | 15,223 | 15,007 | 100.0% | 100.0% | 1.4% |

| Source: Gartner | |||||

In APAC, shipments reached 22.7 million units: a 6.3% decline. The region’s economy is stagnating, putting pressure on discretionary spending. Smartphones are also ranked as a higher priority than PCs. Election activity in Korea, Australia and the Philippines created a temporary lull in IT spending from the government sector. Shipments fell 6.4% in China, where weak business confidence affected consumer buying patterns.

Shipments in EMEA were down 4.3%, to 17.8 million units. The impact of the depreciating euro and resulting price increases ended with Western Europe showing a low-single-digit decline. Brexit, as mentioned above, did not impact Q2 results beyond the weakening pound. Post-Brexit, the significantly weaker pound will cause price increases that will likely cause downward pressure on Q4 sales in the UK.

Analyst Comment

IDC released its preliminary results at the same time, which largely tallied with Gartner’s. IDC said that shipments declined 4.5% YoY to 62.4 million units. The firm expects some new systems to be purchased now that the free Windows 10 upgrades have ended, but said that the overall PC market continues to struggle.

IDC, like Gartner, said that US was the only market to show signs of growth. EMEA results were expected to be down, in line with the global forecast, and APACexJ also declined on weak consumer spending.

Vendors were ranked similarly to Gartner, led by Lenovo and followed by HP Inc., Dell, Asus and Apple. (TA)