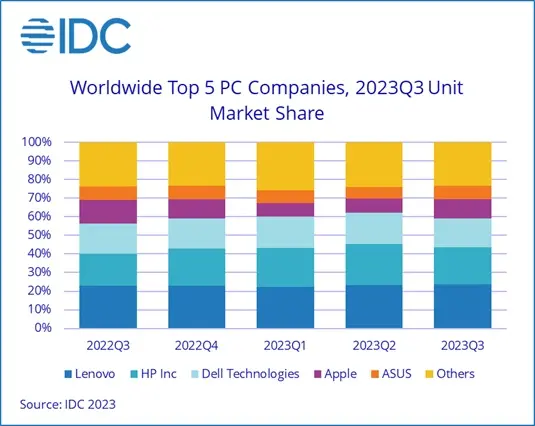

The third quarter of 2023 witnessed a continued decline in PC shipments, registering a 7.6% decrease YoY, amounting to 68.2 million units shipped. This data, as sourced from IDC, presents a clear image of the current dynamics of the global PC market.

The silver lining here is the growth observed in PC shipments for two consecutive quarters. Most distribution channels have streamlined their PC inventory in recent months, maintaining it near optimal levels. However, the PC market continues to grapple with the challenge of downward pricing pressures. This factor remains a significant concern for both consumer and business sectors. It’s evident that the majority of top-tier vendors witnessed significant declines during this quarter. Apple’s sharp decline, in particular, can be attributed to unfavorable comparisons YoY, primarily resulting from the disruption caused by COVID-19 in Q3’22, which affected production. On the brighter side, HP’s growth is largely attributed to an effective inventory normalization process.

Factors such as the upcoming device refresh cycle and the impending end of support for Windows 10 are anticipated to stimulate sales from the latter half of 2024. However, in the interim, the industry might have to navigate through some challenges. One notable aspect is the industry’s inclination towards exploring production and procurement alternatives outside China, a shift driven by the current slowdown.

This geographical diversification is deemed crucial, with advancements in AI integration into PCs being another critical area of focus. Although practical applications are still in the early stages of definition, there’s already considerable interest in this domain. AI-integrated PCs can offer organizations unparalleled customization capabilities, enhancing the user experience while ensuring data privacy and sovereignty. With a slew of AI-centric devices slated for release in the forthcoming year, the industry anticipates a marked elevation in average selling prices, signifying the profound potential of this technology.

| Company | Q3’23 Shipments | Q3’23 Market Share | Q3’22 Shipments | Q3’22 Market Share | YoY Growth |

|---|---|---|---|---|---|

| Lenovo | 16.0 | 23.5% | 16.9 | 22.9% | -5.0% |

| HP Inc. | 13.5 | 19.8% | 12.7 | 17.2% | 6.4% |

| Dell Technologies | 10.3 | 15.0% | 12.0 | 16.2% | -14.3% |

| Apple | 7.2 | 10.6% | 9.4 | 12.7% | -23.1% |

| Asus | 4.9 | 7.1% | 5.4 | 7.4% | -10.7% |

| Others | 16.3 | 23.9% | 17.4 | 23.6% | -6.3% |

| Total | 68.2 | 100.0% | 73.8 | 100.0% | -7.6% |