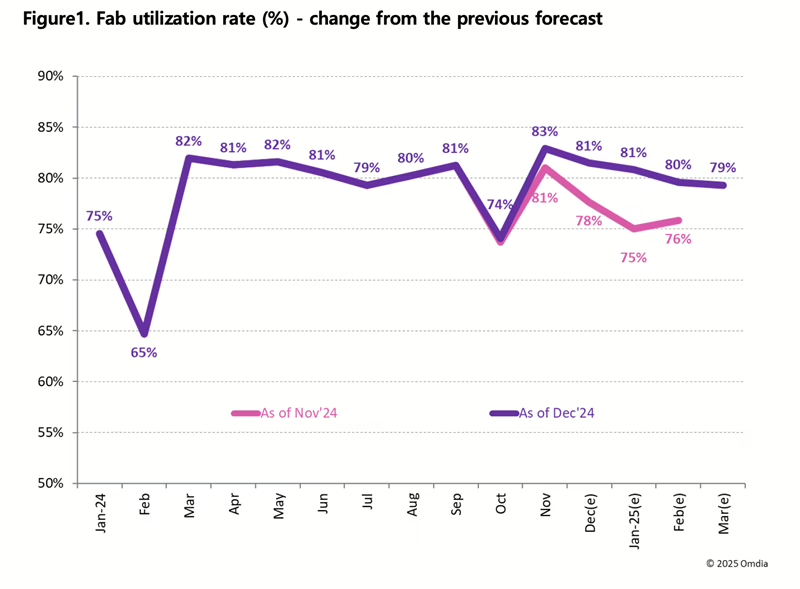

Panel makers increased their fab utilization plans over three consecutive months in the fourth quarter of 2024 and have set a goal of maintaining an 80% utilization rate in the first quarter of 2025. According to the latest analysis from Omdia, the quarterly utilization plan for the final quarter of 2024 stood at 77% by the end of November. By the end of December, it had risen by two percentage points to 79%. Plans for the first quarter of 2025 were then revised upward by four percentage points, bringing quarterly utilization to 80%. In particular, January 2025 fab utilization plans rose by six percentage points.

Alex Kang, Principal Analyst at Omdia, said the upward revision of fab utilization plans is tied to demand for certain TV panels in China, linked to the Chinese government’s “Swap Old for New” subsidy program, which has not yet been fully realized. Kang noted that some China TV makers aim to secure additional TV panels to increase their market share during this period of higher demand. He added that worries about potential tariff measures under the newly elected US government have temporarily boosted demand for LCD TV panels and caused panel makers to adjust their utilization plans. Certain Chinese TV makers are stockpiling TVs in Mexico to streamline shipments to the US, and these sudden orders have increased the possibility of shortages in components such as driver ICs and polarizers for IT LCD manufacturing.

The upward revisions have been more pronounced among Chinese panel makers, including BOE, TCL CSOT, and HKC Display, which supply a larger portion of LCD TV panels to China TV makers. Initially, some of these suppliers had planned a two-week holiday during Lunar New Year at the end of January 2025 to manage production and maintain bargaining power for panel pricing. Instead, they have canceled those plans, deciding to maintain higher output in response to rising panel demand and the expectation of price increases for LCD TV panels in the first half of 2025.

Kang concluded that, despite the pull-in demand and elevated utilization levels, panel makers remain watchful of long-term trends and may return to production-to-order strategies once this wave of demand subsides.